Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note. Mr Singh is allowed to retain two rent free houses (one at Delhi and the other one is a Srinagar), so for first three

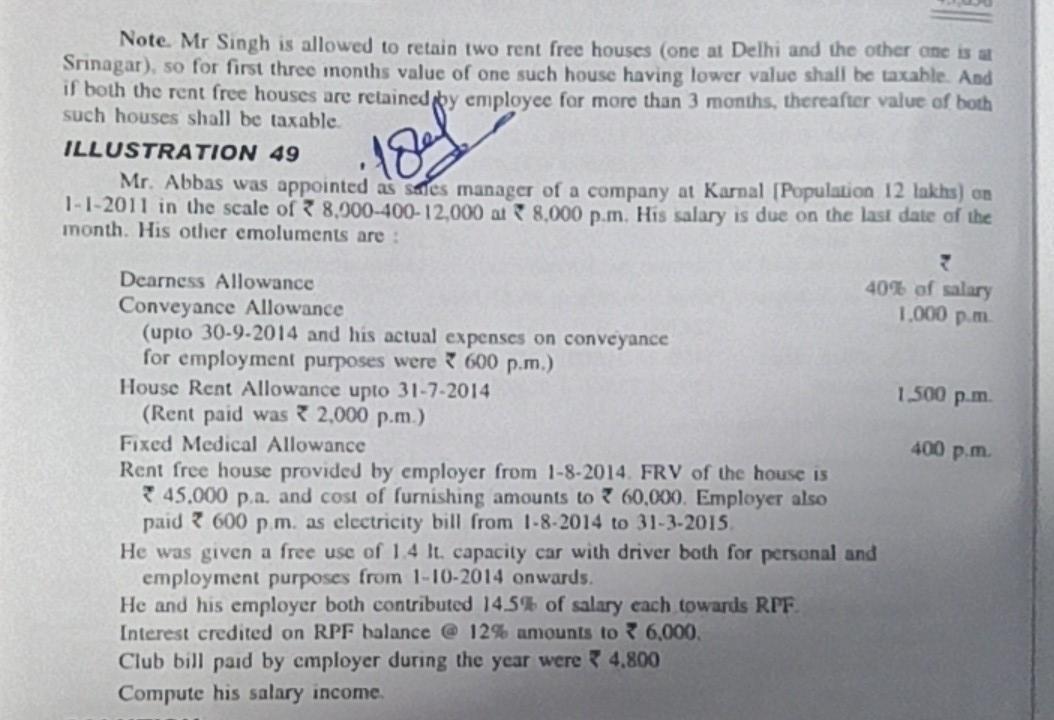

Note. Mr Singh is allowed to retain two rent free houses (one at Delhi and the other one is a Srinagar), so for first three months value of one such house having lower value shall be taxable. And if both the rent free houses are retained by employee for more than 3 months, thereafter value of both such houses shall be taxable ILLUSTRATION 49 Mr. Abbas was appointed as sales manager of a company at Karnal (Population 12 lakhs) on 1-1-2011 in the scale of 8,000-400-12,000 al 8,000 p.m. His salary is due on the last date of the month. His other emoluments are: 1894 1.000 pm 1.500 pm 400 pm Dearness Allowance 40% of salary Conveyance Allowance (upto 30-9-2014 and his actual expenses on conveyance for employment purposes were 600 p.m.) House Rent Allowance upto 31-7-2014 (Rent paid was 2.000 p.m.) Fixed Medical Allowance Rent free house provided by employer from 1-8-2014. FRV of the house is 3 45.000 p.a. and cost of furnishing amounts to 360,000. Employer also paid ? 600 p m. as electricity bill from 1-8-2014 to 31-3-2015 He was given a free use of 1.4 It. capacity car with driver both for personal and employment purposes from 1-10-2014 onwards. He and his employer both contributed 14.5% of salary each towards RPF Interest credited on RPF balance @ 12% amounts to 6.000. Club bill paid by employer during the year were 4.800 Compute his salary income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started