Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NOTE: Take Parameter x to be 4 (i.e. PARAMETER X = 4) Consider the market model with the following bonds: Dirty price Maturity Nominal Interest

NOTE: Take Parameter x to be 4 (i.e. PARAMETER X = 4)

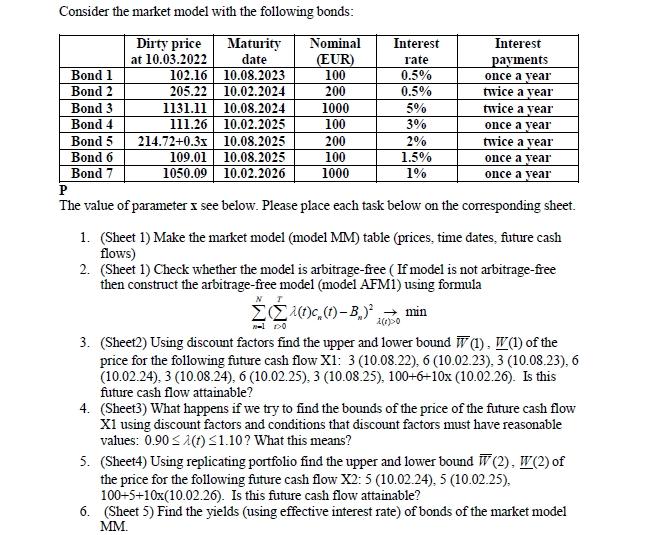

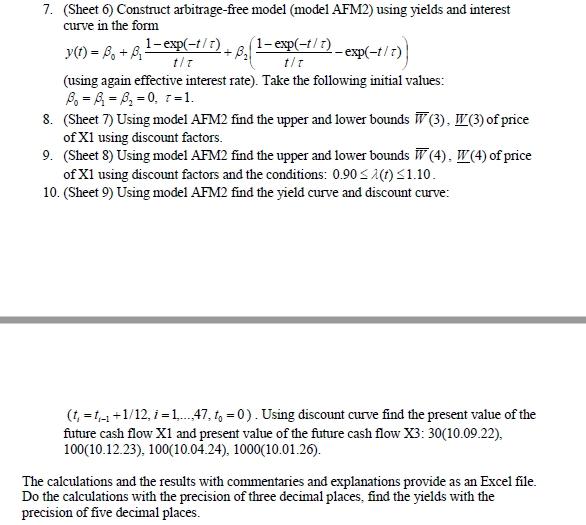

Consider the market model with the following bonds: Dirty price Maturity Nominal Interest Interest at 10.03.2022 date (EUR) rate payments Bond 1 102.16 10.08.2023 100 0.5% once a year Bond 2 205.22 10.02.2024 200 0.5% twice a year Bond 3 1131.11 10.08.2024 1000 5% twice a year Bond 4 111.26 10.02.2025 100 3% once a year Bond 5 214.72+0.3x 10.08.2025 200 2% twice a year Bond 6 109.01 10.08.2025 100 1.5% once a year Bond 7 1050.09 10.02.2026 1000 1% once a year P The value of parameter I see below. Please place each task below on the corresponding sheet. Nel 10 2()>0 1. (Sheet 1) Make the market model (model MM) table prices, time dates, future cash flows) 2. (Sheet 1) Check whether the model is arbitrage-free (If model is not arbitrage-free then construct the arbitrage-free model (model AFMI) using formula 231()(1)-B.) min 3. (Sheet2) Using discount factors find the upper and lower bound (1), W (1) of the price for the following future cash flow X1: 3 (10.08.22), 6 (10.02.23), 3 (10.08.23), 6 (10.02.24), 3 (10.08.24), 6 (10.02.25), 3 (10.08.25), 100+6+10x (10.02.26). Is this future cash flow attainable? 4. (Sheet3) What happens if we try to find the bounds of the price of the future cash flow X1 using discount factors and conditions that discount factors must have reasonable values: 0.90 0 1. (Sheet 1) Make the market model (model MM) table prices, time dates, future cash flows) 2. (Sheet 1) Check whether the model is arbitrage-free (If model is not arbitrage-free then construct the arbitrage-free model (model AFMI) using formula 231()(1)-B.) min 3. (Sheet2) Using discount factors find the upper and lower bound (1), W (1) of the price for the following future cash flow X1: 3 (10.08.22), 6 (10.02.23), 3 (10.08.23), 6 (10.02.24), 3 (10.08.24), 6 (10.02.25), 3 (10.08.25), 100+6+10x (10.02.26). Is this future cash flow attainable? 4. (Sheet3) What happens if we try to find the bounds of the price of the future cash flow X1 using discount factors and conditions that discount factors must have reasonable values: 0.90Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started