Question

Note: See section 5.2 Application: Discount Rates and Loans in either textbook (especially the sub-section Computing Canadian Mortgage Payments) for a discussion on how Canadian

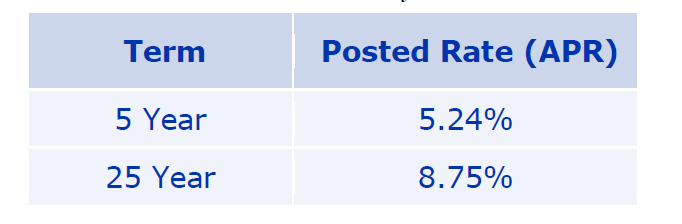

Note: See section 5.2 Application: Discount Rates and Loans in either textbook (especially the sub-section Computing Canadian Mortgage Payments) for a discussion on how Canadian mortgage rates are quoted and how the effective annual rate, the monthly rate and the monthly payments are calculated. Below you will find interest rate information from the RBC Royal Bank website:

RBC calculates monthly payments using 25-year amortization regardless of the term the customer chooses. The term of the mortgage simply refers to the length of the period for which the interest rate is fixed. Jane and John Dough want to buy a house in Edmonton for $600,000. They have $150,000 in savings that they can use as a down payment, and they plan to borrow the rest from RBC. a. Assume the Doughs chose the five-year term mortgage. i. What is the monthly payment over the five-year term of the mortgage? ii. What will the outstanding principal balance be at the end of the mortgage term of five years? iii. What will the monthly payment be if, at the end of five years, the loan is renewed at 9.8% APR? (The remaining amortization period is 20 years.) b. Assume the Doughs chose the 25-year term mortgage. What is the monthly payment over the 25-year term of the mortgage? Why would anyone choose the 25-year term?

\begin{tabular}{|c|c|} \hline Term & Posted Rate (APR) \\ \hline 5 Year & 5.24% \\ \hline 25 Year & 8.75% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started