Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note :- Please solve in such a way that i can get full marks TAXATION MANAGEMENT (FIN623) Assignment 01 Marks: 10 Residential Status and Taxable

Note :- Please solve in such a way that i can get full marks

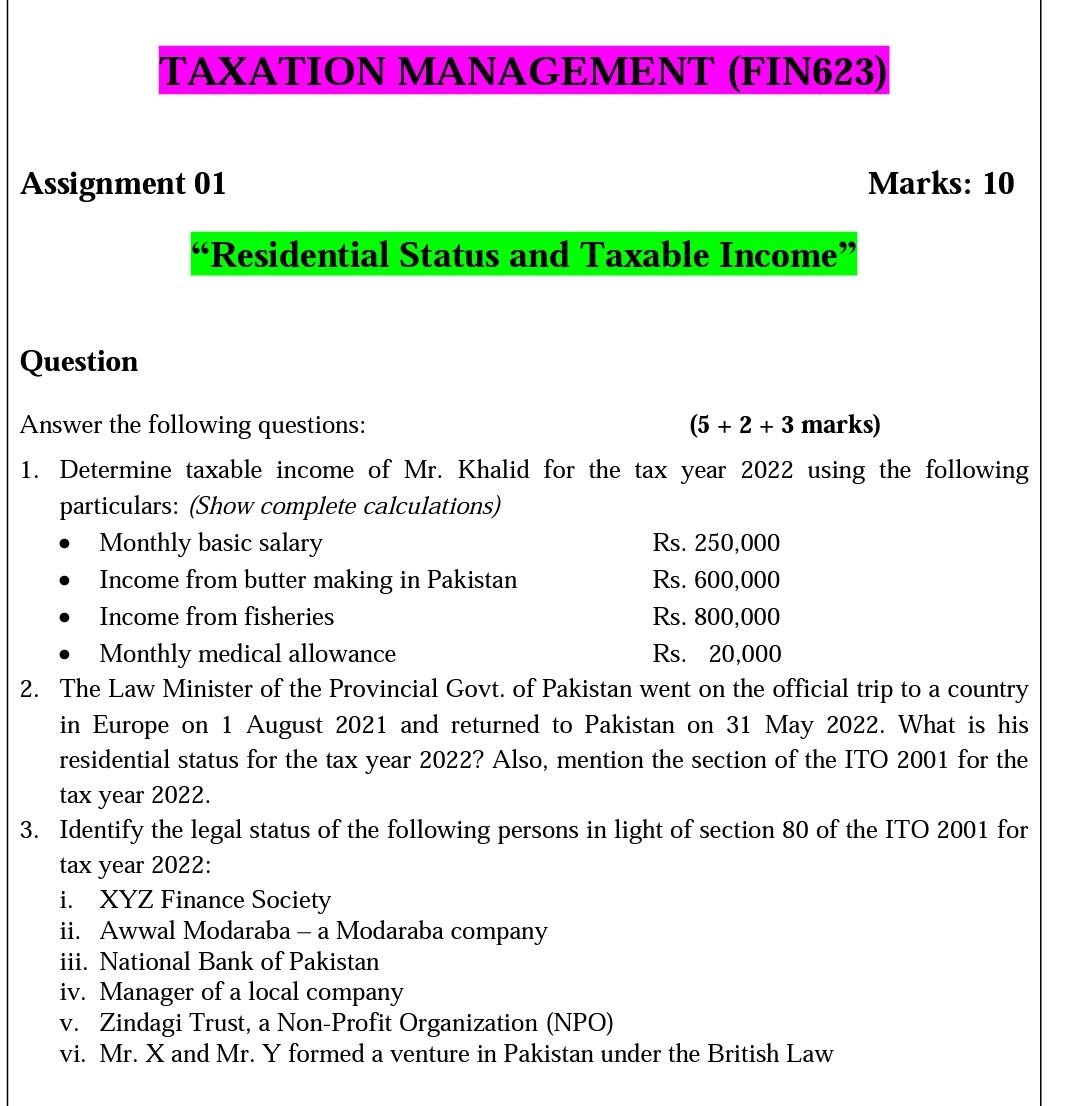

TAXATION MANAGEMENT (FIN623) Assignment 01 Marks: 10 "Residential Status and Taxable Income Question . . . Answer the following questions: (5 + 2 + 3 marks) 1. Determine taxable income of Mr. Khalid for the tax year 2022 using the following particulars: (Show complete calculations) Monthly basic salary Rs. 250,000 Income from butter making in Pakistan Rs. 600,000 Income from fisheries Rs. 800,000 Monthly medical allowance Rs. 20,000 2. The Law Minister of the Provincial Govt. of Pakistan went on the official trip to a country in Europe on 1 August 2021 and returned to Pakistan on 31 May 2022. What is his residential status for the tax year 2022? Also, mention the section of the ITO 2001 for the tax year 2022. 3. Identify the legal status of the following persons in light of section 80 of the ITO 2001 for tax year 2022: i. XYZ Finance Society ii. Awwal Modaraba - a Modaraba company iii. National Bank of Pakistan iv. Manager of a local company V. Zindagi Trust, a Non-Profit Organization (NPO) vi. Mr. X and Mr. Y formed a venture in Pakistan under the British LawStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started