Answered step by step

Verified Expert Solution

Question

1 Approved Answer

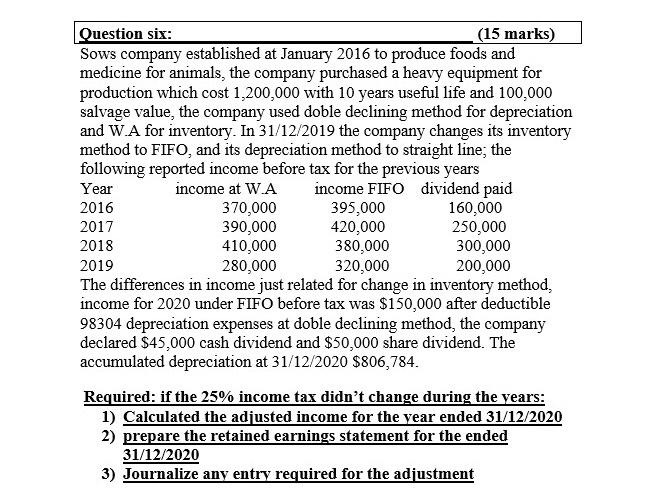

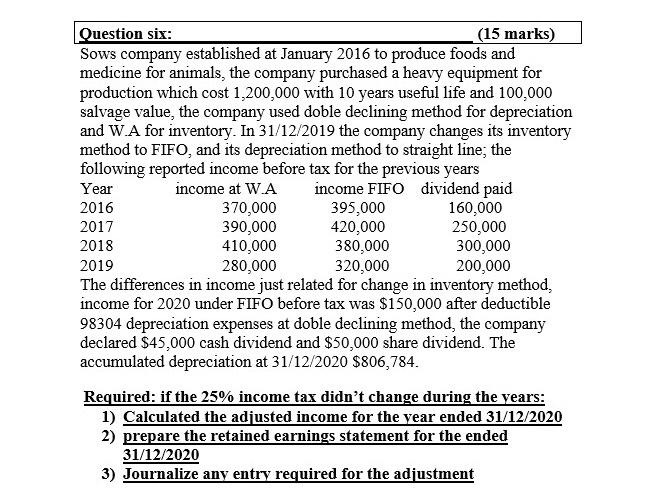

note: Please solve in (IFRS) principles method not (FASB) Question six: (15 marks) Sows company established at January 2016 to produce foods and medicine for

note: Please solve in (IFRS) principles method not (FASB)

Question six: (15 marks) Sows company established at January 2016 to produce foods and medicine for animals, the company purchased a heavy equipment for production which cost 1,200,000 with 10 years useful life and 100,000 salvage value, the company used doble declining method for depreciation and W. A for inventory. In 31/12/2019 the company changes its inventory method to FIFO, and its depreciation method to straight line; the following reported income before tax for the previous years Year income at WA income FIFO dividend paid 2016 370,000 395,000 160,000 2017 390,000 420,000 250,000 2018 410,000 380,000 300,000 2019 280,000 320,000 200,000 The differences in income just related for change in inventory method, income for 2020 under FIFO before tax was $150,000 after deductible 98304 depreciation expenses at doble declining method, the company declared $45,000 cash dividend and $50,000 share dividend. The accumulated depreciation at 31/12/2020 $806,784. Required: if the 25% income tax didn't change during the years: 1) Calculated the adjusted income for the year ended 31/12/2020 2) prepare the retained earnings statement for the ended 31/12/2020 3) Journalize any entry required for the adjustment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started