Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. Example 5-11 To illustrate the tax saving

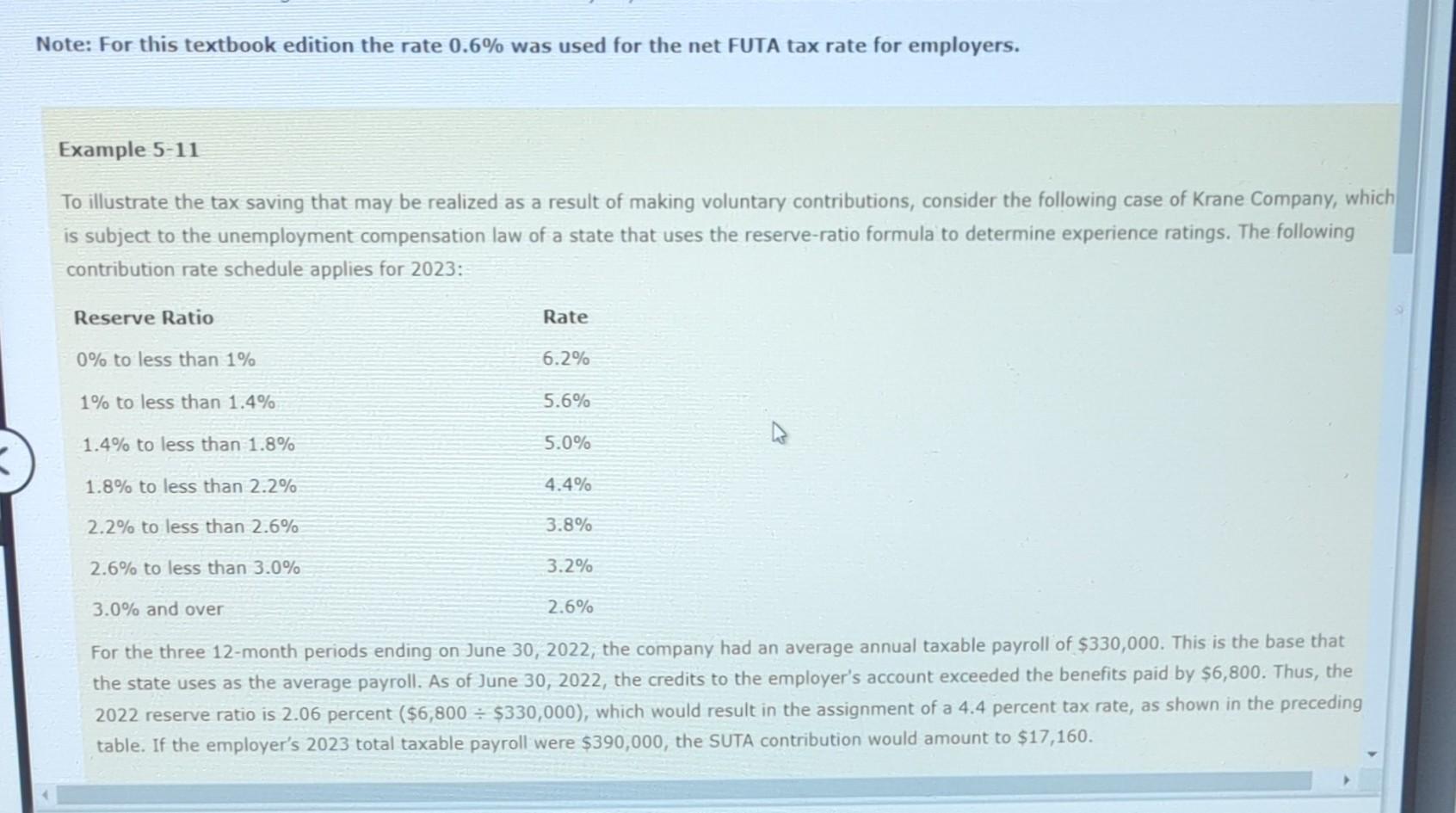

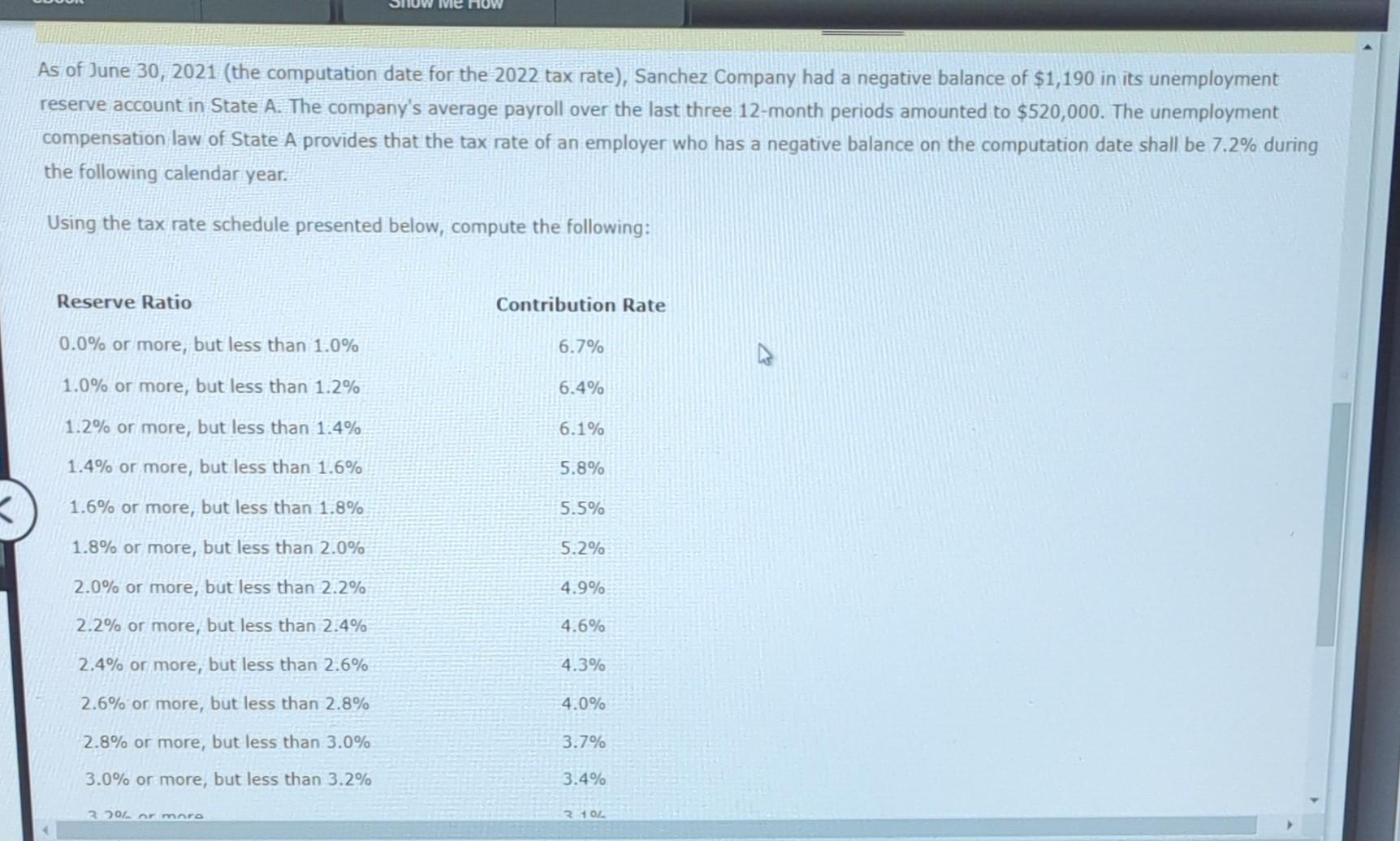

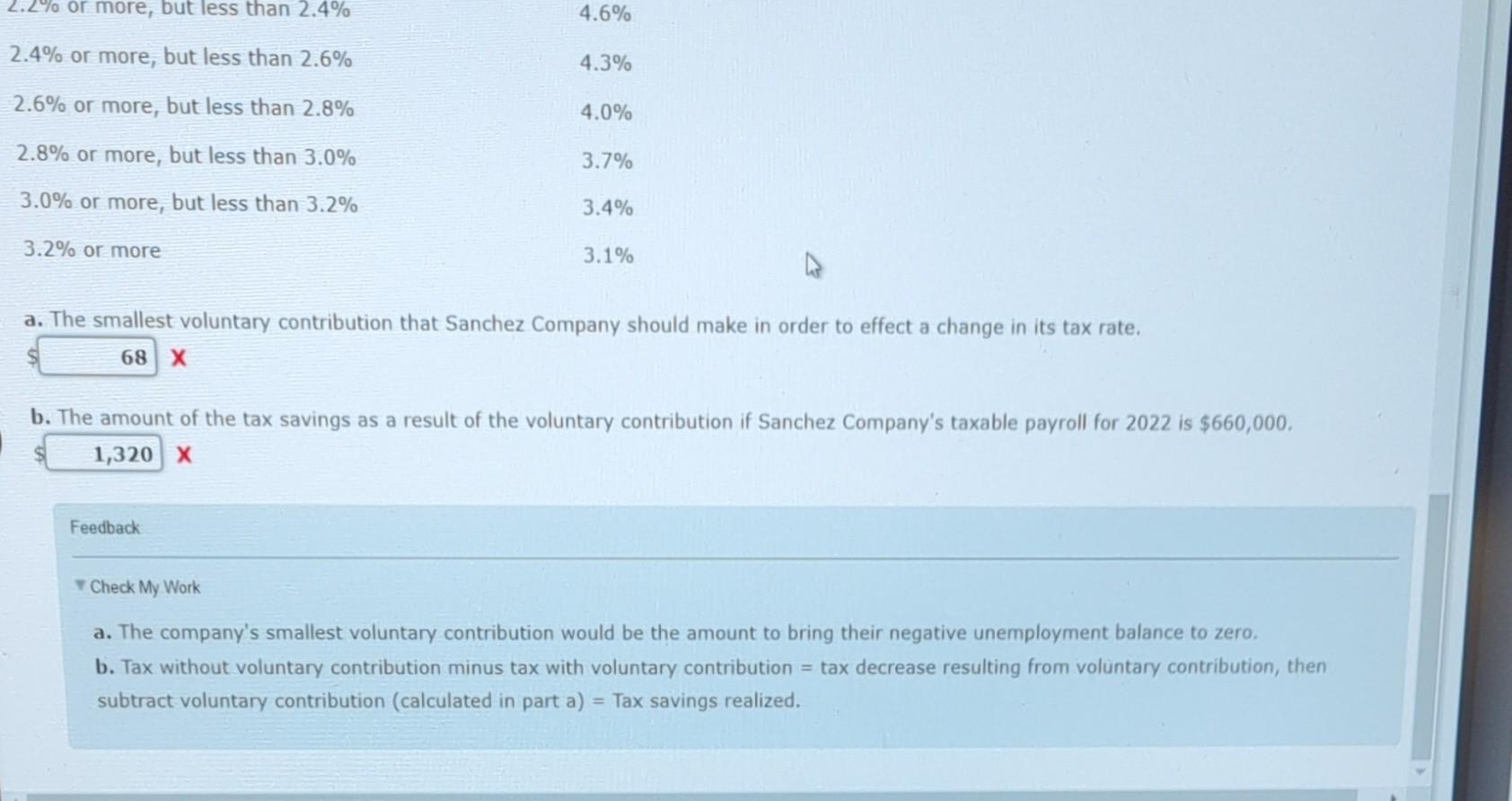

Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. Example 5-11 To illustrate the tax saving that may be realized as a result of making voluntary contributions, consider the following case of Krane Company, which is subject to the unemployment compensation law of a state that uses the reserve-ratio formula to determine experience ratings. The following contribution rate schedule applies for 2023: For the three 12 -month periods ending on June 30,2022 , the company had an average annual taxable payroll of $330,000. This is the base the state uses as the average payroll. As of June 30,2022 , the credits to the employer's account exceeded the benefits paid by $6,800. Thus, the 2022 reserve ratio is 2.06 percent ($6,800$330,000), which would result in the assignment of a 4.4 percent tax rate, as shown in the preceding table. If the employer's 2023 total taxable payroll were $390,000, the SUTA contribution would amount to $17,160. As of June 30,2021 (the computation date for the 2022 tax rate), Sanchez Company had a negative balance of $1,190 in its unemployment reserve account in State A. The company's average payroll over the last three 12 -month periods amounted to $520,000. The unemployment compensation law of State A provides that the tax rate of an employer who has a negative balance on the computation date shall be 7.2% during the following calendar year. Using the tax rate schedule presented below, compute the following: The smallest voluntary contribution that Sanchez Company should make in order to effect a change in its tax rate. x b. The amount of the tax savings as a result of the voluntary contribution if Sanchez Company's taxable payroll for 2022 is $660,000. x Feedback Check My Work a. The company's smallest voluntary contribution would be the amount to bring their negative unemployment balance to zero. b. Tax without voluntary contribution minus tax with voluntary contribution = tax decrease resulting from voluntary contribution, then subtract voluntary contribution (calculated in part a) = Tax savings realized

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started