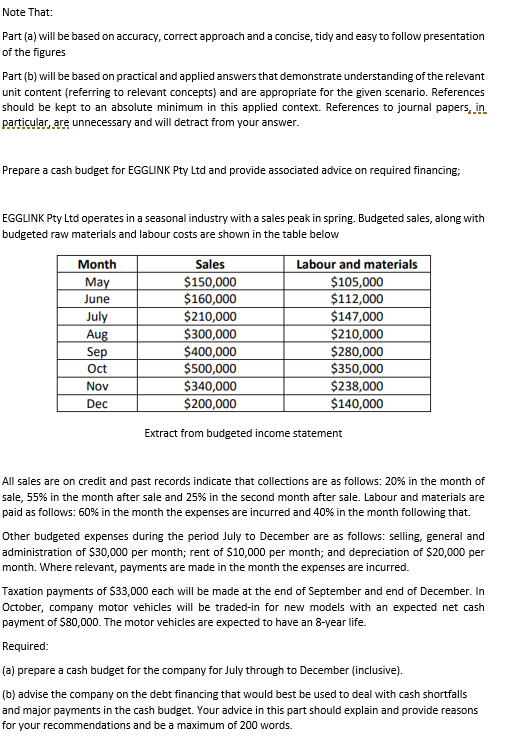

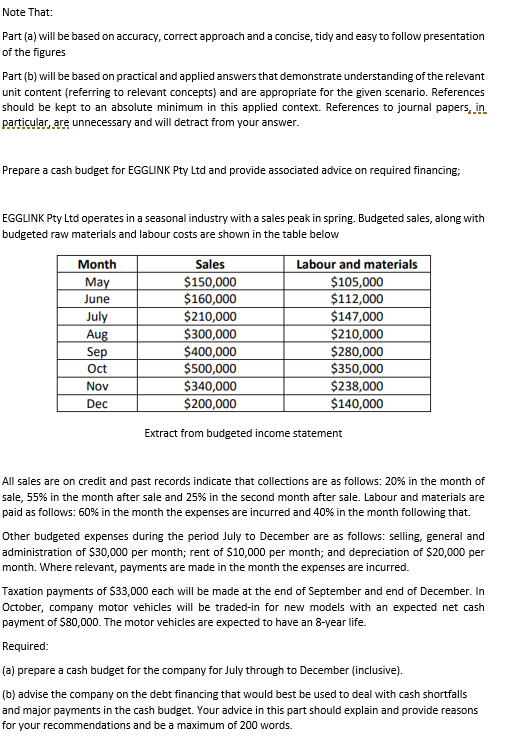

Note That: Part (a) will be based on accuracy, correct approach and a concise, tidy and easy to follow presentation of the figures Part (b) will be based on practical and applied answers that demonstrate understanding of the relevant unit content (referring to relevant concepts) and are appropriate for the given scenario. References should be kept to an absolute minimum in this applied context. References to journal papers, in particular, are unnecessary and will detract from your answer. Prepare a cash budget for EGGLINK Pty Ltd and provide associated advice on required financing; EGGLINK Pty Ltd operates in a seasonal industry with a sales peak in spring. Budgeted sales, along with budgeted raw materials and labour costs are shown in the table below Month May June July Aug Sep Oct Nov Dec Sales $150,000 $160,000 $210,000 $300,000 $400,000 $500,000 $340,000 $200,000 Labour and materials $105,000 $112,000 $147,000 $210,000 $280,000 $350,000 $238,000 $140,000 Extract from budgeted income statement All sales are on credit and past records indicate that collections are as follows: 20% in the month of sale, 55% in the month after sale and 25% in the second month after sale. Labour and materials are paid as follows: 60% in the month the expenses are incurred and 40% in the month following that. Other budgeted expenses during the period July to December are as follows: selling, general and administration of $30,000 per month; rent of $10,000 per month; and depreciation of $20,000 per month. Where relevant, payments are made in the month the expenses are incurred. Taxation payments of $33,000 each will be made at the end of September and end of December. In October, company motor vehicles will be traded-in for new models with an expected net cash payment of $80,000. The motor vehicles are expected to have an 8-year life. Required: (a) prepare a cash budget for the company for July through to December (inclusive) (b) advise the company on the debt financing that would best be used to deal with cash shortfalls and major payments in the cash budget. Your advice in this part should explain and provide reasons for your recommendations and be a maximum of