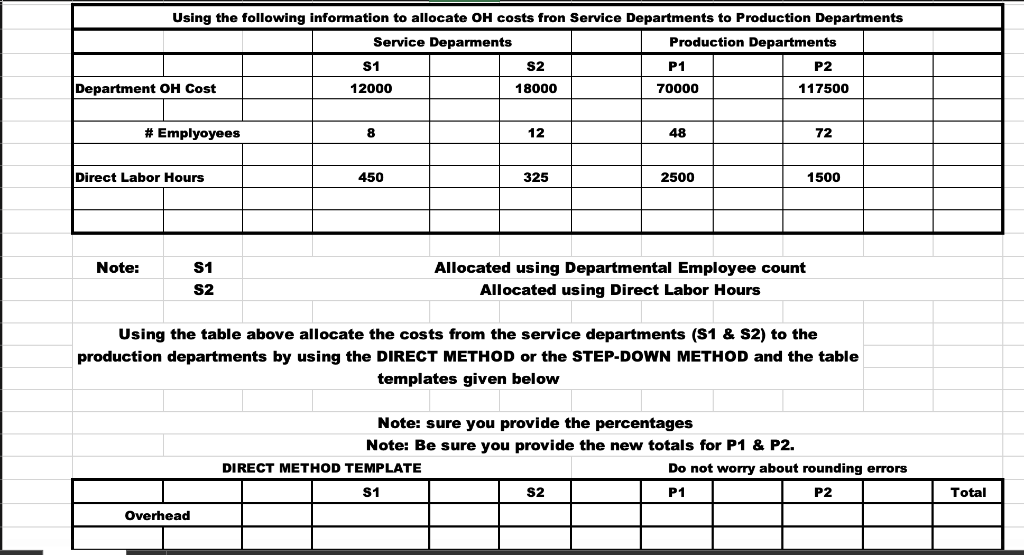

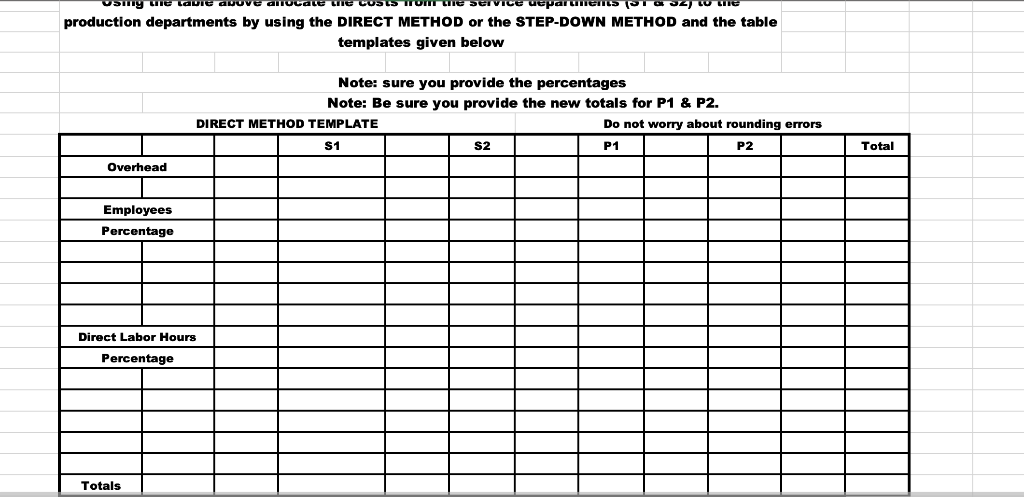

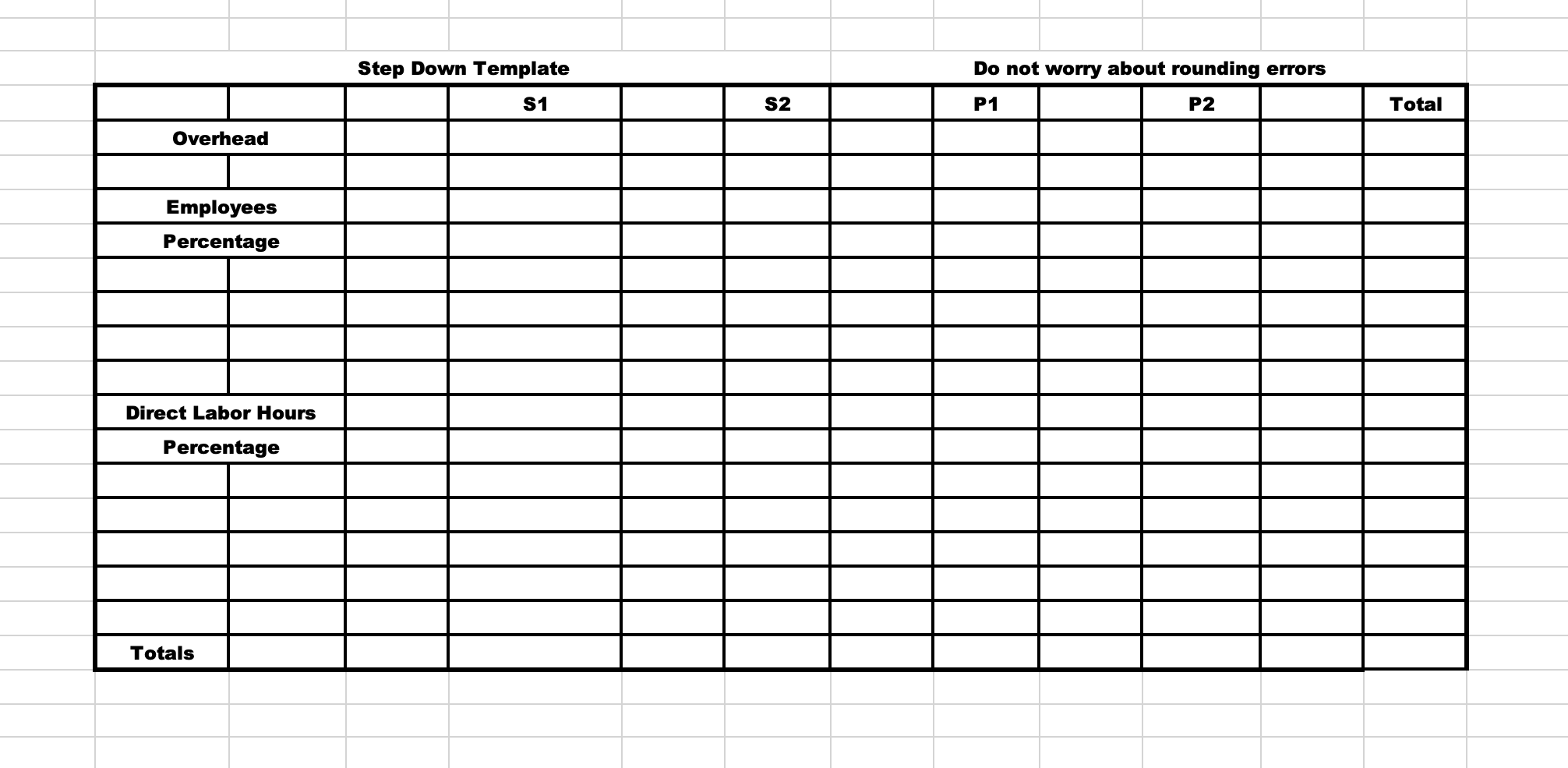

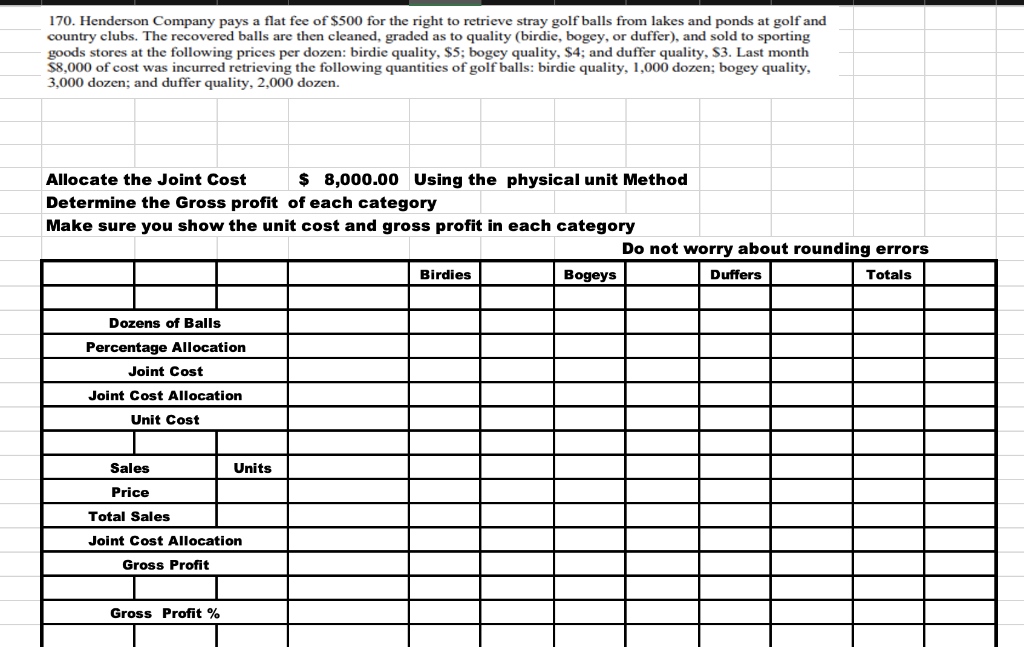

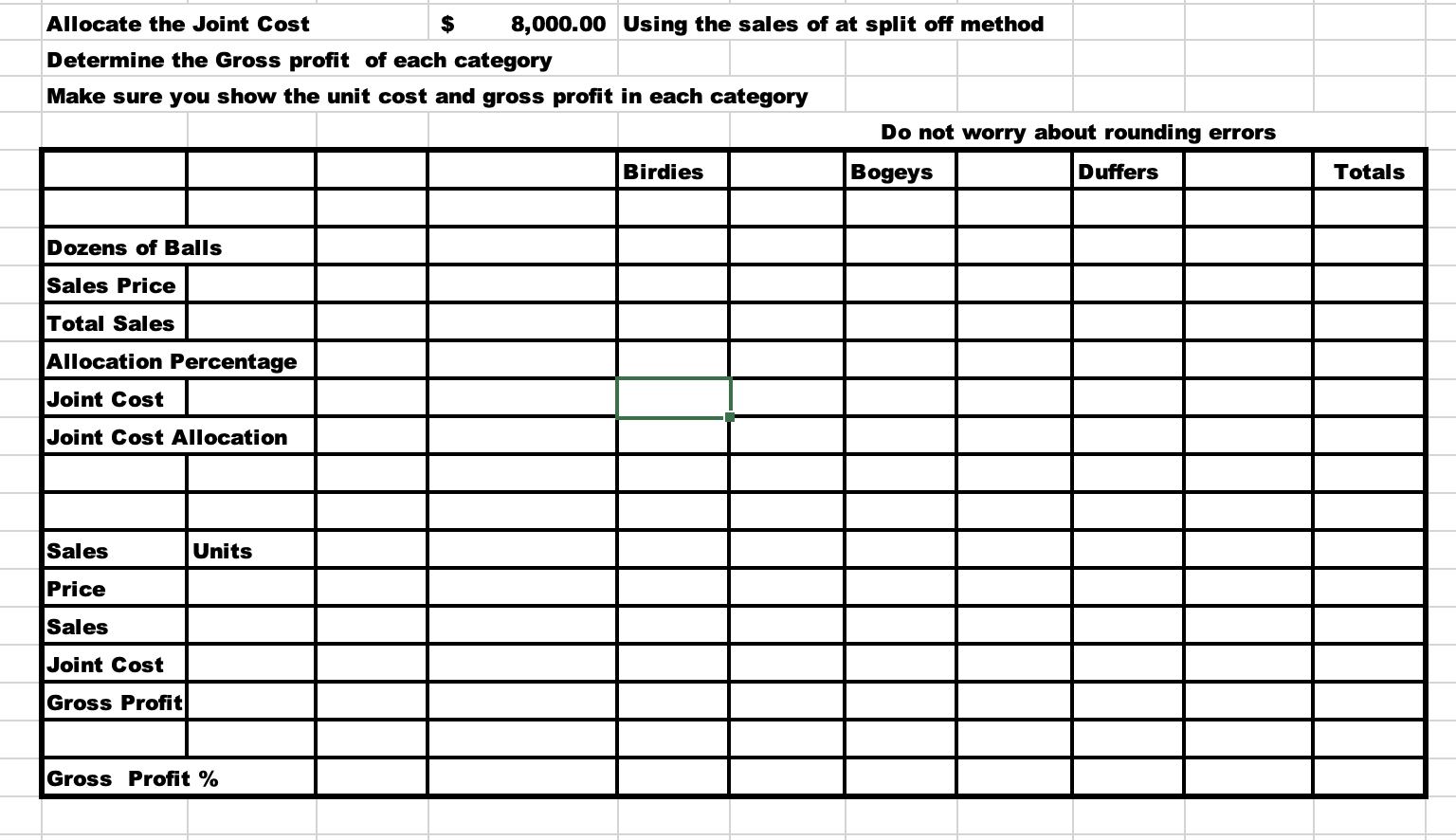

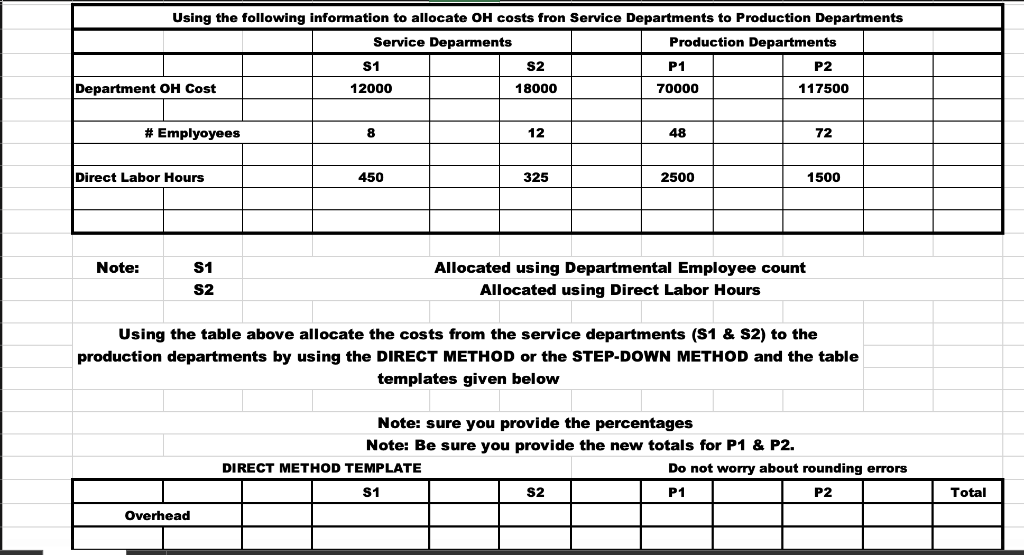

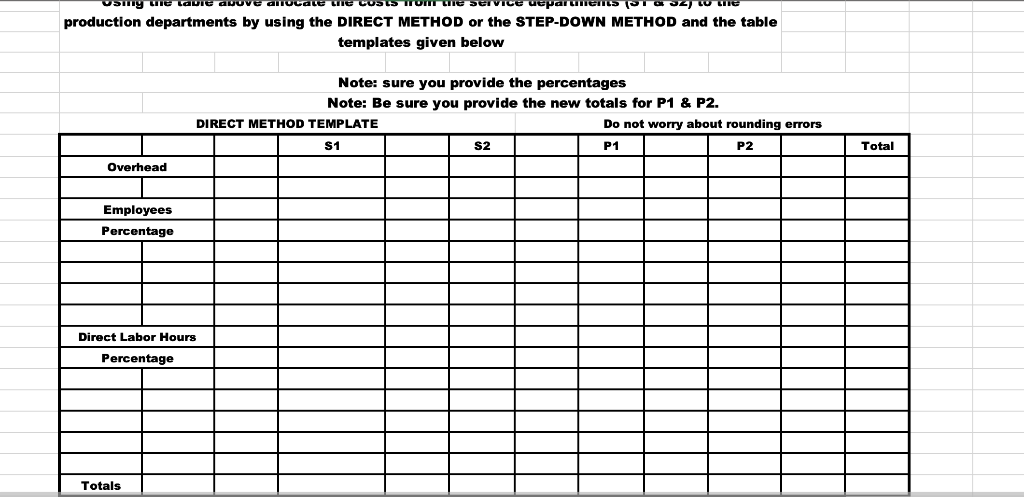

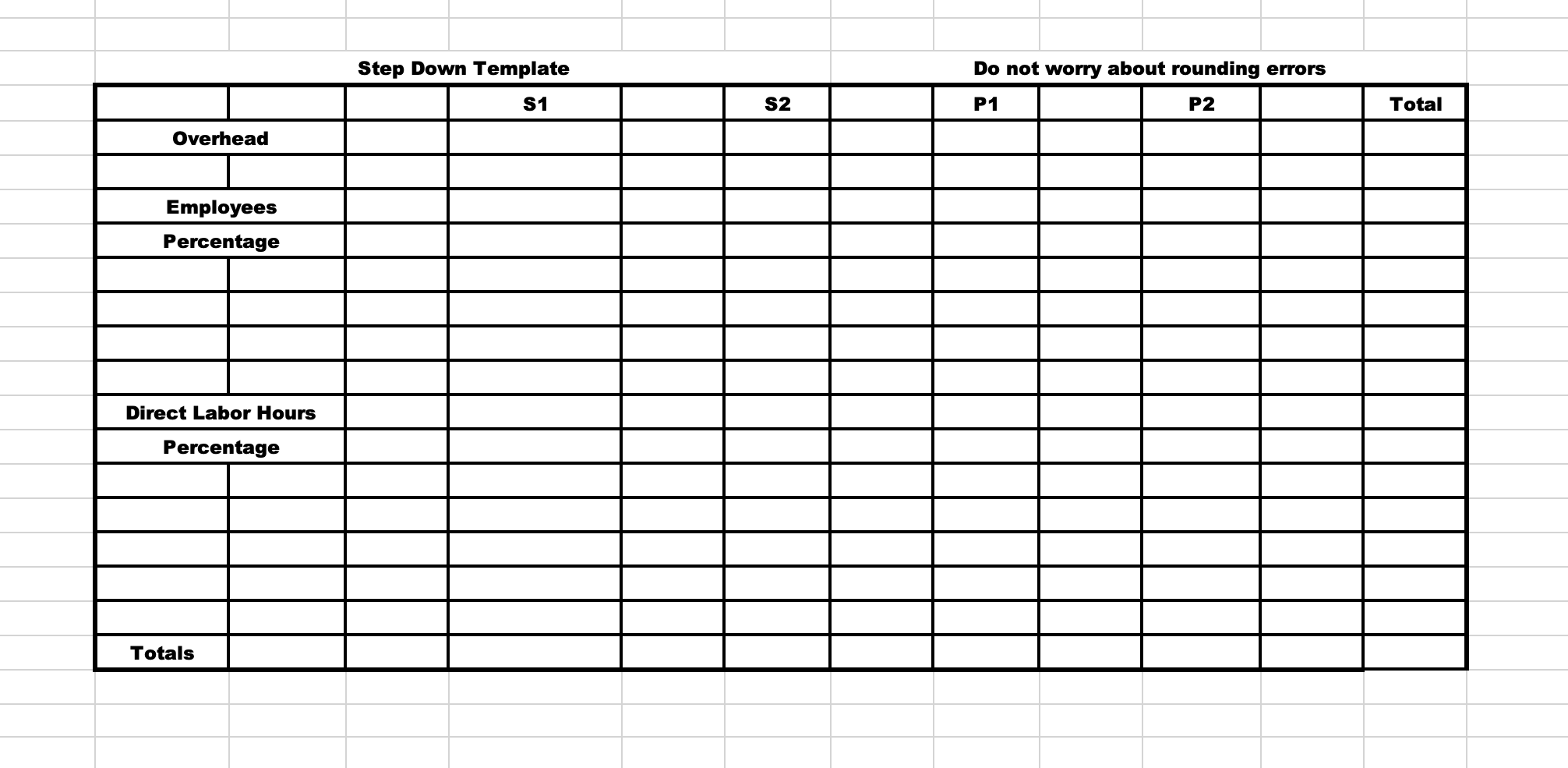

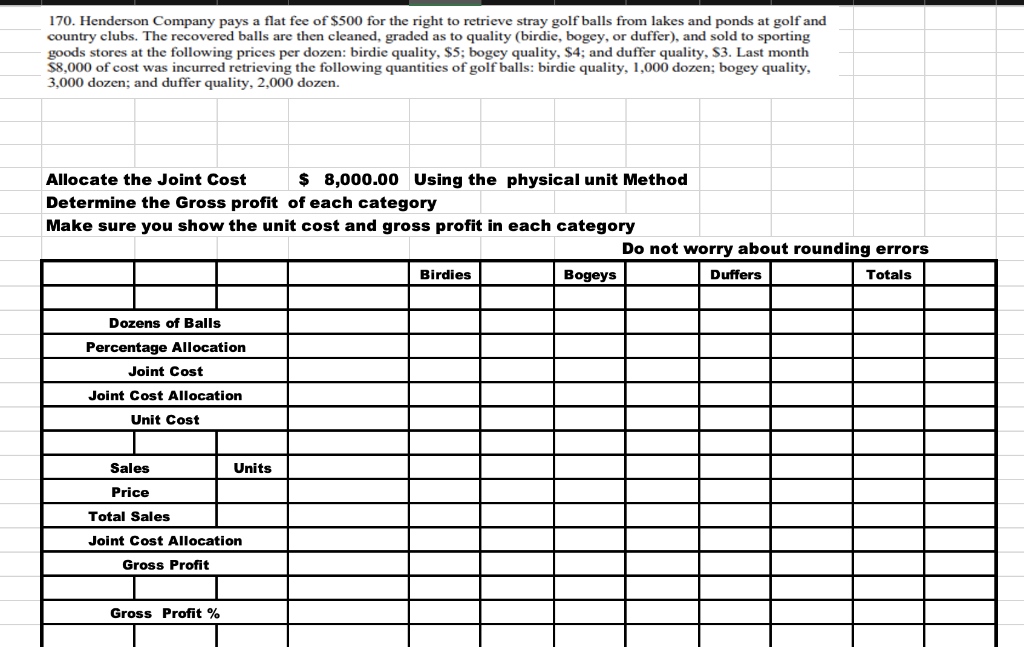

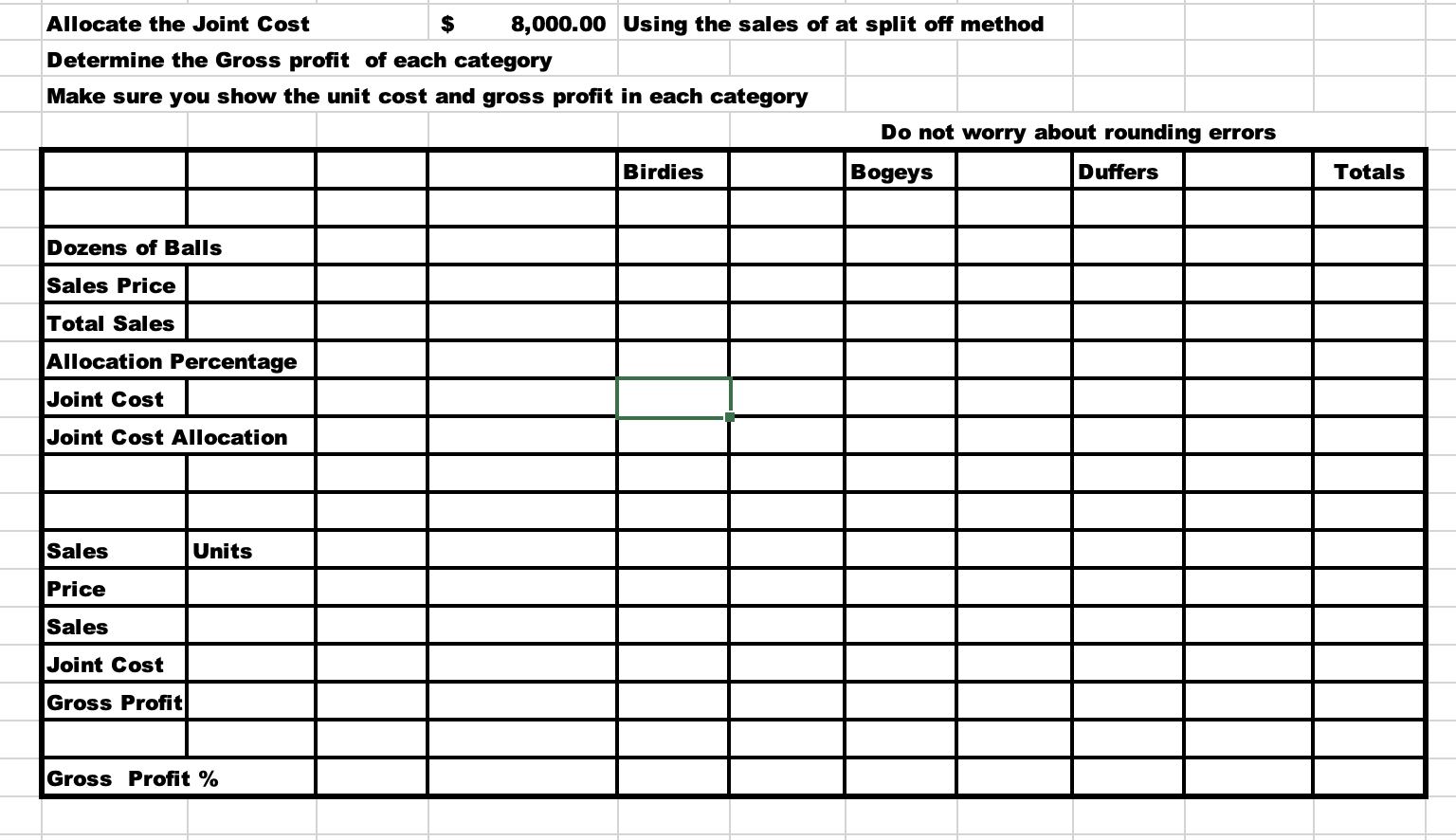

Note: S1 Allocated using Departmental Employee count Allocated using Direct Labor Hours Using the table above allocate the costs from the service departments (S1 \& S2) to the production departments by using the DIRECT METHOD or the STEP-DOWN METHOD and the table templates given below Note: sure you provide the percentages Note: Be sure you provide the new totals for P1 \& P2. DIRECT METHOD TEMPLATE Do not worry about rounding errors production departments by using the DIRECT METHOD or the STEP-DOWN METHOD and the table templates given below Note: sure you provide the percentages Note: Be sure you provide the new totals for P1 8 P2. DIRECT METHOD TEMPLATE Do not worry about rounding errors Step Down Template Do not worry about rounding errors 170. Henderson Company pays a flat fee of $500 for the right to retrieve stray golf balls from lakes and ponds at golf and country clubs. The recovered balls are then cleaned, graded as to quality (birdie, bogey, or duffer), and sold to sporting goods stores at the following prices per dozen: birdie quality, $5; bogey quality, $4; and duffer quality, \$3. Last month $8,000 of cost was incurred retrieving the following quantities of golf balls: birdie quality, 1,000 dozen; bogey quality, 3,000 dozen; and duffer quality, 2,000 dozen. Allocate the Joint Cost $8,000.00 Using the sales of at split off method Determine the Gross profit of each category Make sure you show the unit cost and gross profit in each category Do not worry about rounding errors Note: S1 Allocated using Departmental Employee count Allocated using Direct Labor Hours Using the table above allocate the costs from the service departments (S1 \& S2) to the production departments by using the DIRECT METHOD or the STEP-DOWN METHOD and the table templates given below Note: sure you provide the percentages Note: Be sure you provide the new totals for P1 \& P2. DIRECT METHOD TEMPLATE Do not worry about rounding errors production departments by using the DIRECT METHOD or the STEP-DOWN METHOD and the table templates given below Note: sure you provide the percentages Note: Be sure you provide the new totals for P1 8 P2. DIRECT METHOD TEMPLATE Do not worry about rounding errors Step Down Template Do not worry about rounding errors 170. Henderson Company pays a flat fee of $500 for the right to retrieve stray golf balls from lakes and ponds at golf and country clubs. The recovered balls are then cleaned, graded as to quality (birdie, bogey, or duffer), and sold to sporting goods stores at the following prices per dozen: birdie quality, $5; bogey quality, $4; and duffer quality, \$3. Last month $8,000 of cost was incurred retrieving the following quantities of golf balls: birdie quality, 1,000 dozen; bogey quality, 3,000 dozen; and duffer quality, 2,000 dozen. Allocate the Joint Cost $8,000.00 Using the sales of at split off method Determine the Gross profit of each category Make sure you show the unit cost and gross profit in each category Do not worry about rounding errors