Question

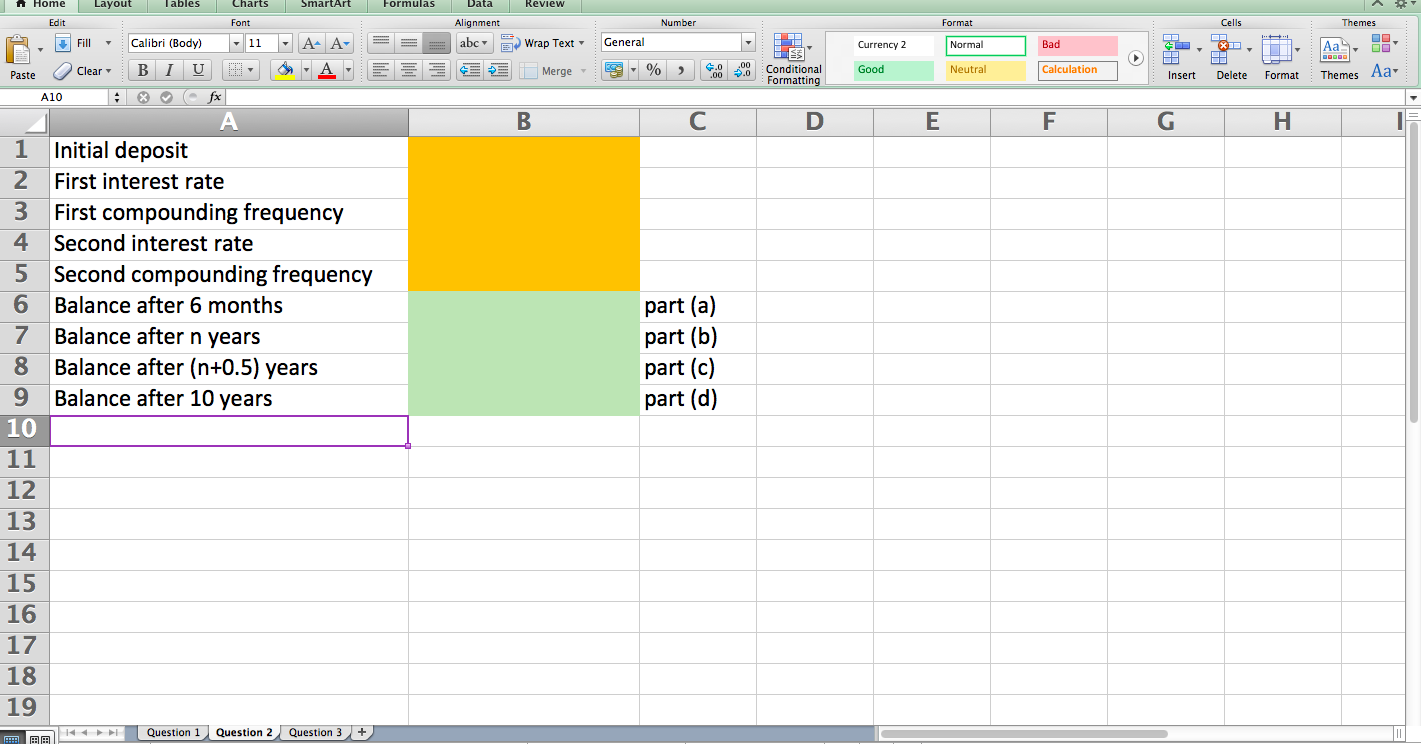

NOTE FOR TUTOR: PLEASE FILL IN EXCEL LIKE THE ONE ATTACHED AND ALSO PREPARE LOAN REPAYMENT SCHEDULE! THANK YOU! QUESTION 2 Burt deposits $10,000 into

NOTE FOR TUTOR: PLEASE FILL IN EXCEL LIKE THE ONE ATTACHED AND ALSO PREPARE LOAN REPAYMENT SCHEDULE! THANK YOU!

QUESTION 2

Burt deposits $10,000 into a bank account today. The account earns 4.5% per annum compounding daily for the first 4 years, then 5.5% per annum compounded quarterly thereafter. No further deposits or withdrawals will be made.

For this question, assume all months are of equal length and ignore leap years.

(a) Calculate the account balance six months from today.

(1 mark)

Burt deposits $10,000 into a bank account today. The account earns 4.5% per annum compounding daily for the first 4 years, then 5.5% per annum compounded quarterly thereafter. No further deposits or withdrawals will be made.

For this question, assume all months are of equal length and ignore leap years.

(b) Calculate the account balance 4 years from today.

(1 mark)

Burt deposits $10,000 into a bank account today. The account earns 4.5% per annum compounding daily for the first 4 years, then 5.5% per annum compounded quarterly thereafter. No further deposits or withdrawals will be made.

For this question, assume all months are of equal length and ignore leap years.

(c) Calculate the account balance 4.5 years from today.

(1 mark)

Burt deposits $10,000 into a bank account today. The account earns 4.5% per annum compounding daily for the first 4 years, then 5.5% per annum compounded quarterly thereafter. No further deposits or withdrawals will be made.

For this question, assume all months are of equal length and ignore leap years.

(d) Calculate the account balance 10 years from today.

(1 mark)

Home Layout Tables Edit Charts Font SmartArt Formulas Fill Calibri (Body) 11 A A Data Alignment abc Review Wrap Text General Clear Paste BIU Merge A10 fx A B Number %, C 123456789 Initial deposit First interest rate First compounding frequency 4 Second interest rate 5 Second compounding frequency 6 Balance after 6 months part (a) 7 Balance after n years part (b) 8 Balance after (n+0.5) years part (c) Balance after 10 years part (d) 10 11 12 13 14 15 16 17 18 19 Question 1 Question 2 Question 3 + .00 .0 .0 Conditional Formatting D Currency 2 Good E Format Cells Themes Normal Bad Aal Neutral Calculation Insert Delete Format Themes Aa F G H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure Lets calculate the account balances for different time periods based on the given information W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started