Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note that parts (a), (b), and (c) have already been solved. I have only provided them for further context. Part (d) is the only part

Note that parts (a), (b), and (c) have already been solved. I have only provided them for further context. Part (d) is the only part that should be answered.

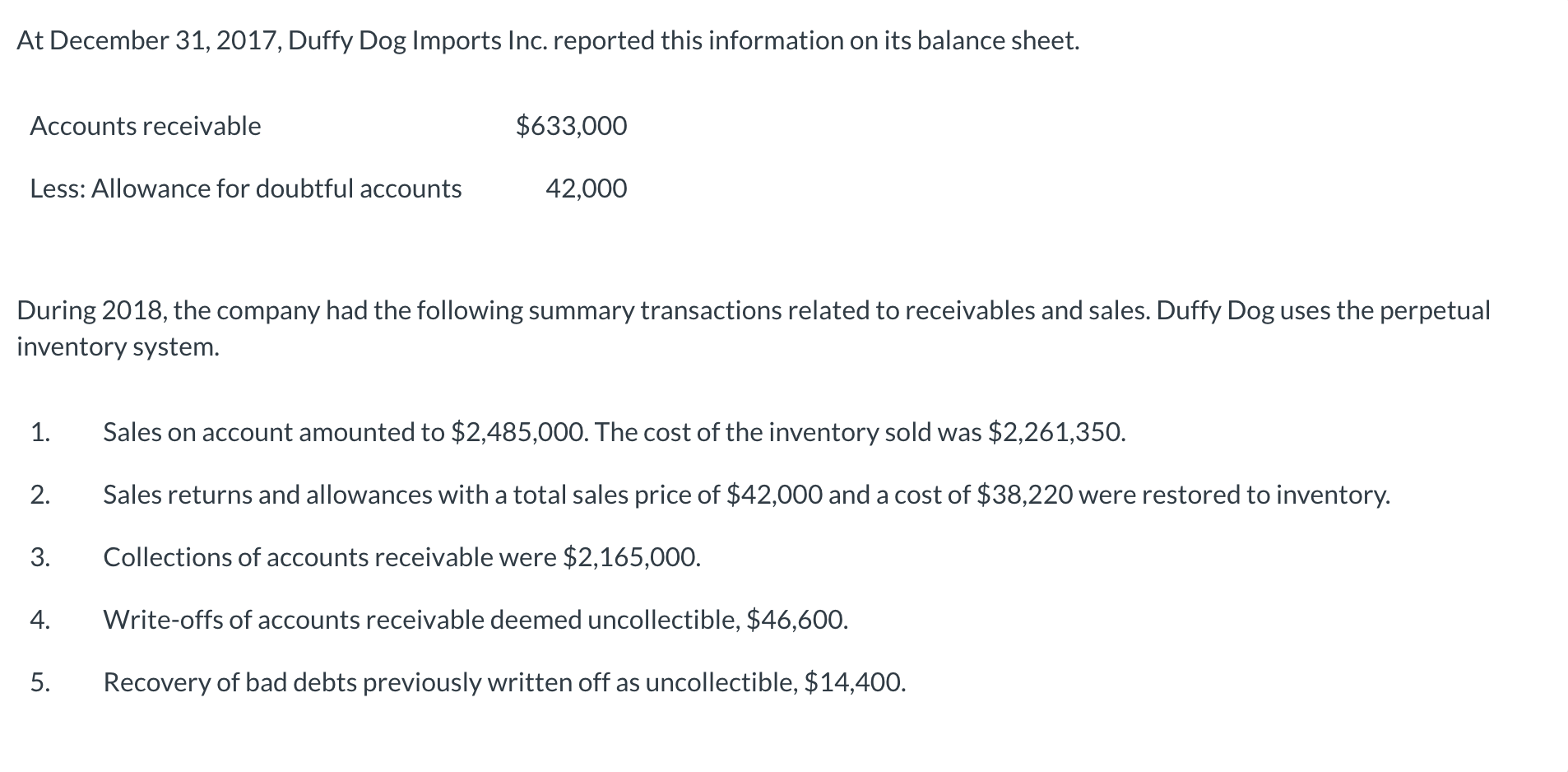

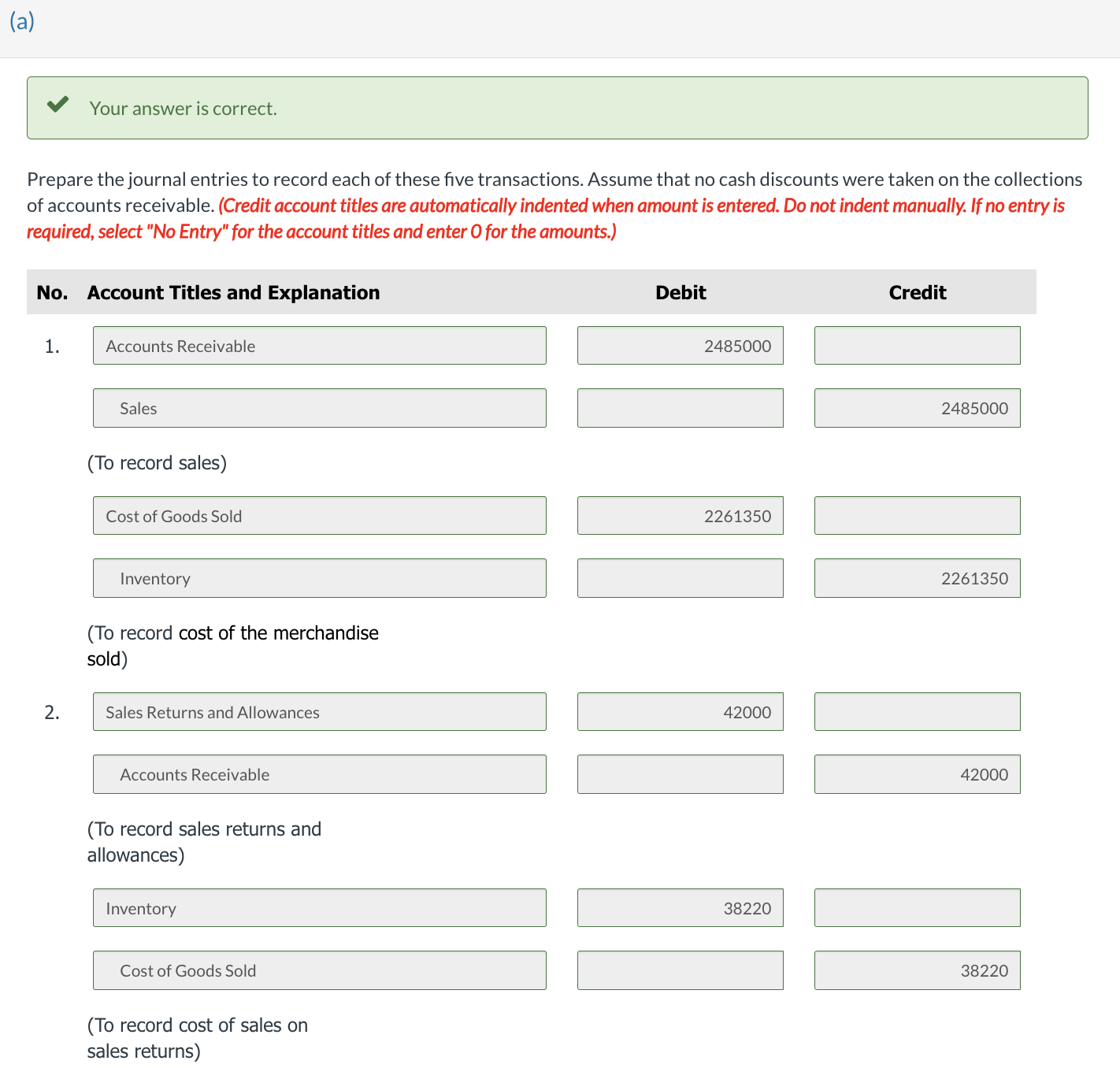

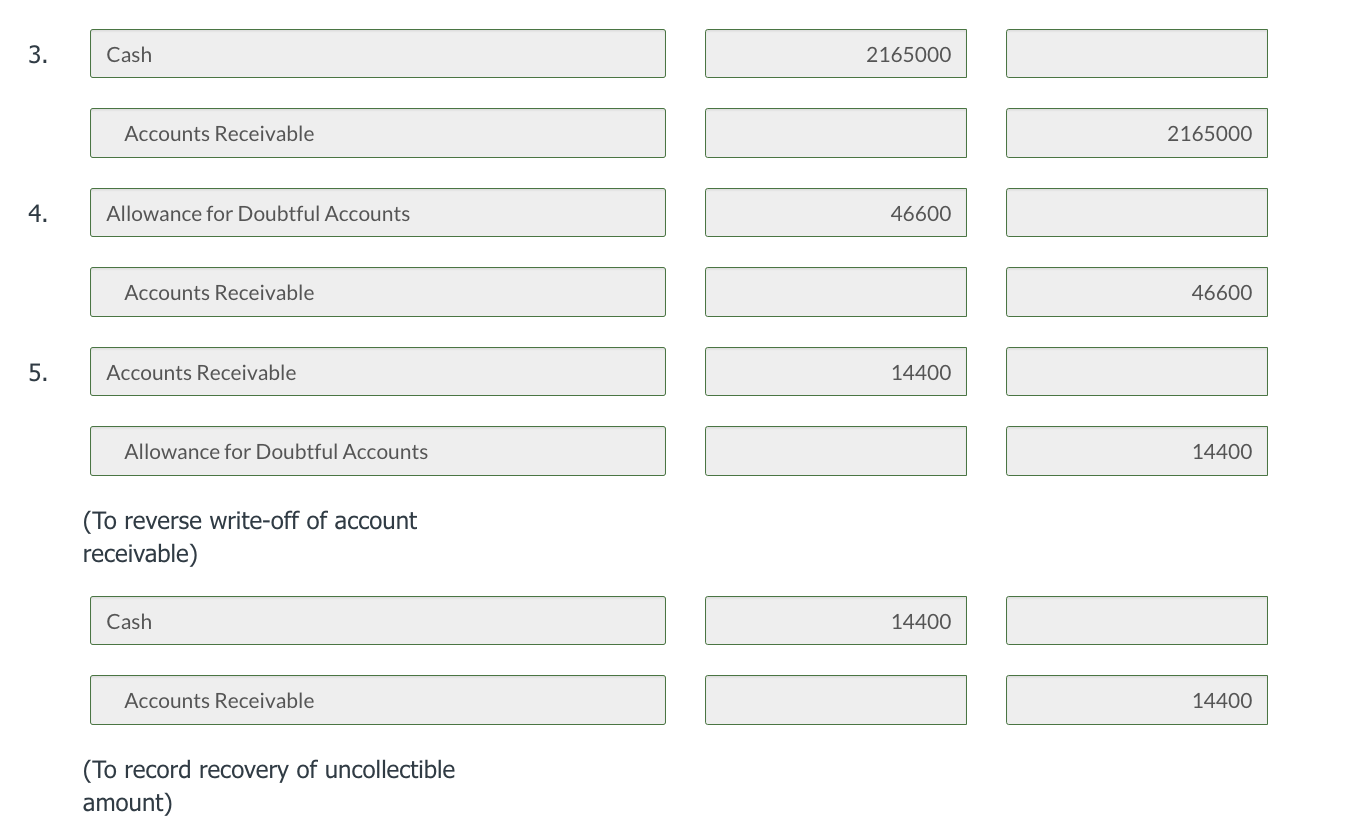

At December 31, 2017, Duffy Dog Imports Inc. reported this information on its balance sheet. During 2018, the company had the following summary transactions related to receivables and sales. Duffy Dog uses the perpetual inventory system. 1. Sales on account amounted to $2,485,000. The cost of the inventory sold was $2,261,350. 2. Sales returns and allowances with a total sales price of $42,000 and a cost of $38,220 were restored to inventory. 3. Collections of accounts receivable were $2,165,000. 4. Write-offs of accounts receivable deemed uncollectible, $46,600. 5. Recovery of bad debts previously written off as uncollectible, $14,400. Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collections of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) N 1 2 3. Cash 2165000 Accounts Receivable 4. Allowance for Doubtful Accounts 46600 Accounts Receivable 5. Accounts Receivable 14400 Allowance for Doubtful Accounts (To reverse write-off of account receivable) Cash Accounts Receivable (To record recovery of uncollectible amount) Your answer is correct. Enter the January 1, 2018, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to the two accounts (use T accounts), and determine the balances before any year-end adjustments. (Post entries in the order of journal entries presented in the previous question.) Prepare the journal entry to record bad debts expense for 2018 , assuming that aging the accounts receivable indicates that estimated uncollectible accounts receivable are $50,500. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Calculate the receivables turnover ratio and average collection period. (Round receivables turnover to 1 decimal place, e.g. 5.2. Round average collection period to nearest whole day, e.g. 15.) Receivables turnover ratio times Average collection period daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started