Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Please just answer question A, B, D and H. LO 12.2. LO 12-3 LO 12-4, LO 12.5 INTEGRATIVE CASE 12.1 Walmart: Free-Cash-Flows Valuation of

Note: Please just answer question A, B, D and H.

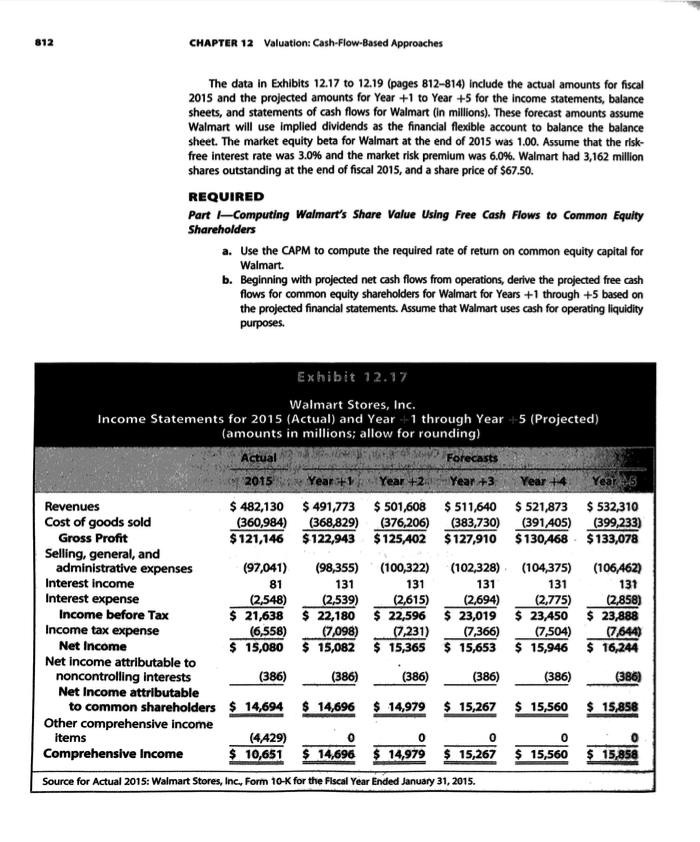

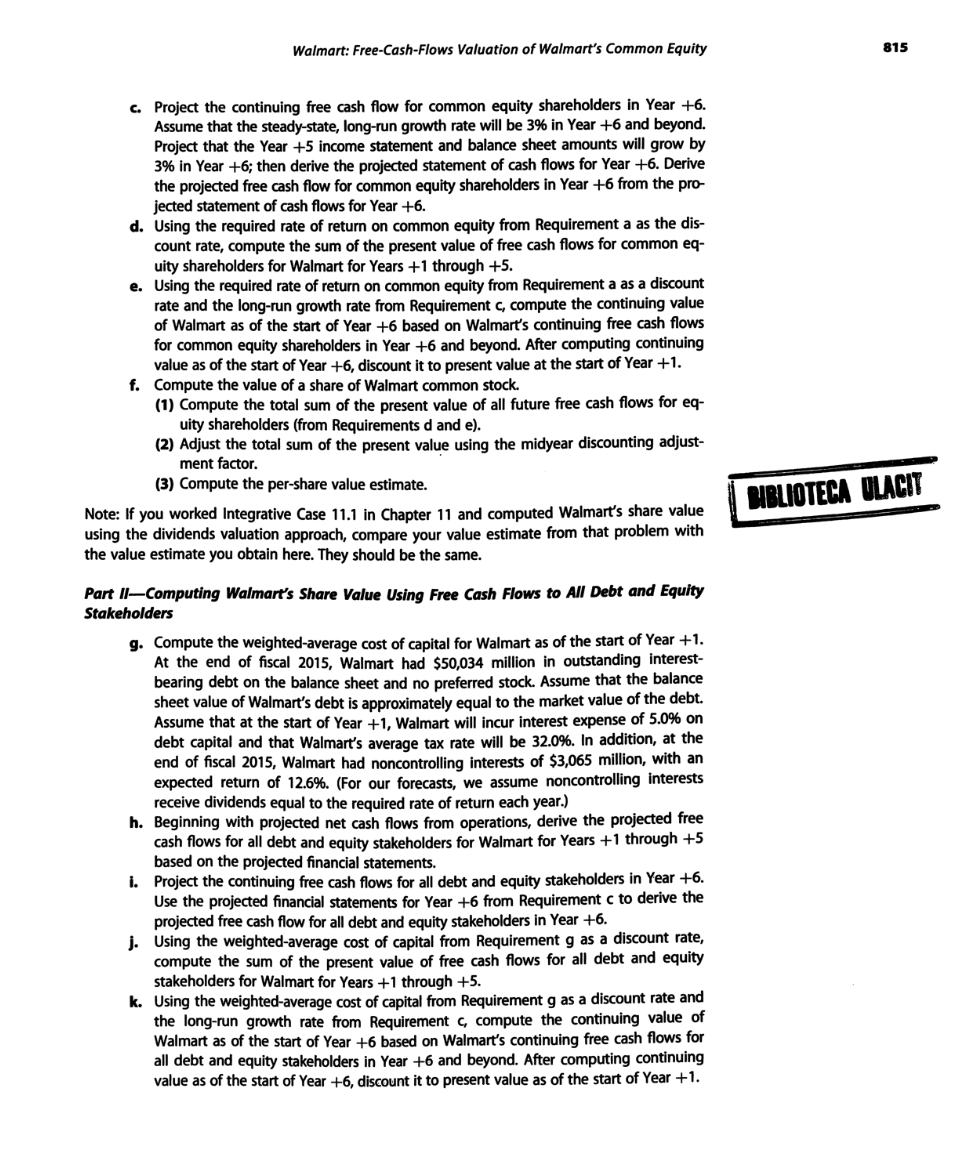

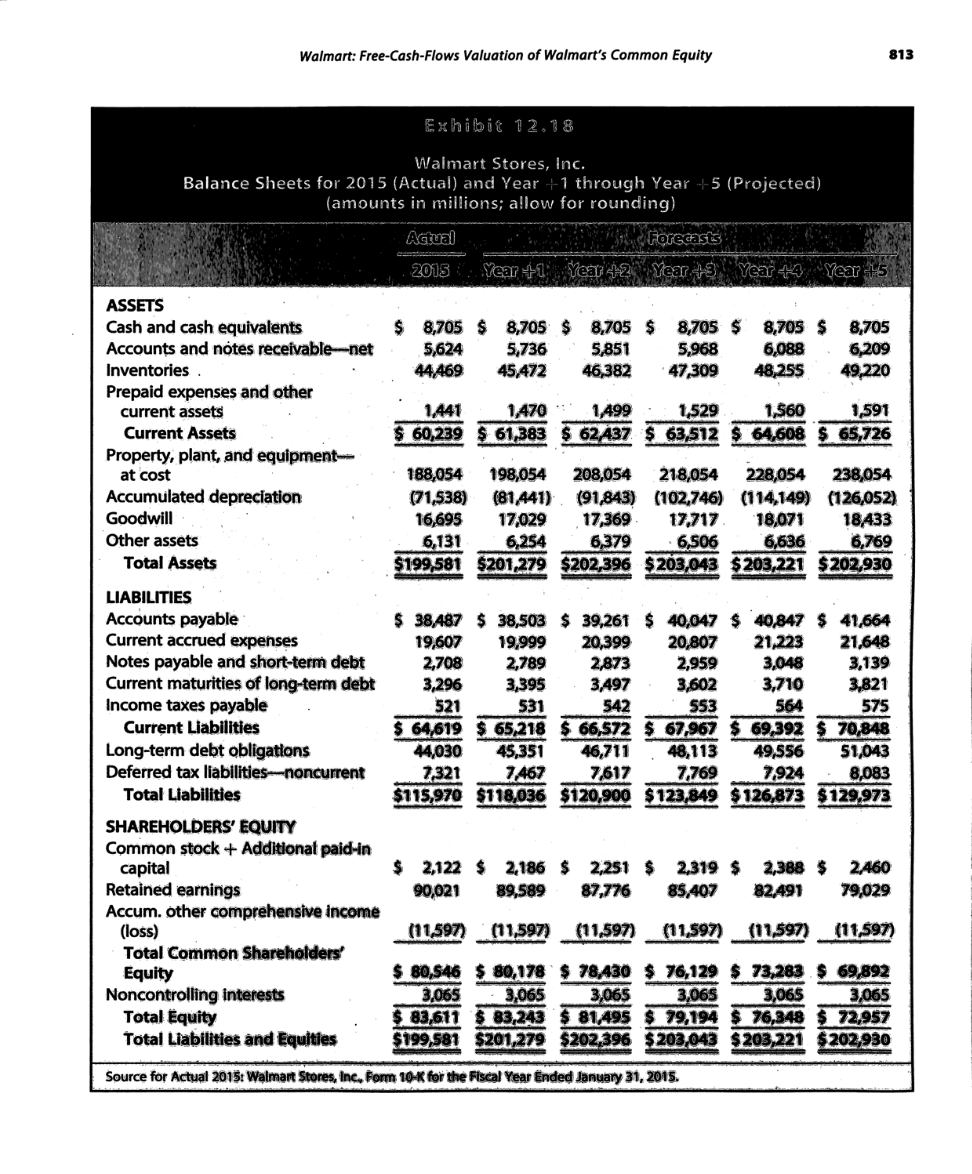

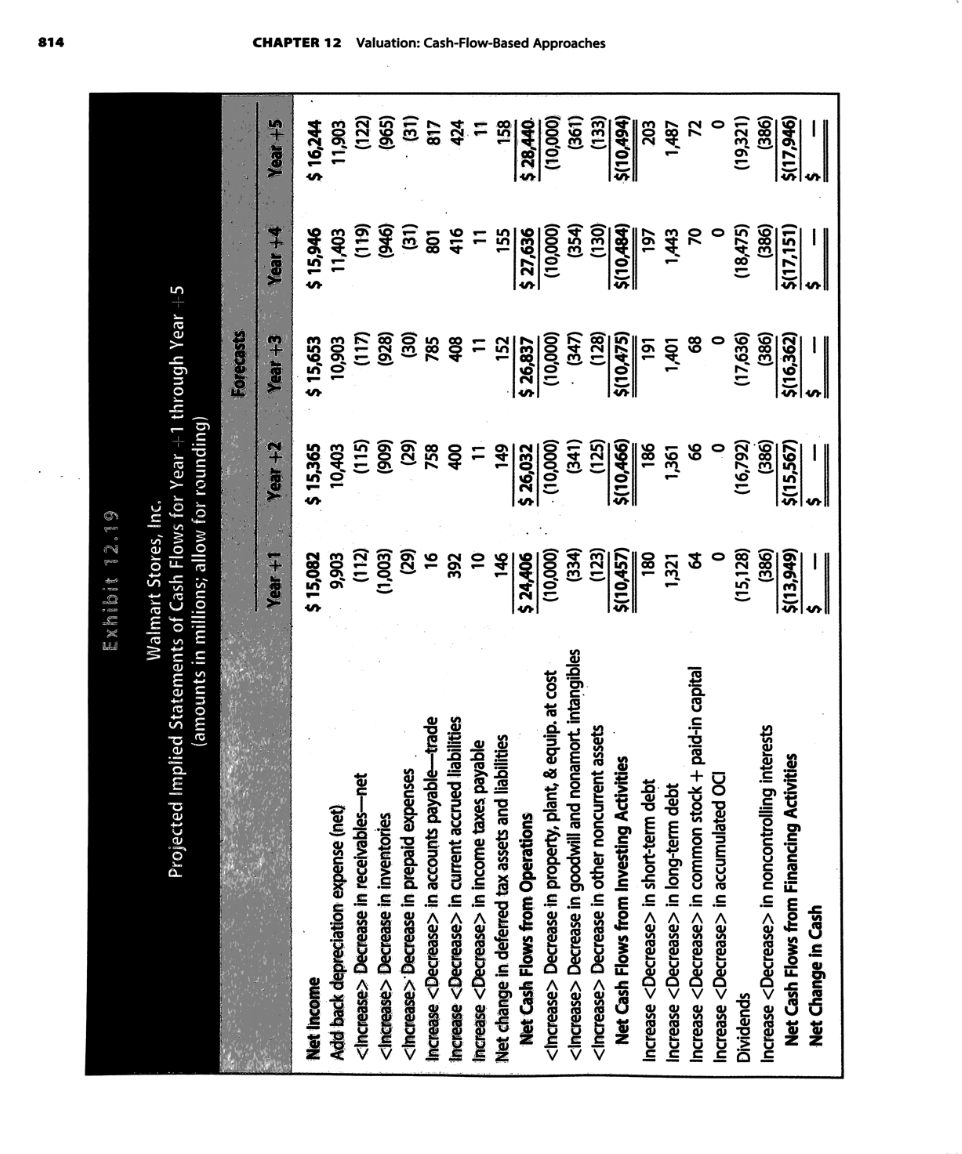

LO 12.2. LO 12-3 LO 12-4, LO 12.5 INTEGRATIVE CASE 12.1 Walmart: Free-Cash-Flows Valuation of Walmart's Common Equity In Integrative Case 10.1, we projected financial statements for Walmart Stores, Inc. (Walmart), for Years +1 through +5. In this portion of the Walmart Integrative Case, we use the projected financial statements from Integrative Case 10.1 and apply the techniques learned in this chapter to compute Walmart's required rate of return on equity and share value based on the free-cash- flows valuation models. We also compare our value estimate to Walmart's share price at the time of the case development to provide an investment recommendation. 812 CHAPTER 12 Valuation: Cash-Flow-Based Approaches The data in Exhibits 12.17 to 12.19 (pages 812-814) include the actual amounts for fiscal 2015 and the projected amounts for Year +1 to Year +5 for the income statements, balance sheets, and statements of cash flows for Walmart (in millions). These forecast amounts assume Walmart will use implied dividends as the financial flexible account to balance the balance sheet. The market equity beta for Walmart at the end of 2015 was 1.00. Assume that the risk- free interest rate was 3.0% and the market risk premium was 6.0%. Walmart had 3,162 million shares outstanding at the end of fiscal 2015, and a share price of $67.50. REQUIRED Part Computing Walmart's Share Value Using Free Cash Flows to common Equity Shareholders a. Use the CAPM to compute the required rate of return on common equity capital for Walmart. b. Beginning with projected net cash flows from operations, derive the projected free cash flows for common equity shareholders for Walmart for Years +1 through +5 based on the projected financial statements. Assume that Walmart uses cash for operating liquidity purposes. Exhibit 12.17 Walmart Stores, Inc. Income Statements for 2015 (Actual) and Year -1 through Year +5 (Projected) (amounts in millions; allow for rounding) Actual 58 Forecasts 2015 Year +1 Year +24 Year +3 Year +4 Year 45 Revenues $ 482,130 $ 491,773 $ 501,608 $ 511,640 $ 521,873 $532,310 Cost of goods sold (360,984) (368,829) (376,206) (383,730) (391,405) (399,233) Gross Profit $ 121,146 $122,943 $125,402 $127,910 $ 130,468 $ 133,078 Selling, general, and administrative expenses (97,041) (98,355) (100,322) (102,328) (104,375) (106,462) Interest Income 131 131 131 131 131 Interest expense (2,548) (2,539) (2,615) (2,694) (2,775) (2,858) Income before Tax $ 21,638 $ 22,180 $ 22,596 $ 23,019 $ 23,450 $ 23,888 Income tax expense (6,558) (7,098) (7,231) (7,366) (7,504) (7644) Net Income $ 15,080 $ 15,082 $ 15,365 $ 15,653 $ 15,946 $ 16,244 Net Income attributable to noncontrolling interests (386) (386) (386) (386) (386) (386) Net Income attributable to common shareholders $ 14,694 14,696 $ 14,979 $ 15,267 $ 15,560 $ 15,858 Other comprehensive income items (4429) 0 0 0 Comprehensive Income $ 10,651 14,696 $14,979 15,267 $ 15,560 $ 15,858 Source for Actual 2015: Walmart Stores, Inc., Form 10-K for the Fiscal Year Ended January 31, 2015. 81 Walmart: Free-Cash-Flows Valuation of Walmart's Common Equity 815 c. Project the continuing free cash flow for common equity shareholders in Year +6. Assume that the steady-state, long-run growth rate will be 3% in Year +6 and beyond. Project that the Year +5 income statement and balance sheet amounts will grow by 3% in Year +6; then derive the projected statement of cash flows for Year +6. Derive the projected free cash flow for common equity shareholders in Year +6 from the pro- jected statement of cash flows for Year +6. d. Using the required rate of return on common equity from Requirement a as the dis- count rate, compute the sum of the present value of free cash flows for common eq- uity shareholders for Walmart for Years +1 through +5. e. Using the required rate of return on common equity from Requirement a as a discount rate and the long-run growth rate from Requirements, compute the continuing value of Walmart as of the start of Year +6 based on Walmart's continuing free cash flows for common equity shareholders in Year +6 and beyond. After computing continuing value as of the start of Year +6, discount it to present value at the start of Year +1. f. Compute the value of a share of Walmart common stock. (1) Compute the total sum of the present value of all future free cash flows for eq- uity shareholders (from Requirements d and e). (2) Adjust the total sum of the present value using the midyear discounting adjust- ment factor. (3) Compute the per-share value estimate. Note: If you worked Integrative Case 11.1 in Chapter 11 and computed Walmart's share value using the dividends valuation approach, compare your value estimate from that problem with the value estimate you obtain here. They should be the same. BIBLIOTECA ULACIT Part II-Computing Walmart's Share Value Using Free Cash Flows to All Debt and Equity Stakeholders g. Compute the weighted-average cost of capital Walmart as of the start of Year +1. At the end of fiscal 2015, Walmart had $50,034 million in outstanding interest- bearing debt on the balance sheet and no preferred stock. Assume that the balance sheet value of Walmart's debt is approximately equal to the market value of the debt. Assume that at the start of Year +1, Walmart will incur interest expense of 5.0% on debt capital and that Walmart's average tax rate will be 32.0%. In addition, at the end of fiscal 2015, Walmart had noncontrolling interests of $3,065 million, with an expected return of 12.6%. (For our forecasts, we assume noncontrolling interests receive dividends equal to the required rate of return each year.) h. Beginning with projected net cash flows from operations, derive the projected free cash flows for all debt and equity stakeholders for Walmart for Years +1 through +5 based on the projected financial statements. i. Project the continuing free cash flows for all debt and equity stakeholders in Year +6. Use the projected financial statements for Year +6 from Requirement c to derive the projected free cash flow for all debt and equity stakeholders in Year +6. j. Using the weighted-average cost of capital from Requirement g as a discount rate, compute the sum of the present value of free cash flows for all debt and equity stakeholders for Walmart for Years +1 through +5. k. Using the weighted average cost of capital from Requirement g as a discount rate and the long-run growth rate from Requirement compute the continuing value of Walmart as of the start of Year +6 based on Walmart's continuing free cash flows for all debt and equity stakeholders in Year +6 and beyond. After computing continuing value as of the start of Year +6, discount it to present value as of the start of Year +1. Walmart: Free-Cash-Flows Valuation of Walmart's Common Equity 813 Exhibit 12.18 Walmart Stores, Inc. Balance Sheets for 2015 (Actual) and Year +1 through Year (amounts in millions; allow for rounding) -5 (Projected) Actual Forecasts Year 1 Year 42 Year 45 2015 Year 4 Year +5 $ 8,705 $ 8,705 $ 8,705 $ 8,705 $ 8,705 $ 5,624 5,736 5,851 5,968 6,088 44,469 45,472 46,382 47,309 48,255 8,705 6,209 49,220 1.470 ASSETS Cash and cash equivalents Accounts and notes receivable-net Inventories Prepaid expenses and other current assets Current Assets Property, plant, and equipment- at cost Accumulated depreciation Goodwill Other assets Total Assets 1,441 60,239 1,499 1,529 1,560 1,591 61,383 $ 62 A37 $ 63,512 $ 64,608 $ 65,726 188,054 198,054 208,054 218,054 228,054 238,054 (71,538) (81,441) (91,843) (102,746) (114,149) (126,052) 16,695 17,029 17,369 17,717 18,071 18433 6,131 6,254 6,379 6,506 6,636 6,769 $199,581 $201.279 $202,396 $203,043 $203,221 $ 202,930 $ 38,487 $ 38,503 $ 39,261 $ 40,047 $ 40,847 $ 41,664 19,607 19,999 20,399 20,807 21,223 21,648 2,708 2,789 2,873 2,959 3,048 3,139 3,296 3,395 3,497 3,602 3,710 3,821 521 531 542 553 564 575 $ 64,619 $ 65,218 $ 66,572 $ 67,967 $ 69,392 $ 70,848 44,030 45,351 46,711 48,113 49,556 51,043 7,321 1,467 7,617 7,769 7,924 $115,970 $118,036 $120.900 $123,849 $126,873 $129.973 8,083 LIABILITIES Accounts payable Current accrued expenses Notes payable and short-term debt Current maturities of long-term debt Income taxes payable Current Liabilities Long-term debt obligations Deferred tax liabilities--noncurrent Total Liabilities SHAREHOLDERS' EQUITY Common stock + Additional paid-in capital Retained earnings Accum. other comprehensive income (loss) Total Common Shareholders Equity Noncontrolling interests Total Equity Total Liabilities and Equities $ 2,122 $ 2,186 $ 2,251 $ 2,319 $ 2,388 $ 2,460 90,021 89,589 87,776 85,407 82.491 79,029 (11,597) (11,597) (11,597) (11,597) (11,597) (11,597) $ 80,546 $ 80,178 $ 78,430 $ 76,129 $ 73,283 $ 69,892 3,065 3,065 3,065 3,065 3,065 3,065 83,611 $ 83,243 $ 81,495 $ 79,194 $ 76,348 $ 72,957 $199,581 $201.279 $202,396 $203,043 $203,221 $ 202,930 Source for Actual 2015: Walmart Stores, Inc. Form 10-K for the Fiscal Year Ended January 31, 2015. 814 Exhibit 12.19 Walmart Stores, Inc. Projected Implied Statements of Cash Flows for Year +1 through Year +5 (amounts in millions; allow for rounding) Forecasts Year +1 Year +2 Year +3 Year +4 Year +5 Net Income Add back depreciation expense (net)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started