Answered step by step

Verified Expert Solution

Question

1 Approved Answer

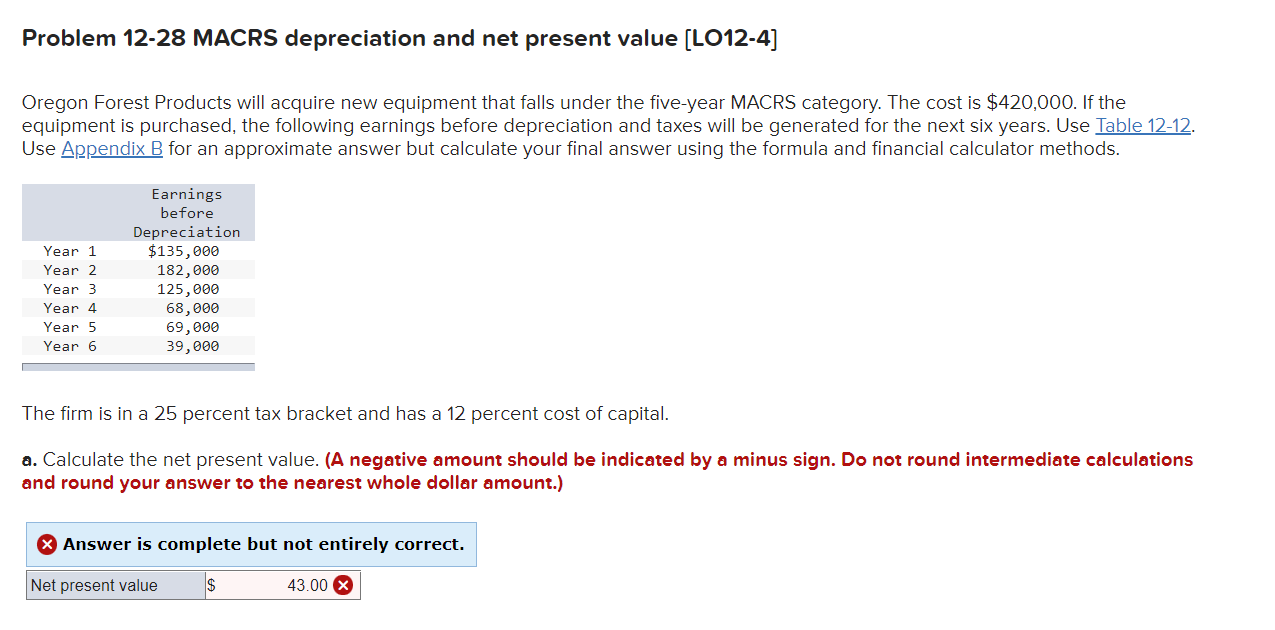

(Note that the answer is not 43) Problem 12-28 MACRS depreciation and net present value [LO12-4) Oregon Forest Products will acquire new equipment that falls

(Note that the answer is not 43)

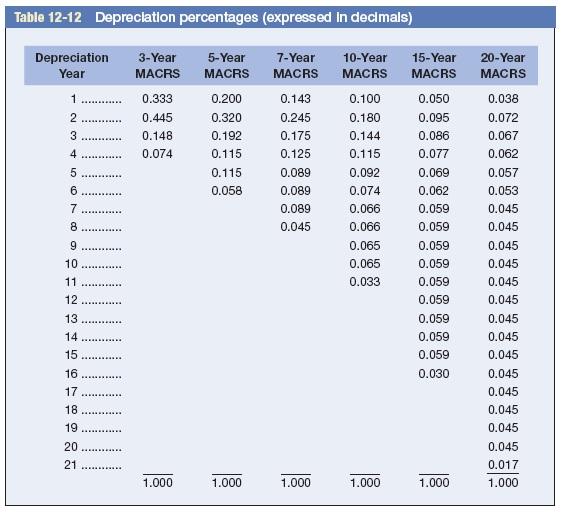

Problem 12-28 MACRS depreciation and net present value [LO12-4) Oregon Forest Products will acquire new equipment that falls under the five-year MACRS category. The cost is $420,000. If the equipment is purchased, the following earnings before depreciation and taxes will be generated for the next six years. Use Table 12-12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Earnings before Depreciation $135,000 182,000 125,000 68,000 69,000 39,000 The firm is in a 25 percent tax bracket and has a 12 percent cost of capital. a. Calculate the net present value. (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole dollar amount.) Answer is complete but not entirely correct. Net present value 43.00 X Table 12-12 Depreciation percentages (expressed in decimals) Depreciation Year 3-Year MACRS 1 0.333 5-Year MACRS 0.200 0.320 0.192 0.115 0.115 0.058 0.445 0.148 0.074 3 7-Year MACRS 0.143 0.245 0.175 0.125 0.089 0.089 0.089 0.045 4 5 10-Year MACRS 0.100 0.180 0.144 0.115 0.092 0.074 0.066 0.066 0.065 0.065 0.033 7 8 15-Year MACRS 0.050 0.095 0.086 0.077 0.069 0.062 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.030 9 10 11 12 20-Year MACRS 0.038 0.072 0.067 0.062 0.057 0.053 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.017 1.000 13 14 15 w 16 17 18 19 20 21 1.000 1.000 1.000 1.000 1.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started