Note: I live in Australia, and this question is about commonwealth bank. So please look on the annual report of Commonwealth bank.

I have uploaded few slides and helpful tips for you. Please have a look.

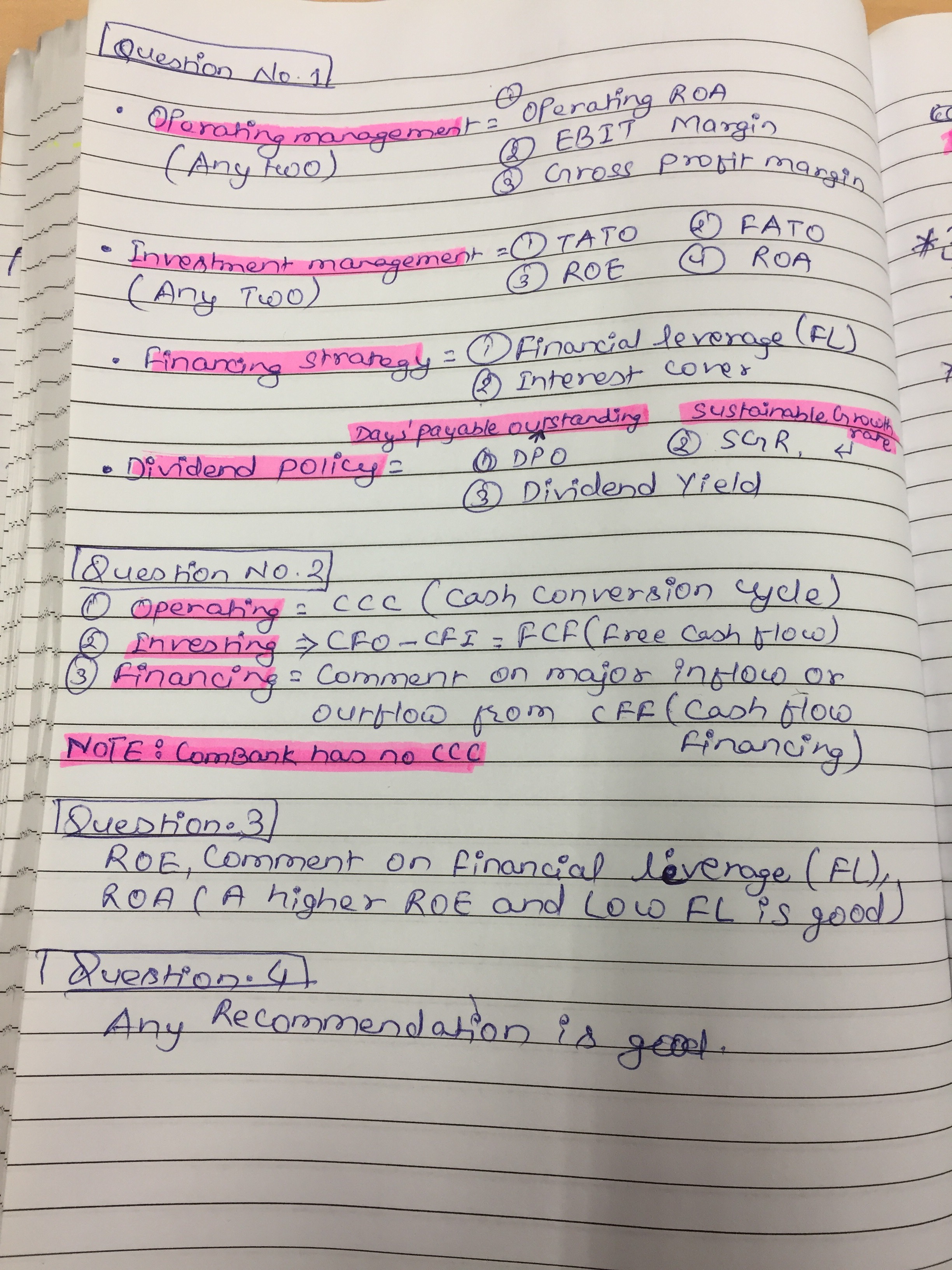

SO, What are the criteria for this assignment?

1) Question number 1,2 and 3 should be done in excel and Microsoft. Whatever is the analysis, you must first show it in excel and explain in Microsoft word.

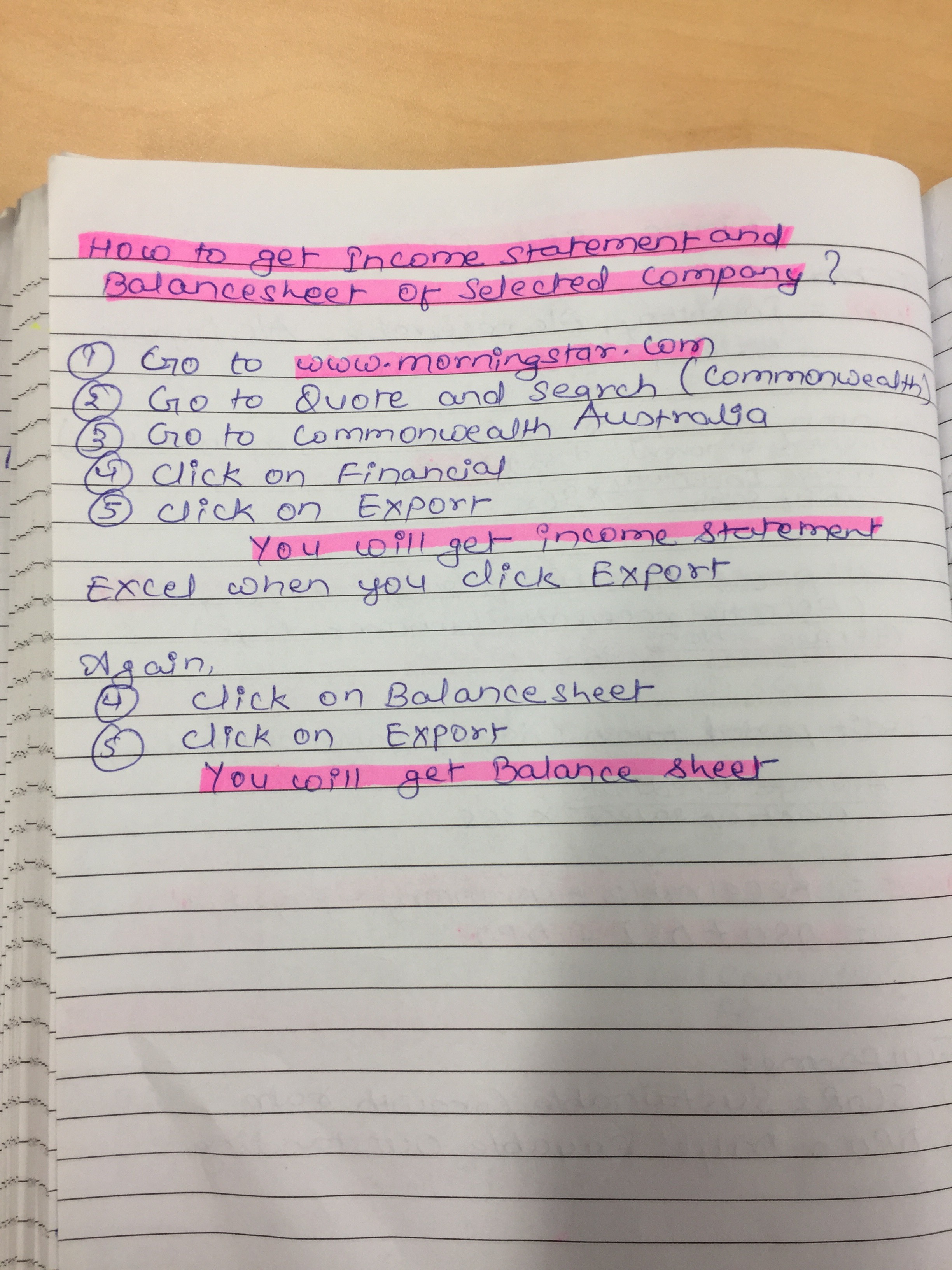

2) www.morningstar.com is the website where you can get income statement and balance sheet of selected company. I have also attached the file by explaining the procedure of using that website.This website makes your job really easier. Once you get the income statement, please do your solution on the same excel but in the different sheet. it makes my lecturer easy to check my assignment.

3) Do not worry, i have uploaded everything. i have even mentioned the way of doing solutions. Just calculate the things which i have written in the attachment.

ACCT2005 Annual Report Analysis & Interpretation Module 4 Chapter 5 Financial Analysis Laureate International Universities Learning Objectives Explain importance of objectives of financial analysis Explain the principles of ratio analysis Apply ratio analysis to evaluate operating management, investment management, financing strategy, and dividend policies Apply cash flow analysis to three groups of activities: operating, investing, and financing Laureate International Universities Key Concepts Two primary tools in financial analysis: - Ratio analysis - to assess how various line items in financial statements relate to each other and to measure relative performance. - Cash flow analysis - to evaluate liquidity and the management of operating, investing and financing activities as they relate to cash flow. Laureate International Universities Ratio Analysis Profitability and growth drive a company's value. Managers can employ four levers to achieve growth and profit targets: 1. 2. 3. 4. Operating management Investment management Financing strategy Dividend policy Ratio analysis seeks to evaluate a company's effectiveness in these areas. Laureate International Universities Laureate International Universities Financial Ratios: Principles Ratios should be appropriately measured and calculated so that they can draw meaningful conclusions and should follow core principles. Core principles are: - Ratio has particular goal or purpose - Consistency of measurement units: stock versus flow - Consistency of measurement scope: adjustments Laureate International Universities Ratio Analysis Evaluating ratios requires comparison against some benchmarks, such as: -Ratios over time from prior periods (time series) -Ratios of other companies in the industry (cross-sectional) -Some absolute benchmark -Common size analysis. Effective ratio analysis must attempt to relate underlying business factors to the financial numbers. The text illustrates ratio analysis by applying it to: -Bega Cheese Group (Bega) and Warrnambool Cheese & Butter Factory (WCBF) Laureate International Universities Common Size Analyses Common size analyses: State all Income Statement items as percentages of Sales State all Balance Sheet items as percentages of total assets - Shows trends in line items over time - Comparisons between different companies Laureate International Universities Profitability Analysis ROE is a comprehensive measure of and is a good starting point to systematically analyse a company's performance. ROE = Net Income / Average shareholders' equity Why average balance sheet 'stock' items? Compare to cost of equity Refer to Table 5.1 (p.151) textbook Laureate International Universities Profitability Analysis: Traditional Approach ROE = ROA * Financial leverage = Net income * Assets Assets Shareholders' equity Could use EBIT to measure performance EBIT = Earnings before interest, taxes, depreciation and amortisation Compare to weighted average cost of capital (WACC) Refer to Table 5.2 (p.154) textbook Laureate International Universities Profitability Analysis: Alternative Approach The traditional approach has some limitations due to compositing denominator and numerator. Alternative approach: ROE equal to = Operating ROA * Common Earnings Leverage * Capital Structure Leverage or, = Operating ROA + Financial Leverage Gain + Unexpected ROE Laureate International Universities Bega and Warrnambool Cases: ROE Comparison Laureate International Universities Income Statement Ratios Common-sized income statements facilitate comparisons of key line items across time and different companies. Additional ratios are also helpful: - Gross profit margin - EBIT margin - EBITDA margin (EBIT also before depreciation & amortisation) Laureate International Universities Gross Profit Margin Measures the profitability of sales, less direct costs of sales: Gross profit margin = Sales - Cost of sales Sales The gross profit margin is an indicator of: - The price premium that a company's product commands in the market - The efficiency of a company's procurement and/or production process. Laureate International Universities EBIT and EBITDA Margins The EBIT margin provides a comprehensive measure of operations: EBIT margin = EBIT Sales The EBITDA margin eliminates the significant non-cash expenses of depreciation and amortisation along with interest and taxes: EBITDA = Earnings before interest, taxes, depreciation, and amortization Laureate International Universities Bega and WCBF: Comparison of Key Income Statement Ratios Laureate International Universities Investment Management: Asset Turnover Asset management is a key indicator of how effective a company's management is. Asset turnover may be broken into two primary components: 1. Working capital management 2. Long-term asset management Laureate International Universities Working Capital Management Working capital: the difference between current assets and current liabilities. Key ratios useful to analysing working capital management include: - - - - - Operating working capital to sales Operating working capital turnover Accounts receivable turnover (day's receivables) Inventory turnover (day's inventory) Accounts payable turnover (day's payables) Laureate International Universities Asset Management Ratios: Bega and WCBF Laureate International Universities Financial Management: Financial Leverage Analysis Borrowing allows a company to access capital, but increases the risk of ownership for equity holders. Analysis of leverage can be performed on both short- and long-term debts: - Liquidity analysis relates to evaluating current liabilities - Solvency analysis relates to longer term liabilities Laureate International Universities Liquidity Analysis Several ratios useful to evaluate a company's liquidity: - Current ratio - Quick ratio - Cash ratio - Operating cash flow ratio Each of these ratios attempts to measure the ability of a company to pay its current debts. Laureate International Universities Liquidity Analysis (cont'd) Liquidity ratios allows the user to understand how to interpret them: Current ratio = Current assets / Current liabilities Current liabilities Quick ratio= Cash + Short-term investments + Accounts receivable Current liabilities Cash ratio = Cash + Marketable securities Current liabilities Operating cash flow ratio = Cash flows from operations Current liabilities Laureate International Universities Liquidity Ratios: Bega and WCBF Laureate International Universities Debt and Coverage Ratios Beyond short-term survival, solvency measures the ability of a company to meet long-term obligations. Several useful ratios are used to analyse solvency. Three using only shareholders' equity as a denominator are: Liabilities-to-equity ratio = Total liabilities Shareholders' equity Debt-to-equity ratio = Short-term debt + Long-term debt Shareholders' equity Net-debt-to-equity ratio = Short-term debt + Long-term debt - Cash and marketable securities Shareholders' equity Laureate International Universities Debt and Coverage Ratios (cont'd) Two ratios that use debt as a proportion of total capital are: Debt-to-capital ratio = Short-term debt + Long-term debt Short-term debt + Long-term debt + Shareholders' equity Net-debt-to-net-capital ratio = Interest bearing liabilities - Cash & marketable securities Interest-bearing liabilities - Cash & marketable securities + Shareholders' equity Laureate International Universities Debt and Coverage Ratios (cont'd) Two ratios specifically address the ability to pay interest on debts: Interest coverage ratio (earnings basis) = Net income + Interest expense + Tax expense Interest expense Interest coverage ratio (cash flow basis) = Cash flow from operations + Interest expense + Taxes paid Interest expense Laureate International Universities Bega and WCBF: Debt and Coverage Ratios Laureate International Universities Sustainable Growth A comprehensive measure of a company's ratios is the sustainable growth rate, which uses ROE : ROE * (1 - Dividend payout ratio) where: Dividend payout ratio = Cash dividends paid Net income Sustainable growth rate measures the ability of a company to maintain its profitability and financial policies. Laureate International Universities Laureate International Universities Sustainable Growth Rates: Bega and WCBF Laureate International Universities Cash Flow Analysis The ratio analysis previously discussed used accrual accounting. Cash flow analysis provides further insights into operating, investing and financing activities. All Australian and New Zealand companies are required to include a Statement of Cash Flows in their financial statements. Laureate International Universities Cash Flow Analysis (cont'd) A number of questions can be answered through analysis of the Statement of Cash Flows, e.g. - Operating activities How strong is the company's internal cash flow generation? How well is working capital being managed? - Investing activities How much cash did the company invest in growth assets? - Financing activities What type of external financing does the company rely on? Did the company use internally generated funds for investments? Did the company use internally generated funds to pay dividends? Laureate International Universities Cash Flow Analysis (cont'd) Differences in reporting cash flow information allow for variation across companies that complicate comparisons. Analysts can make adjustments to net income to arrive at free cash flows, a commonly used metric for financial analysis. Compare cash flow from operations to net income - Significant differences assessed One-off events? Accounting policies? - Relation changing over time? Laureate International Universities Total Cash Flow Analysis Record cash flow from Operations - Did operations produce a positive cash flow? Calculate cash flow from Operations before working capital - Did operations rely on or add to working capital? Calculate cash flow from Operations before interest payments - How is working capital being managed? Calculate cash flow after Investments - Does the company finance long-term investments internally? Calculate cash flow after dividend payments - Are the dividend payments sustainable? Calculate Cash flow after external financing - Examine financing policies Laureate International Universities Total Cash Flow Analysis: Bega and WCBF Laureate International Universities Summary Two primary tools in financial analysis: 1. Ratio analysis - to assess how various line items in financial statements relate to each other and to measure relative performance. 2. Cash flow analysis - to evaluate liquidity and the management of operating, investing and financing activities as they relate to cash flow. Both forms of analyses must be evaluated while considering whether a company's performance is consistent with the strategic initiatives of management. Laureate International Universities ACCT2005 Annual Report Analysis & Interpretation Module 5 Social and Environmental Analysis Laureate International Universities Sustainability Development Sustainable development is a development process that meets current generations' needs without compromising those of future generations (The Brundtland Report 1987) Three areas of sustainable development: economic, social and environmental development Social and environmental analysis is covered in this module. Stakeholders' interest in corporate sustainability: e.g. shareholders, customers, fund investors, community groups, media, government and regulators, creditors or banks (Rankin et al., 2012 p.327) Laureate International Universities Corporate Sustainability Corporate sustainability comprises economic, social and environmental business practices. A continuing process to build long-term value for a company: - improving reputation - involving customers and other stakeholders - encompassing continuing business ethical and responsible behaviour, and - contributing to economic development Laureate International Universities Corporate Sustainability (cont'd) Corporate social practices examples Suppliers choice: contracting suppliers who practice corporate sustainability themselves Customers: communicating sustainability practices to customers Employees: protecting the rights of employees Local community: creating and maintaining good relationship with local communities, supporting local charities, sponsoring local events Laureate International Universities Corporate Sustainability (cont'd) Corporate environmental practices examples 1. using resources more efficiently 2. reducing pollution and waste 3. not associating with businesses that abuse the local environment 4. cutting greenhouse gas emissions or other pollutants, 5. other activities to reduce environmental footprint of products Laureate International Universities Corporate Sustainability - Benefits Corporate sustainability helps cutting costs: - Regulatory compliance reduces litigation costs. - Efficient energy uses reduce utility bills. - Good business reputation helps recruiting, retaining, and motivating employees. - Better business understanding contributes to developing new products and services, e.g. waste implication could be built in new product design and new production processes. Laureate International Universities Corporate Sustainability - Benefits Good sustainability practices improve business performance, stronger customer loyalty, and motivated employees Other benefits of good sustainability practices: - Boosting company image - A source of innovation and new business opportunities - A means of product or service differentiation - Improved share price Laureate International Universities Corporate Sustainability (cont'd) Social responsibility ensures - Human rights and workers' rights are not abused: e.g. providing adequate work conditions, appropriate health and safety policies - Ethical supply chains are created and maintained: e.g. complying with codes of conduct, having regular visits from ethical auditors - Irresponsible marketing of products and services are not carried out: e.g. retailing Fairtrade products to help producers in developing countries make better trading conditions and promote sustainability Laureate International Universities Sustainability Reporting The Global Reporting Initiative (GRI) defines the goal of sustainable development: '...to meet the needs of the present without compromising the ability of future generations to meet their own needs.' Businesses can prepare sustainability reports based on GRI's G3 and G3.1 reporting guidelines Reporting sustainability practices forms part of a company's accountability to its stakeholders. Sustainability reporting enhances reputation and image Financial reporting in practice example: pp.112-113 Maynard (2013) Laureate International Universities Sustainability Reporting (cont'd) G3 Guidelines were launched in 2006, providing sustainability disclosures so that organisations can be transparent about their performance in key sustainability areas. G3.1 Guidelines were released in 2011, updating G3 Guidelines and providing guidance on defining the content of a sustainability report. Environmental indicators in G3.1 Guidelines on page 28: e.g. materials, water, energy, biodiversity, emissions, effluents, and waste Social indicators in G3.1 Guidelines on pp.30-39: labour practices, human rights, society, and product responsibility Laureate International Universities Sustainability Reporting (cont'd) No regulation governing sustainability reporting except accounting standard requirements - IAS 37 Provisions, Contingent Liabilities and Contingent Assets requires disclosure of provisions for future costs of environmental damage, asset decomposition in extract industries - IAS 1 Presentation of Financial Statements encourages companies to disclose abnormally large items to avoid distortion of financial results, e.g. environmental fines and penalties Issues in sustainability reporting: what measures should be reported to show performance and improvement Laureate International Universities \f\f