Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NOTE: PLEASE ANSWER ALL THE QUESTION QUESTION 5 Nuha Sdn Bhd operates a company that supplies computer equipment to local and international markets. The following

NOTE: PLEASE ANSWER ALL THE QUESTION

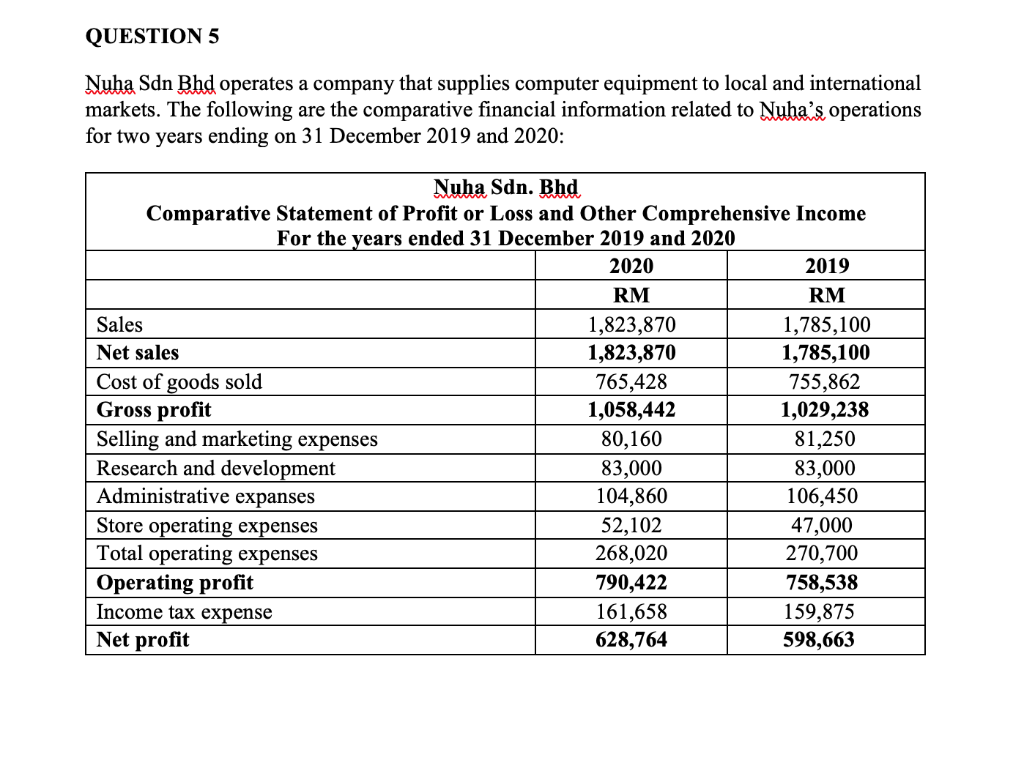

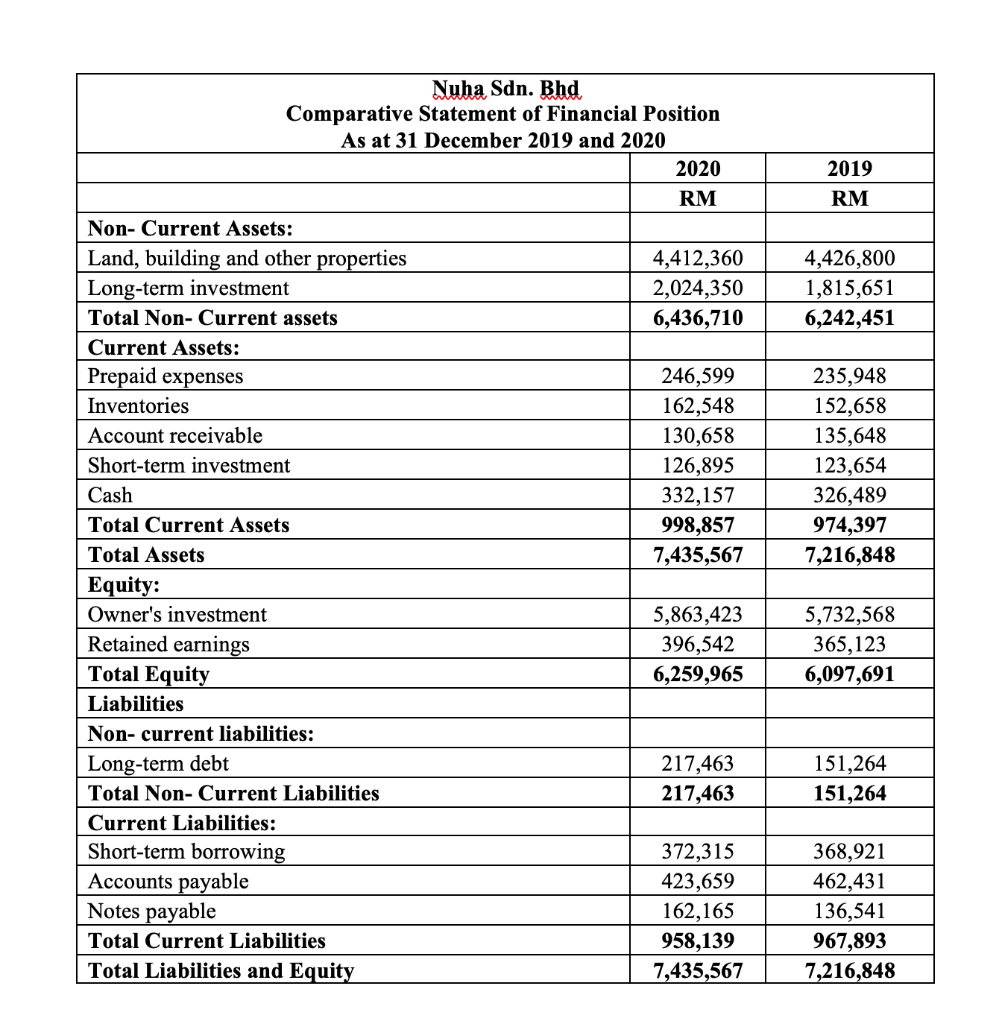

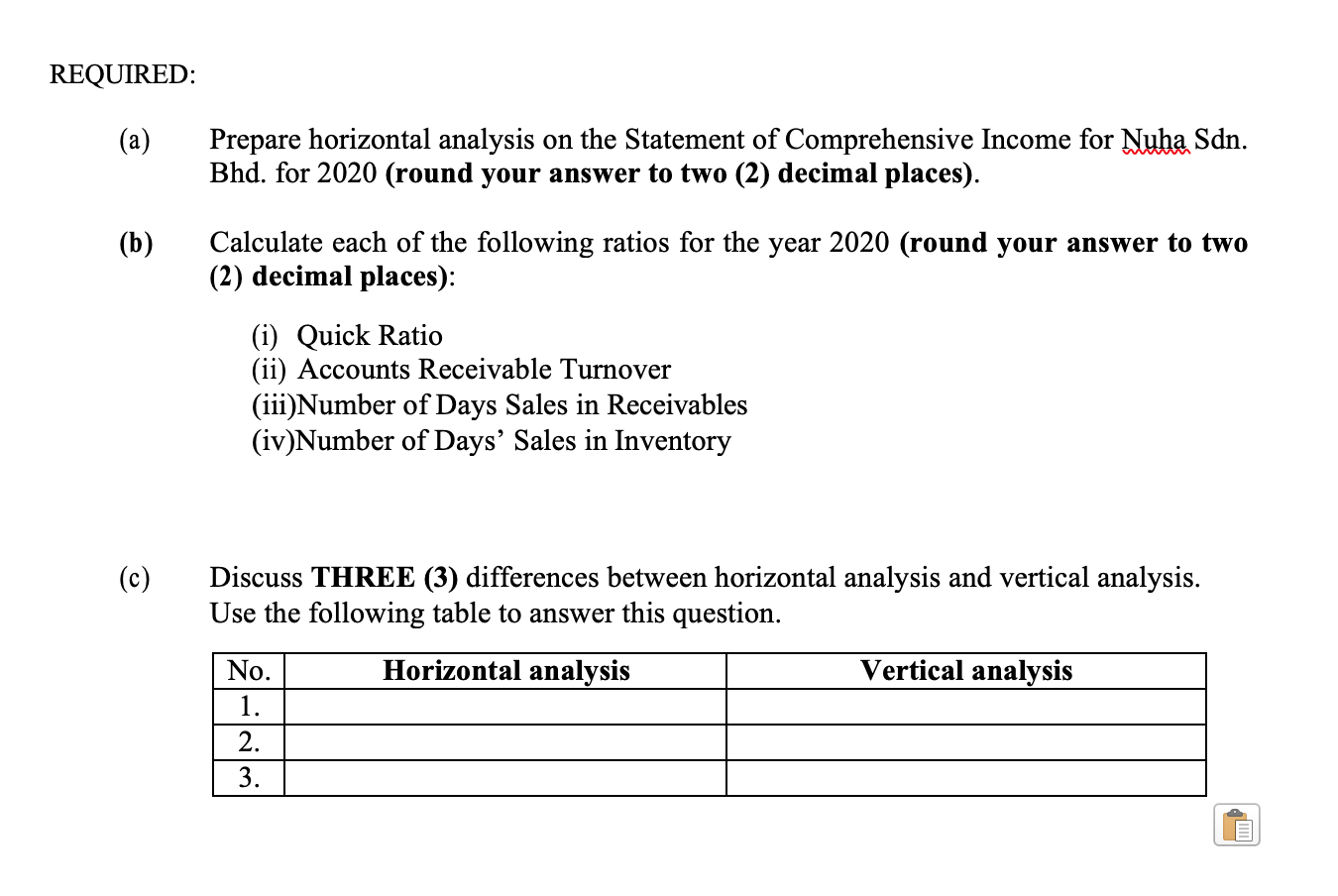

QUESTION 5 Nuha Sdn Bhd operates a company that supplies computer equipment to local and international markets. The following are the comparative financial information related to Nuha's operations for two years ending on 31 December 2019 and 2020: Nuha Sdn. Bhd Comparative Statement of Profit or Loss and Other Comprehensive Income For the years ended 31 December 2019 and 2020 2020 2019 RM RM Sales 1,823,870 1,785,100 Net sales 1,823,870 1,785,100 Cost of goods sold 765,428 755,862 Gross profit 1,058,442 1,029,238 Selling and marketing expenses 80,160 81,250 Research and development 83,000 83,000 Administrative expanses 104,860 106,450 Store operating expenses 52,102 47,000 Total operating expenses 268,020 270,700 Operating profit 790,422 758,538 Income tax expense 161,658 159,875 Net profit 628,764 598,663 2019 RM 4,426,800 1,815,651 6,242,451 Nuha Sdn. Bhd Comparative Statement of Financial Position As at 31 December 2019 and 2020 2020 RM Non- Current Assets: Land, building and other properties 4,412,360 Long-term investment 2,024,350 Total Non-Current assets 6,436,710 Current Assets: Prepaid expenses 246,599 Inventories 162,548 Account receivable 130,658 Short-term investment 126,895 Cash 332,157 Total Current Assets 998,857 Total Assets 7,435,567 Equity: Owner's investment 5,863,423 Retained earnings 396,542 Total Equity 6,259,965 Liabilities Non-current liabilities: Long-term debt 217,463 Total Non-Current Liabilities 217,463 Current Liabilities: Short-term borrowing 372,315 Accounts payable 423,659 Notes payable 162,165 Total Current Liabilities 958,139 Total Liabilities and Equity 7,435,567 235,948 152,658 135,648 123,654 326,489 974,397 7,216,848 5,732,568 365,123 6,097,691 151,264 151,264 368,921 462,431 136,541 967,893 7,216,848 REQUIRED: (a) Prepare horizontal analysis on the Statement of Comprehensive Income for Nuha Sdn. Bhd. for 2020 (round your answer to two (2) decimal places). (b) Calculate each of the following ratios for the year 2020 (round your answer to two (2) decimal places): (i) Quick Ratio (ii) Accounts Receivable Turnover (iii)Number of Days Sales in Receivables (iv)Number of Days Sales in Inventory (c) Discuss THREE (3) differences between horizontal analysis and vertical analysis. Use the following table to answer this question. No. Horizontal analysis Vertical analysis 1. 2. 3. mStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started