Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: In addition to the main file showing your hand-written or typed answers, you will be asked to upload a further file or screenshot for

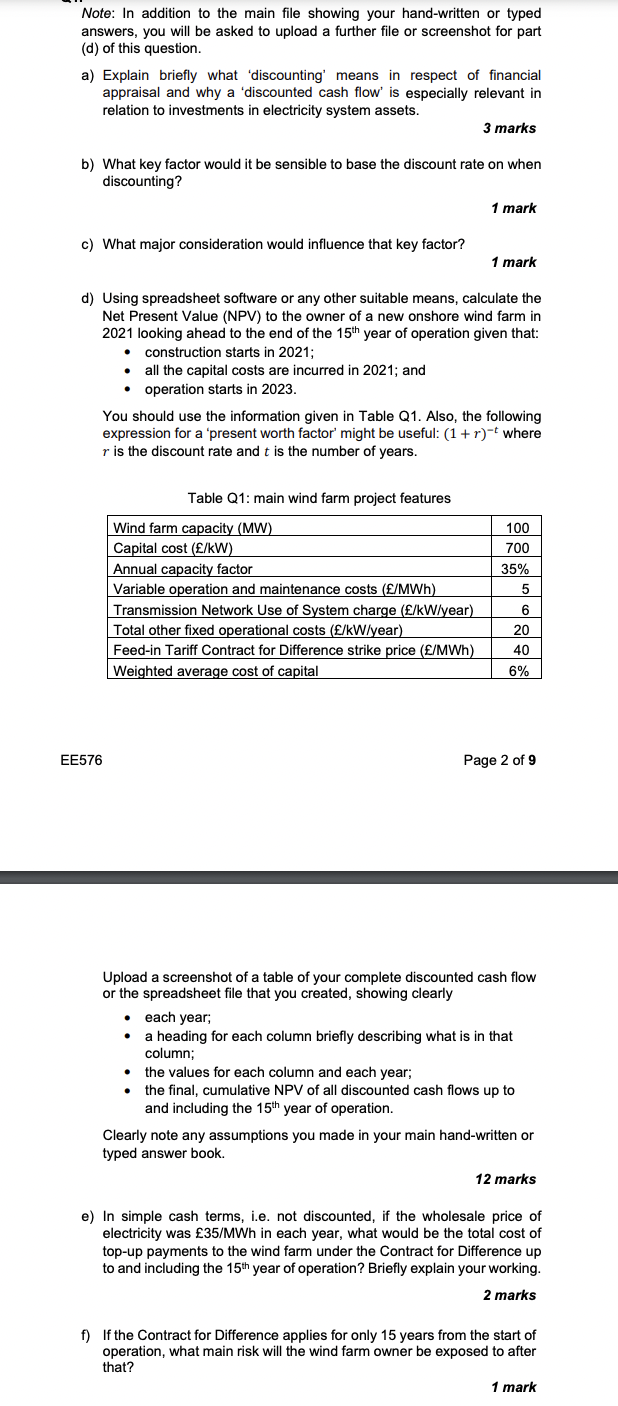

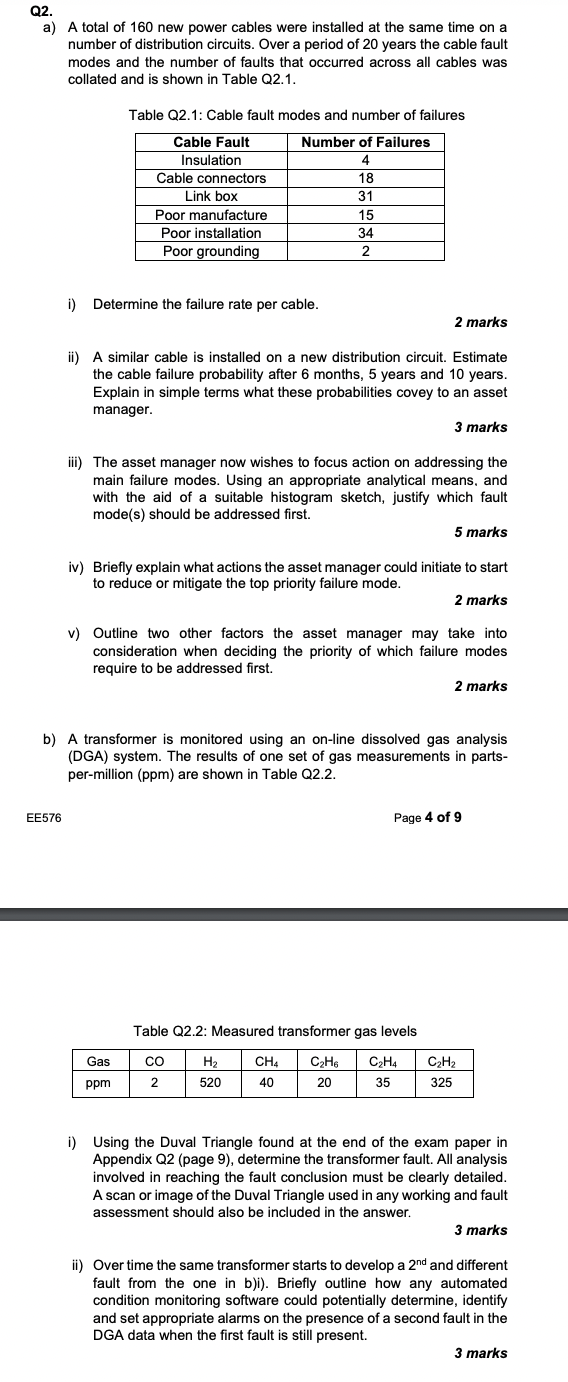

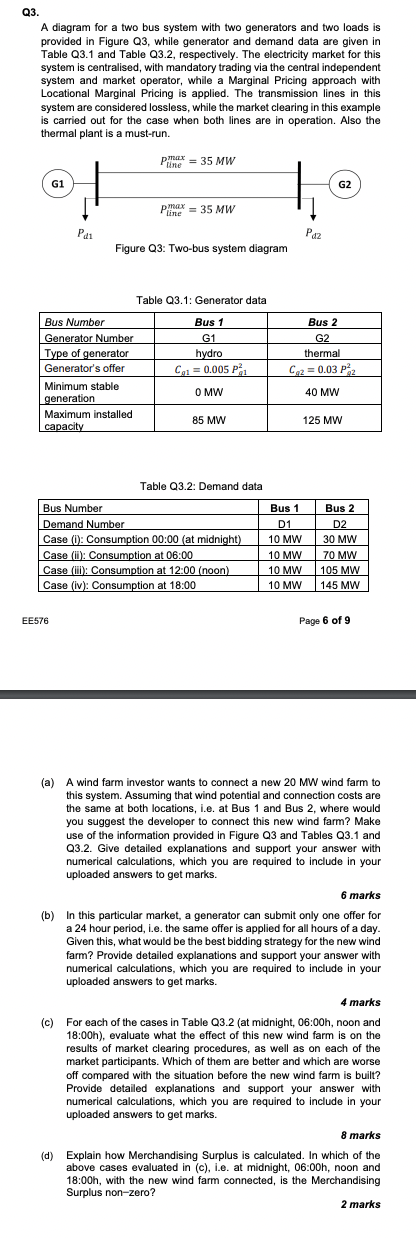

Note: In addition to the main file showing your hand-written or typed answers, you will be asked to upload a further file or screenshot for part (d) of this question. a) Explain briefly what 'discounting' means in respect of financial appraisal and why a 'discounted cash flow' is especially relevant in relation to investments in electricity system assets. 3 marks b) What key factor would it be sensible to base the discount rate on when discounting? 1 mark c) What major consideration would influence that key factor? 1 mark d) Using spreadsheet software or any other suitable means, calculate the Net Present Value (NPV) to the owner of a new onshore wind farm in 2021 looking ahead to the end of the 15th year of operation given that: - construction starts in 2021; - all the capital costs are incurred in 2021; and - operation starts in 2023. You should use the information given in Table Q1. Also, the following expression for a 'present worth factor' might be useful: (1+r)t where r is the discount rate and t is the number of years. Table Q1: main wind farm project features EE576 Page 2 of 9 Upload a screenshot of a table of your complete discounted cash flow or the spreadsheet file that you created, showing clearly - each year; - a heading for each column briefly describing what is in that column; - the values for each column and each year; - the final, cumulative NPV of all discounted cash flows up to and including the 15th year of operation. Clearly note any assumptions you made in your main hand-written or typed answer book. 12 marks e) In simple cash terms, i.e. not discounted, if the wholesale price of electricity was 35/MWh in each year, what would be the total cost of top-up payments to the wind farm under the Contract for Difference up to and including the 15th year of operation? Briefly explain your working. 2 marks f) If the Contract for Difference applies for only 15 years from the start of operation, what main risk will the wind farm owner be exposed to after that? 1 mark Q3. A diagram for a two bus system with two generators and two loads is provided in Figure Q3, while generator and demand data are given in Table Q3.1 and Table Q3.2, respectively. The electricity market for this system is centralised, with mandatory trading via the central independent system and market operator, while a Marginal Pricing approach with Locational Marginal Pricing is applied. The transmission lines in this system are considered lossless, while the market clearing in this example is carried out for the case when both lines are in operation. Also the thermal plant is a must-run. Table Q3.1: Generator data Table Q3.2: Demand data EE576 Page 6 of 9 (a) A wind farm investor wants to connect a new 20MW wind farm to this system. Assuming that wind potential and connection costs are the same at both locations, i.e. at Bus 1 and Bus 2, where would you suggest the developer to connect this new wind farm? Make use of the information provided in Figure Q3 and Tables Q3.1 and Q3.2. Give detailed explanations and support your answer with numerical calculations, which you are required to include in your uploaded answers to get marks. 6 marks (b) In this particular market, a generator can submit only one offer for a 24 hour period, i.e. the same offer is applied for all hours of a day. Given this, what would be the best bidding strategy for the new wind farm? Provide detailed explanations and support your answer with numerical calculations, which you are required to include in your uploaded answers to get marks. 4 marks (c) For each of the cases in Table Q3.2 (at midnight, 06:00h, noon and 18:00h), evaluate what the effect of this new wind farm is on the results of market clearing procedures, as well as on each of the market participants. Which of them are better and which are worse off compared with the situation before the new wind farm is built? Provide detalled explanations and support your answer with numerical calculations, which you are required to include in your uploaded answers to get marks. 8 marks (d) Explain how Merchandising Surplus is calculated. In which of the above cases evaluated in (c), i.e. at midnight, 06:00h, noon and 18:00h, with the new wind farm connected, is the Merchandising Surplus non-zero? 2 marks Q2. a) A total of 160 new power cables were installed at the same time on a number of distribution circuits. Over a period of 20 years the cable fault modes and the number of faults that occurred across all cables was collated and is shown in Table Q2.1. Table Q2.1: Cable fault modes and number of failures i) Determine the failure rate per cable. 2 marks ii) A similar cable is installed on a new distribution circuit. Estimate the cable failure probability after 6 months, 5 years and 10 years. Explain in simple terms what these probabilities covey to an asset manager. 3 marks iii) The asset manager now wishes to focus action on addressing the main failure modes. Using an appropriate analytical means, and with the aid of a suitable histogram sketch, justify which fault mode(s) should be addressed first. 5 marks iv) Briefly explain what actions the asset manager could initiate to start to reduce or mitigate the top priority failure mode. 2 marks v) Outline two other factors the asset manager may take into consideration when deciding the priority of which failure modes require to be addressed first. 2 marks b) A transformer is monitored using an on-line dissolved gas analysis (DGA) system. The results of one set of gas measurements in partsper-million (ppm) are shown in Table Q2.2. EE576 Page 4 of 9 Table Q2.2: Measured transformer gas levels i) Using the Duval Triangle found at the end of the exam paper in Appendix Q2 (page 9), determine the transformer fault. All analysis involved in reaching the fault conclusion must be clearly detailed. A scan or image of the Duval Triangle used in any working and fault assessment should also be included in the answer. 3 marks ii) Over time the same transformer starts to develop a 2nd and different fault from the one in b)i). Briefly outline how any automated condition monitoring software could potentially determine, identify and set appropriate alarms on the presence of a second fault in the DGA data when the first fault is still present

Note: In addition to the main file showing your hand-written or typed answers, you will be asked to upload a further file or screenshot for part (d) of this question. a) Explain briefly what 'discounting' means in respect of financial appraisal and why a 'discounted cash flow' is especially relevant in relation to investments in electricity system assets. 3 marks b) What key factor would it be sensible to base the discount rate on when discounting? 1 mark c) What major consideration would influence that key factor? 1 mark d) Using spreadsheet software or any other suitable means, calculate the Net Present Value (NPV) to the owner of a new onshore wind farm in 2021 looking ahead to the end of the 15th year of operation given that: - construction starts in 2021; - all the capital costs are incurred in 2021; and - operation starts in 2023. You should use the information given in Table Q1. Also, the following expression for a 'present worth factor' might be useful: (1+r)t where r is the discount rate and t is the number of years. Table Q1: main wind farm project features EE576 Page 2 of 9 Upload a screenshot of a table of your complete discounted cash flow or the spreadsheet file that you created, showing clearly - each year; - a heading for each column briefly describing what is in that column; - the values for each column and each year; - the final, cumulative NPV of all discounted cash flows up to and including the 15th year of operation. Clearly note any assumptions you made in your main hand-written or typed answer book. 12 marks e) In simple cash terms, i.e. not discounted, if the wholesale price of electricity was 35/MWh in each year, what would be the total cost of top-up payments to the wind farm under the Contract for Difference up to and including the 15th year of operation? Briefly explain your working. 2 marks f) If the Contract for Difference applies for only 15 years from the start of operation, what main risk will the wind farm owner be exposed to after that? 1 mark Q3. A diagram for a two bus system with two generators and two loads is provided in Figure Q3, while generator and demand data are given in Table Q3.1 and Table Q3.2, respectively. The electricity market for this system is centralised, with mandatory trading via the central independent system and market operator, while a Marginal Pricing approach with Locational Marginal Pricing is applied. The transmission lines in this system are considered lossless, while the market clearing in this example is carried out for the case when both lines are in operation. Also the thermal plant is a must-run. Table Q3.1: Generator data Table Q3.2: Demand data EE576 Page 6 of 9 (a) A wind farm investor wants to connect a new 20MW wind farm to this system. Assuming that wind potential and connection costs are the same at both locations, i.e. at Bus 1 and Bus 2, where would you suggest the developer to connect this new wind farm? Make use of the information provided in Figure Q3 and Tables Q3.1 and Q3.2. Give detailed explanations and support your answer with numerical calculations, which you are required to include in your uploaded answers to get marks. 6 marks (b) In this particular market, a generator can submit only one offer for a 24 hour period, i.e. the same offer is applied for all hours of a day. Given this, what would be the best bidding strategy for the new wind farm? Provide detailed explanations and support your answer with numerical calculations, which you are required to include in your uploaded answers to get marks. 4 marks (c) For each of the cases in Table Q3.2 (at midnight, 06:00h, noon and 18:00h), evaluate what the effect of this new wind farm is on the results of market clearing procedures, as well as on each of the market participants. Which of them are better and which are worse off compared with the situation before the new wind farm is built? Provide detalled explanations and support your answer with numerical calculations, which you are required to include in your uploaded answers to get marks. 8 marks (d) Explain how Merchandising Surplus is calculated. In which of the above cases evaluated in (c), i.e. at midnight, 06:00h, noon and 18:00h, with the new wind farm connected, is the Merchandising Surplus non-zero? 2 marks Q2. a) A total of 160 new power cables were installed at the same time on a number of distribution circuits. Over a period of 20 years the cable fault modes and the number of faults that occurred across all cables was collated and is shown in Table Q2.1. Table Q2.1: Cable fault modes and number of failures i) Determine the failure rate per cable. 2 marks ii) A similar cable is installed on a new distribution circuit. Estimate the cable failure probability after 6 months, 5 years and 10 years. Explain in simple terms what these probabilities covey to an asset manager. 3 marks iii) The asset manager now wishes to focus action on addressing the main failure modes. Using an appropriate analytical means, and with the aid of a suitable histogram sketch, justify which fault mode(s) should be addressed first. 5 marks iv) Briefly explain what actions the asset manager could initiate to start to reduce or mitigate the top priority failure mode. 2 marks v) Outline two other factors the asset manager may take into consideration when deciding the priority of which failure modes require to be addressed first. 2 marks b) A transformer is monitored using an on-line dissolved gas analysis (DGA) system. The results of one set of gas measurements in partsper-million (ppm) are shown in Table Q2.2. EE576 Page 4 of 9 Table Q2.2: Measured transformer gas levels i) Using the Duval Triangle found at the end of the exam paper in Appendix Q2 (page 9), determine the transformer fault. All analysis involved in reaching the fault conclusion must be clearly detailed. A scan or image of the Duval Triangle used in any working and fault assessment should also be included in the answer. 3 marks ii) Over time the same transformer starts to develop a 2nd and different fault from the one in b)i). Briefly outline how any automated condition monitoring software could potentially determine, identify and set appropriate alarms on the presence of a second fault in the DGA data when the first fault is still present

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started