Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note : Please use the Financial Mathematics formulas and don't use excel for this question. I'd be appreciated if it is not calculated by each

Note: Please use the Financial Mathematics formulas and don't use excel for this question. I'd be appreciated if it is not calculated by each year. This question is in the book "Financial Mathematics for Actuaries" so I need answer according to it. I'm currently studying for e-xam FM so any related formula would be appreciated. Thanks a lot.

Answer: $57.83

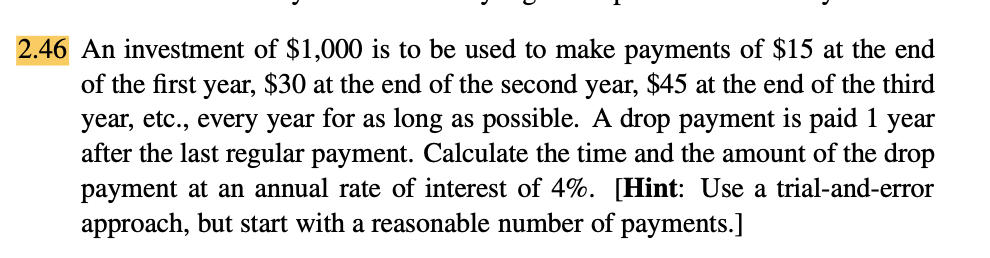

2.46 An investment of $1,000 is to be used to make payments of $15 at the end of the first year, $30 at the end of the second year, $45 at the end of the third year, etc., every year for as long as possible. A drop payment is paid 1 year after the last regular payment. Calculate the time and the amount of the drop payment at an annual rate of interest of 4%. [Hint: Use a trial-and-error approach, but start with a reasonable number of payments.] 2.46 An investment of $1,000 is to be used to make payments of $15 at the end of the first year, $30 at the end of the second year, $45 at the end of the third year, etc., every year for as long as possible. A drop payment is paid 1 year after the last regular payment. Calculate the time and the amount of the drop payment at an annual rate of interest of 4%. [Hint: Use a trial-and-error approach, but start with a reasonable number of payments.]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started