Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Please do answer required part 2 memorandum to David Scott explaining how best to use the budget. Question 1: Budget (20 marks in total)

Note: Please do answer required part 2 memorandum to David Scott explaining how best to use the budget.

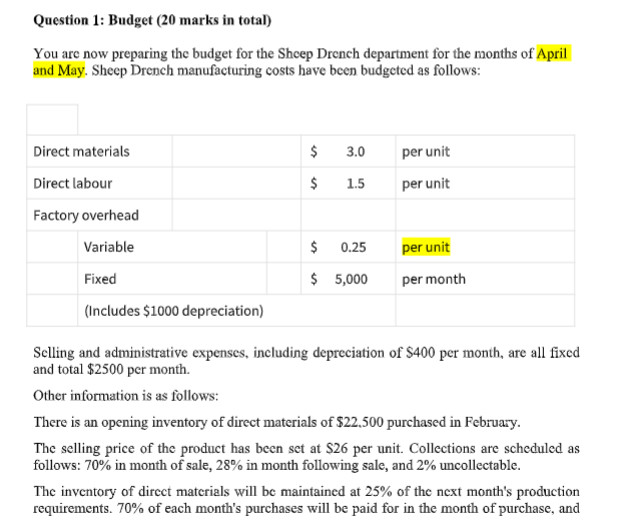

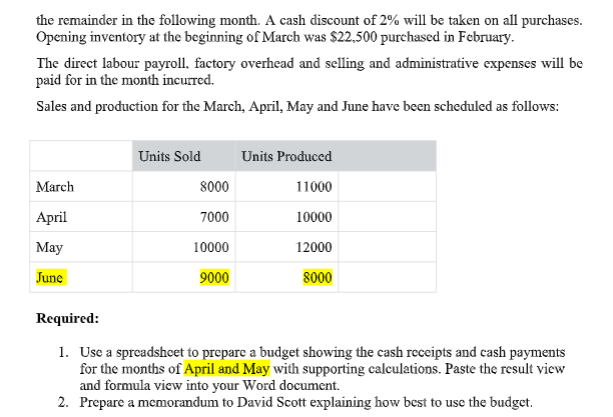

Question 1: Budget (20 marks in total) You are now preparing the budget for the Sheep Drench department for the months of April and May. Sheep Drench manufacturing costs have been budgeted as follows: Direct materials $ $ 3.0 1.5 per unit per unit Direct labour Factory overhead Variable $ 0.25 per unit Fixed $ 5,000 (Includes $1000 depreciation) Selling and administrative expenses, including depreciation of $400 per month, are all fixed and total $2500 per month. Other information is as follows: There is an opening inventory of direct materials of $22.500 purchased in February. The selling price of the product has been set at $26 per unit. Collections are scheduled as follows: 70% in month of sale, 28% in month following sale, and 2% uncollectable. The inventory of direct materials will be maintained at 25% of the next month's production requirements. 70% of each month's purchases will be paid for in the month of purchase, and the remainder in the following month. A cash discount of 2% will be taken on all purchases. Opening inventory at the beginning of March was $22.500 purchased in February. The direct labour payroll, factory overhead and selling and administrative expenses will be paid for in the month incurred. Sales and production for the March, April, May and June have been scheduled as follows: Units Sold Units Produced March 8000 11000 7000 10000 April May 10000 12000 June 9000 8000 Required: 1. Use a spreadsheet to prepare a budget showing the cash receipts and cash payments for the months of April and May with supporting calculations. Paste the result view and formula view into your Word document. 2. Prepare a memorandum to David Scott explaining how best to use the budgetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started