Answered step by step

Verified Expert Solution

Question

1 Approved Answer

note please show working ( no Excel) and thank you. QUESTION 1 Part A: An athlete was offered the following contract for the next three

note please show working ( no Excel) and thank you.

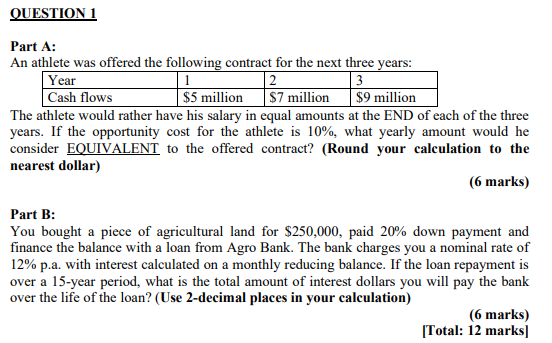

QUESTION 1 Part A: An athlete was offered the following contract for the next three years: Year 2 3 Cash flows $5 million $7 million $9 million The athlete would rather have his salary in equal amounts at the END of each of the three years. If the opportunity cost for the athlete is 10%, what yearly amount would he consider EQUIVALENT to the offered contract? (Round your calculation to the nearest dollar) (6 marks) Part B: You bought a piece of agricultural land for $250,000, paid 20% down payment and finance the balance with a loan from Agro Bank. The bank charges you a nominal rate of 12% p.a. with interest calculated on a monthly reducing balance. If the loan repayment is over a 15-year period, what is the total amount of interest dollars you will pay the bank over the life of the loan? (Use 2-decimal places in your calculation) (6 marks) [Total: 12 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started