Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Please Read the Question Carefully . Book: Analysis of Financial Statements Answer the following questions. Q.No.1 you are required to perform Liquidity, Solvency, and

Note: Please Read the Question Carefully . Book: Analysis of Financial Statements

Answer the following questions.

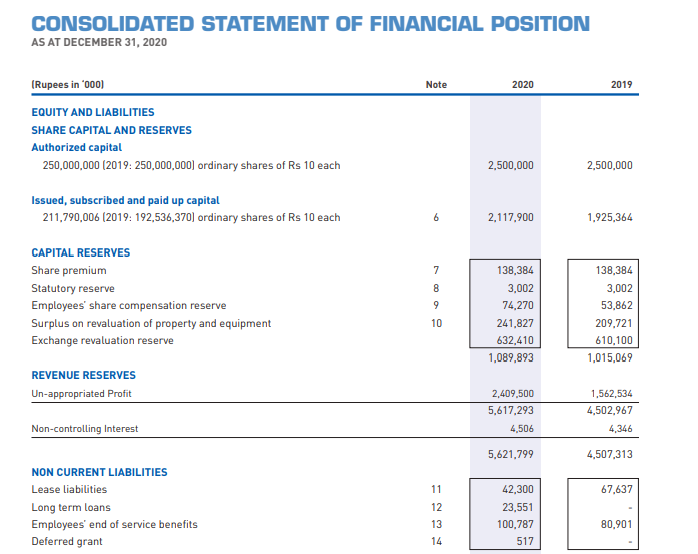

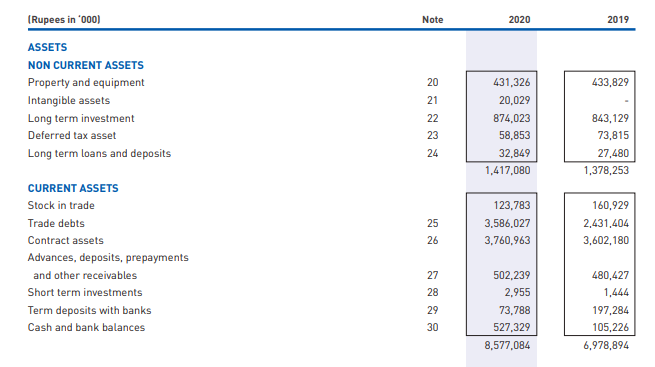

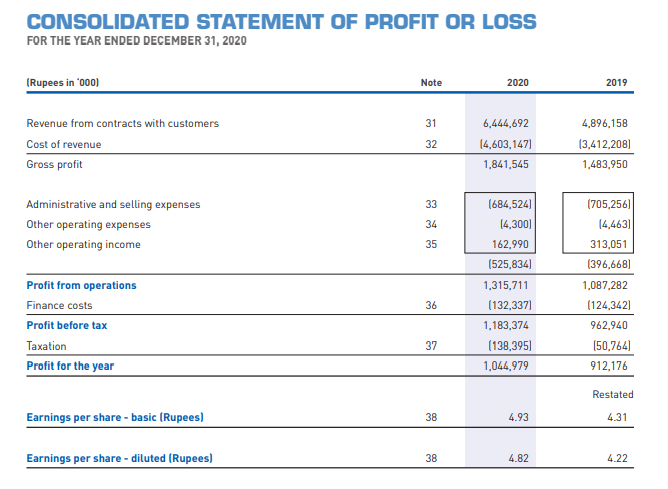

Q.No.1 you are required to perform Liquidity, Solvency, and Profitability Analysis for both the statement (provided above). Analyze both the statements, provide interpretation, and a comprehensive judgment as if the company is lucrative for the purpose of investment for the investors or not.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2020 Note 2020 2019 (Rupees in '000) EQUITY AND LIABILITIES SHARE CAPITAL AND RESERVES Authorized capital 250,000,000 (2019: 250,000,000) ordinary shares of Rs 10 each 2,500,000 2,500,000 Issued, subscribed and paid up capital 211,790,006 (2019: 192,536,370) ordinary shares of Rs 10 each 6 2.117.900 1,925,364 7 8 CAPITAL RESERVES Share premium Statutory reserve Employees' share compensation reserve Surplus on revaluation of property and equipment Exchange revaluation reserve 9 138,384 3,002 74,270 241.827 632,410 1,089,893 138,384 3.002 53,862 209,721 610.100 1,015,069 10 REVENUE RESERVES Un-appropriated Profit 2,409,500 5,617,293 1,562,534 4,502,967 Non-controlling Interest 4,506 4,346 5,621,799 4,507,313 11 67,637 NON CURRENT LIABILITIES Lease liabilities Long term loans Employees' end of service benefits Deferred grant 12 42,300 23.551 100,787 517 80.901 14 167,155 148,538 11 38,159 25,911 1.218 45,554 1,515 12 14 CURRENT LIABILITIES Current portion of lease liabilities Current portion of long term loans Current portion of deferred grant Finances under markup arrangements and other credit facilities - secured Creditors, accrued and other liabilities Contract liabilities Unclaimed dividend 15 16 17 487,386 2,739,492 902.093 10.951 4,205,210 599,339 1,670,783 1,127,342 256,763 3,701,296 18 CONTINGENCIES AND COMMITMENTS 19 9.994.164 8,357,147 Note 2020 2019 (Rupees in '000) ASSETS NON CURRENT ASSETS Property and equipment Intangible assets Long term investment Deferred tax asset Long term loans and deposits 433,829 20 21 22 23 431,326 20.029 874,023 58,853 32,849 1,417,080 843,129 73,815 24 27,480 1,378,253 25 123,783 3.586,027 3.760.963 160,929 2,431,404 3,602,180 26 CURRENT ASSETS Stock in trade Trade debts Contract assets Advances, deposits, prepayments and other receivables Short term investments Term deposits with banks Cash and bank balances 27 28 29 30 502,239 2,955 73.788 527,329 8,577,084 480,427 1,444 197,284 105,226 6,978,894 CONSOLIDATED STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED DECEMBER 31, 2020 (Rupees in '000) Note 2020 2019 31 Revenue from contracts with customers Cost of revenue Gross profit 32 6,444,692 14.603,147) 1.841,545 4.896,158 (3,412,208) 1,483,950 33 Administrative and selling expenses Other operating expenses Other operating income 34 (684,524) [4.300) 162.990 (525,834) 35 1,315,711 (705,256) 14.463) 313,051 (396,6681 1,087,282 (124.342) 962,940 (50,764 912,176 Profit from operations Finance costs Profit before tax Taxation Profit for the year 36 (132,337] 1.183,374 (138,395) 1,044.979 37 Restated Earnings per share - basic (Rupees) 38 4.93 4.31 Earnings per share-diluted (Rupees) 38 4.82 4.22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started