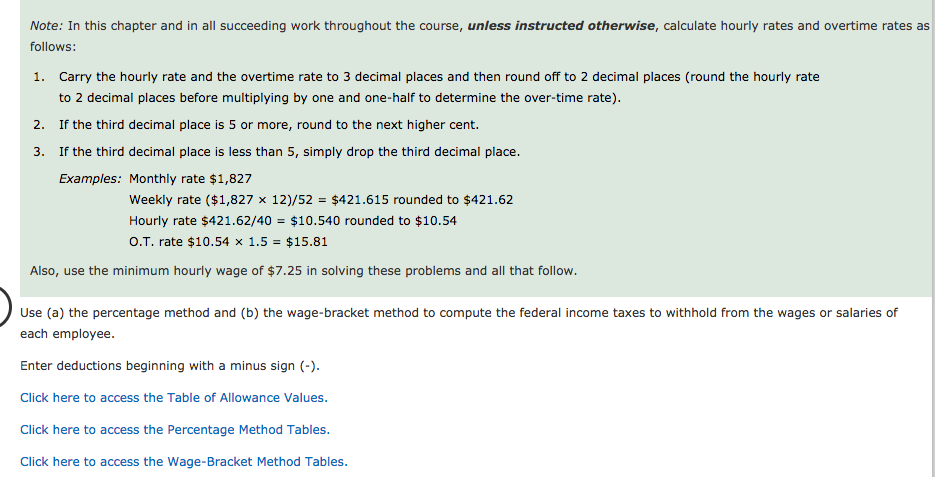

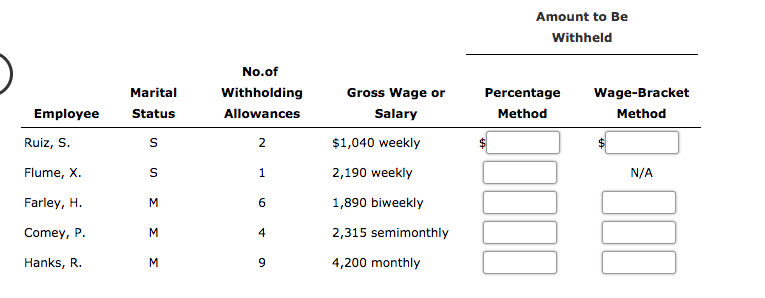

Note: In this chapter and in all succeeding work throughout the course, unless instructed otherwise, calculate hourly rates and overtime rates as follows: Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places (round the hourly rate to 2 decimal places before multiplying by one and one-half to determine the over-time rate). If the third decimal place is 5 or more, round to the next higher cent. If the third decimal place is less than 5, simply drop the third decimal place. Examples: Monthly rate $1,827 1. 2. 3. weekly rate ($1,827 x 12)/52 = $421,615 rounded to $421.62 Hourly rate $421.62/40 = $10.540 rounded to $10.54 o.T. rate $10.54 x 1.5-$15.81 Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter deductions beginning with a minus sign Click here to access the Table of Allowance Values. Click here to access the Percentage Method Tables. Click here to access the Wage-Bracket Method Tables. Note: In this chapter and in all succeeding work throughout the course, unless instructed otherwise, calculate hourly rates and overtime rates as follows: Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places (round the hourly rate to 2 decimal places before multiplying by one and one-half to determine the over-time rate). If the third decimal place is 5 or more, round to the next higher cent. If the third decimal place is less than 5, simply drop the third decimal place. Examples: Monthly rate $1,827 1. 2. 3. weekly rate ($1,827 x 12)/52 = $421,615 rounded to $421.62 Hourly rate $421.62/40 = $10.540 rounded to $10.54 o.T. rate $10.54 x 1.5-$15.81 Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter deductions beginning with a minus sign Click here to access the Table of Allowance Values. Click here to access the Percentage Method Tables. Click here to access the Wage-Bracket Method Tables