Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note that there are a few assumptions in the base case that CANNOT be changed - the investments are made at to, that all

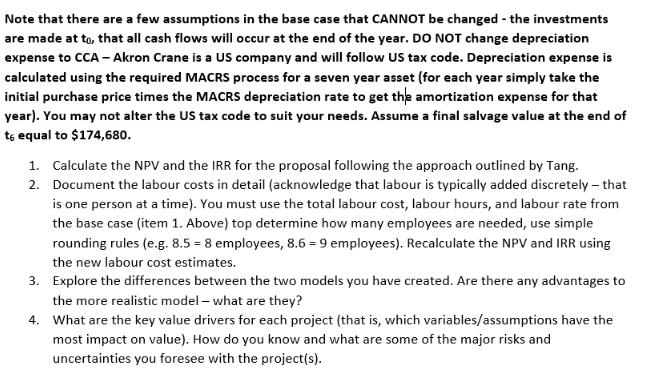

Note that there are a few assumptions in the base case that CANNOT be changed - the investments are made at to, that all cash flows will occur at the end of the year. DO NOT change depreciation expense to CCA - Akron Crane is a US company and will follow US tax code. Depreciation expense is calculated using the required MACRS process for a seven year asset (for each year simply take the initial purchase price times the MACRS depreciation rate to get the amortization expense for that year). You may not alter the US tax code to suit your needs. Assume a final salvage value at the end of to equal to $174,680. 1. Calculate the NPV and the IRR for the proposal following the approach outlined by Tang. 2. Document the labour costs in detail (acknowledge that labour is typically added discretely - that is one person at a time). You must use the total labour cost, labour hours, and labour rate from the base case (item 1. Above) top determine how many employees are needed, use simple rounding rules (e.g. 8.5 = 8 employees, 8.6 = 9 employees). Recalculate the NPV and IRR using the new labour cost estimates. 3. Explore the differences between the two models you have created. Are there any advantages to the more realistic model - what are they? 4. What are the key value drivers for each project (that is, which variables/assumptions have the most impact on value). How do you know and what are some of the major risks and uncertainties you foresee with the project(s).

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 The NPV of the proposal following the Tang approach is 37680 and the IRR is 132 2 The labou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started