Note:

- No interest is payable on the borrowings undertaken from the interest free borrowing facility. Also, the principal borrowed amount does not need to be paid for 6 months from the date of borrowing, so you should assume the any amount borrowed under the facility will not be paid back in M1 to M3

- Ending Cash Balance = Excess of Total Cash + Total Effects of Financing + Opening Cash

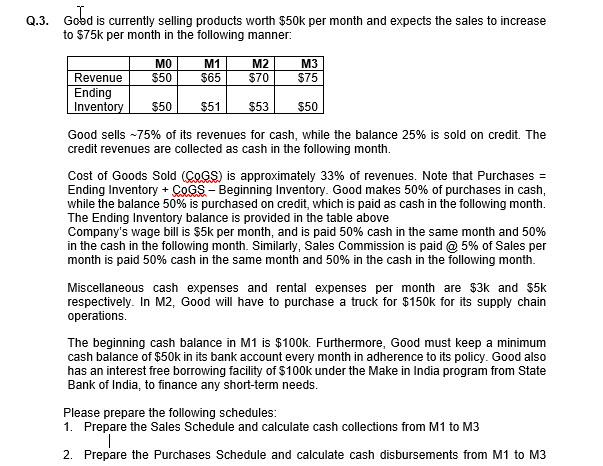

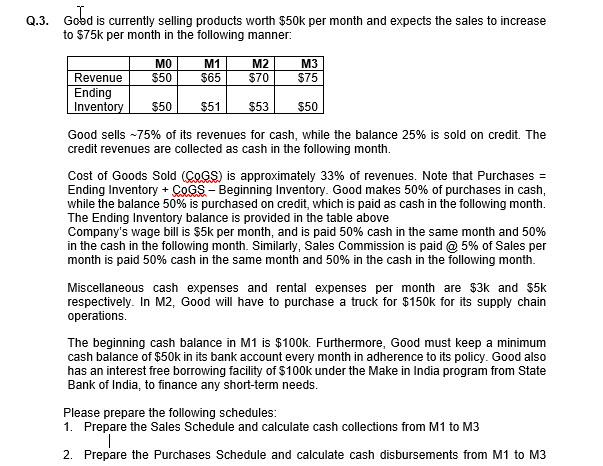

Q.3. Gobd is currently selling products worth $50k per month and expects the sales to increase to $75k per month in the following manner: MO M1 M2 M3 Revenue $50 $65 $70 $75 Ending Inventory $50 $51 $53 $50 Good sells -75% of its revenues for cash, while the balance 25% is sold on credit. The credit revenues are collected as cash in the following month. Cost of Goods Sold (COGS) is approximately 33% of revenues. Note that Purchases = Ending Inventory + COGS - Beginning Inventory. Good makes 50% of purchases in cash, while the balance 50% is purchased on credit which is paid as cash in the following month. The Ending Inventory balance is provided in the table above Company's wage bill is $5k per month, and is paid 50% cash in the same month and 50% in the cash in the following month. Similarly, Sales Commission is paid @ 5% of Sales per month is paid 50% cash in the same month and 50% in the cash in the following month. Miscellaneous cash expenses and rental expenses per month are $3k and $5k respectively. In M2, Good will have to purchase a truck for $150k for its supply chain operations The beginning cash balance in M1 is $100k. Furthermore, Good must keep a minimum cash balance of $50k in its bank account every month in adherence to its policy. Good also has an interest free borrowing facility of $100k under the Make in India program from State Bank of India, to finance any short-term needs. Please prepare the following schedules: 1. Prepare the Sales Schedule and calculate cash collections from M1 to M3 2. Prepare the Purchases Schedule and calculate cash disbursements from M1 to M3 Q.3. Gobd is currently selling products worth $50k per month and expects the sales to increase to $75k per month in the following manner: MO M1 M2 M3 Revenue $50 $65 $70 $75 Ending Inventory $50 $51 $53 $50 Good sells -75% of its revenues for cash, while the balance 25% is sold on credit. The credit revenues are collected as cash in the following month. Cost of Goods Sold (COGS) is approximately 33% of revenues. Note that Purchases = Ending Inventory + COGS - Beginning Inventory. Good makes 50% of purchases in cash, while the balance 50% is purchased on credit which is paid as cash in the following month. The Ending Inventory balance is provided in the table above Company's wage bill is $5k per month, and is paid 50% cash in the same month and 50% in the cash in the following month. Similarly, Sales Commission is paid @ 5% of Sales per month is paid 50% cash in the same month and 50% in the cash in the following month. Miscellaneous cash expenses and rental expenses per month are $3k and $5k respectively. In M2, Good will have to purchase a truck for $150k for its supply chain operations The beginning cash balance in M1 is $100k. Furthermore, Good must keep a minimum cash balance of $50k in its bank account every month in adherence to its policy. Good also has an interest free borrowing facility of $100k under the Make in India program from State Bank of India, to finance any short-term needs. Please prepare the following schedules: 1. Prepare the Sales Schedule and calculate cash collections from M1 to M3 2. Prepare the Purchases Schedule and calculate cash disbursements from M1 to M3