Note: The answer already available on Chegg is incorrect and incomplete. Hence, if someone copies that on my question. I will downvote.. Do the work with your own knowledge and understanding,, I am sharing the templates as well..

Note: The answer already available on Chegg is incorrect and incomplete. Hence, if someone copies that on my question. I will downvote.. Do the work with your own knowledge and understanding,, I am sharing the templates as well..

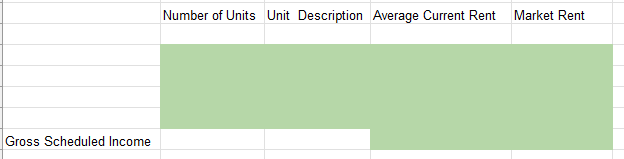

Rent Roll

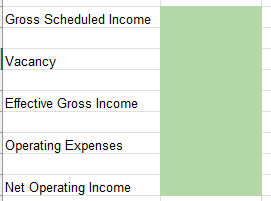

Operating Statement (Pro Forma)

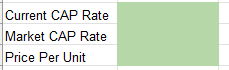

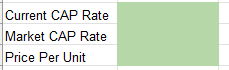

Acquisition Analysis

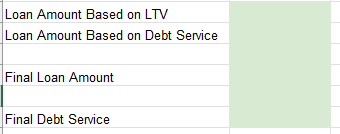

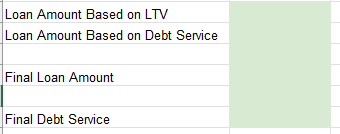

Leverage Analysis

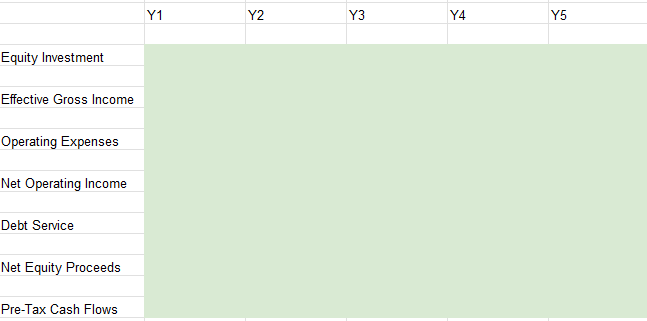

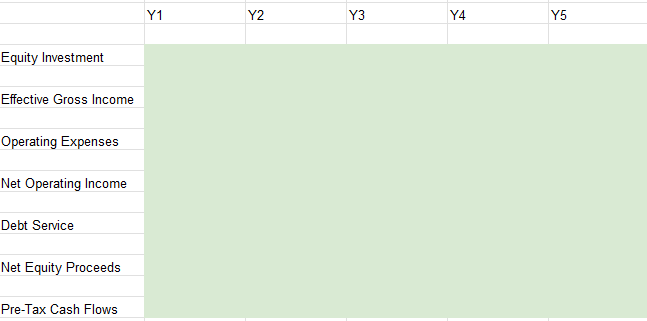

5-Year Investment Projection

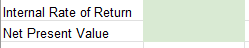

Investment Returns

Investment Returns

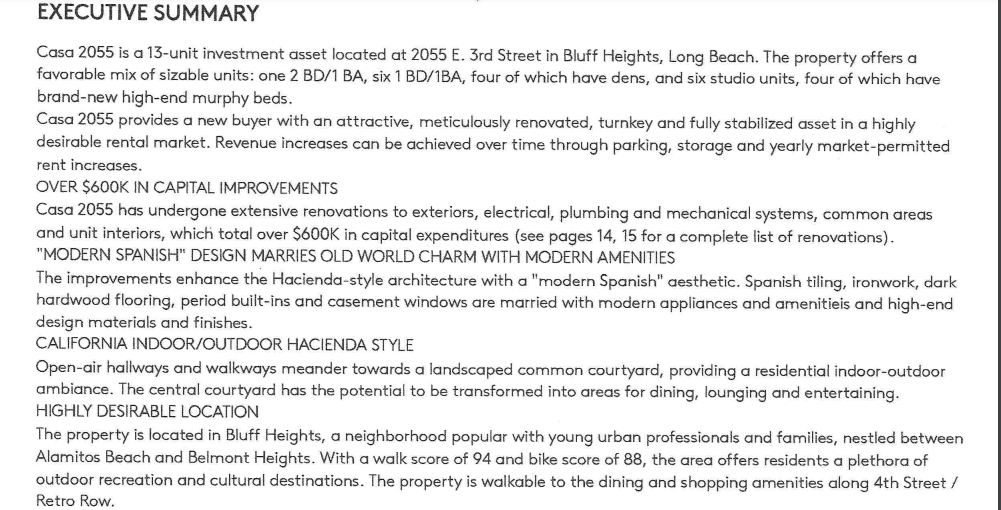

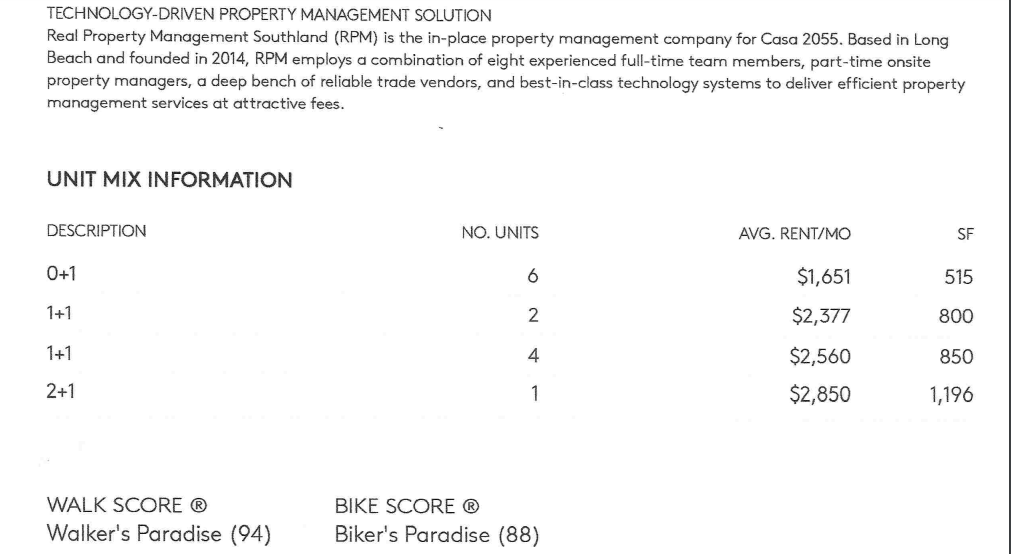

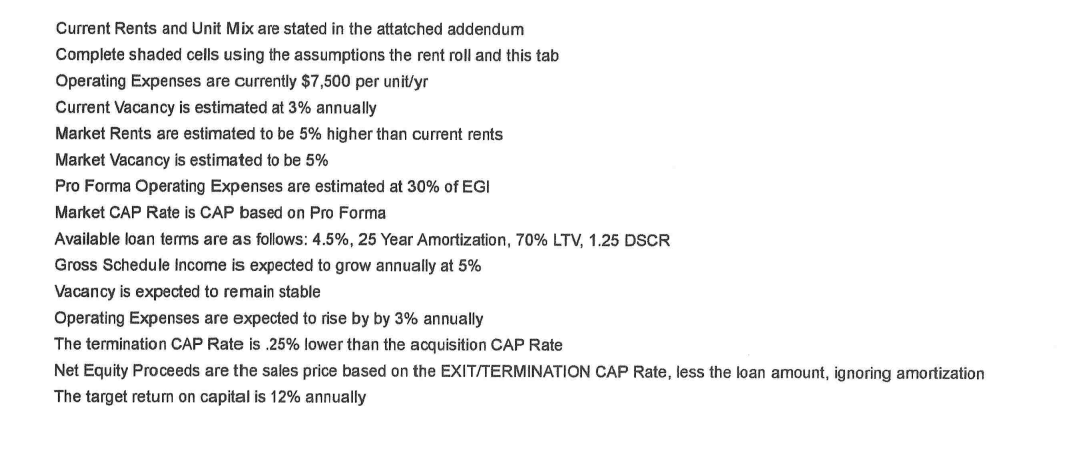

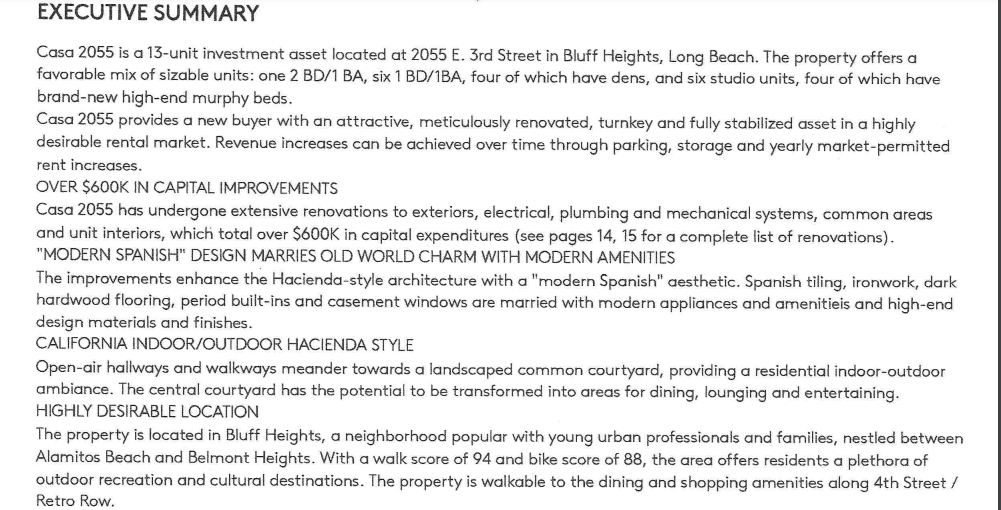

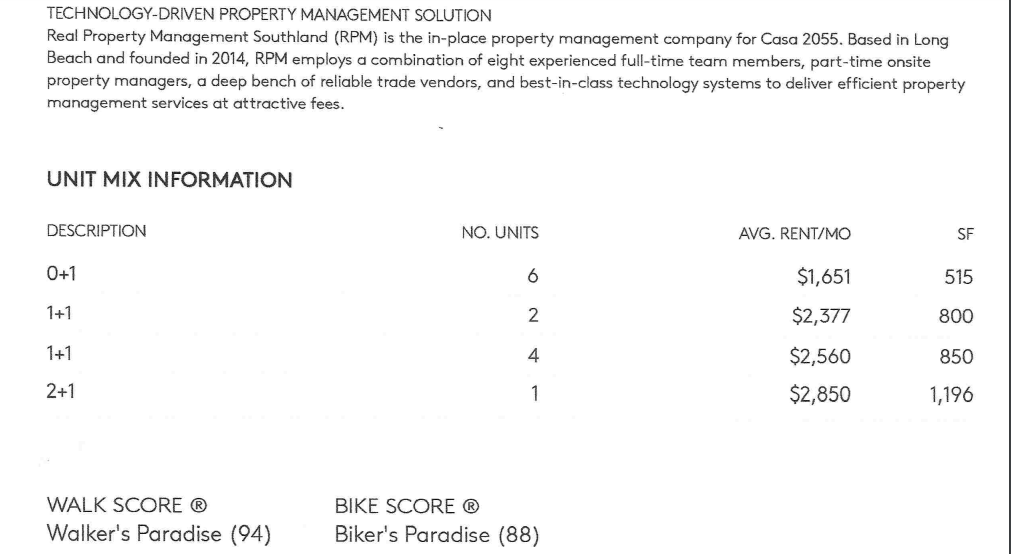

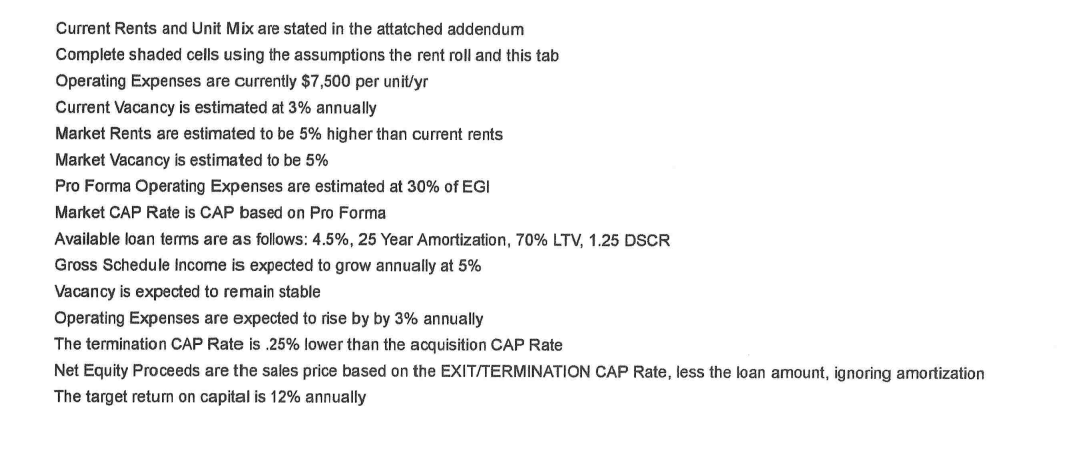

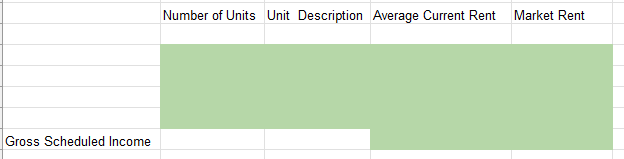

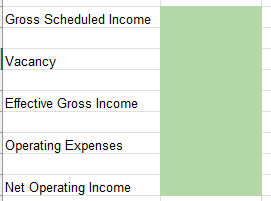

EXECUTIVE SUMMARY Casa 2055 is a 13-unit investment asset located at 2055 E. 3rd Street in Bluff Heights, Long Beach. The property offers a favorable mix of sizable units: one 2 BD/1 BA, six 1 BD/1BA, four of which have dens, and six studio units, four of which have brand-new high-end murphy beds. Casa 2055 provides a new buyer with an attractive, meticulously renovated, turnkey and fully stabilized asset in a highly desirable rental market. Revenue increases can be achieved over time through parking, storage and yearly market-permitted rent increases. OVER $600K IN CAPITAL IMPROVEMENTS Casa 2055 has undergone extensive renovations to exteriors, electrical, plumbing and mechanical systems, common areas and unit interiors, which total over $600K in capital expenditures (see pages 14, 15 for a complete list of renovations). "MODERN SPANISH DESIGN MARRIES OLD WORLD CHARM WITH MODERN AMENITIES The improvements enhance the Hacienda-style architecture with a "modern Spanish" aesthetic. Spanish tiling, ironwork, dark hardwood flooring, period built-ins and casement windows are married with modern appliances and amenitieis and high-end design materials and finishes. CALIFORNIA INDOOR/OUTDOOR HACIENDA STYLE Open-air hallways and walkways meander towards a landscaped common courtyard, providing a residential indoor-outdoor ambiance. The central courtyard has the potential to be transformed into areas for dining, lounging and entertaining. HIGHLY DESIRABLE LOCATION The property is located in Bluff Heights, a neighborhood popular with young urban professionals and families, nestled between Alamitos Beach and Belmont Heights. With a walk score of 94 and bike score of 88, the area offers residents a plethora of outdoor recreation and cultural destinations. The property is walkable to the dining and shopping amenities along 4th Street / Retro Row. TECHNOLOGY-DRIVEN PROPERTY MANAGEMENT SOLUTION Real Property Management Southland (RPM) is the in-place property management company for Casa 2055. Based in Long Beach and founded in 2014, RPM employs a combination of eight experienced full-time team members, part-time onsite property managers, a deep bench of reliable trade vendors, and best-in-class technology systems to deliver efficient property management services at attractive fees. UNIT MIX INFORMATION DESCRIPTION NO. UNITS AVG. RENT/MO SF 0+1 6 $1,651 515 1+1 2 $2,377 800 1+1 4 $2,560 850 2+1 1 $2,850 1,196 WALK SCORE Walker's Paradise (94) BIKE SCORE Biker's Paradise (88) Current Rents and Unit Mix are stated in the attatched addendum Complete shaded cells using the assumptions the rent roll and this tab Operating Expenses are currently $7,500 per unit/yr Current Vacancy is estimated at 3% annually Market Rents are estimated to be 5% higher than current rents Market Vacancy is estimated to be 5% Pro Forma Operating Expenses are estimated at 30% of EGI Market CAP Rate is CAP based on Pro Forma Available loan terms are as follows: 4.5%, 25 Year Amortization, 70% LTV, 1.25 DSCR Gross Schedule Income is expected to grow annually at 5% Vacancy is expected to remain stable Operating Expenses are expected to rise by by 3% annually The termination CAP Rate is .25% lower than the acquisition CAP Rate Net Equity Proceeds are the sales price based on the EXIT/TERMINATION CAP Rate, less the loan amount, ignoring amortization The target return on capital is 12% annually Number of Units Unit Description Average Current Rent Market Rent Gross Scheduled Income Gross Scheduled Income Vacancy Effective Gross Income Operating Expenses Net Operating Income Current CAP Rate Market CAP Rate Price Per Unit Loan Amount Based on LTV Loan Amount Based on Debt Service Final Loan Amount Final Debt Service Y1 Y2 Y3 Y4 Y5 Equity Investment Effective Gross Income Operating Expenses Net Operating Income Debt Service Net Equity Proceeds Pre-Tax Cash Flows Internal Rate of Return Net Present Value EXECUTIVE SUMMARY Casa 2055 is a 13-unit investment asset located at 2055 E. 3rd Street in Bluff Heights, Long Beach. The property offers a favorable mix of sizable units: one 2 BD/1 BA, six 1 BD/1BA, four of which have dens, and six studio units, four of which have brand-new high-end murphy beds. Casa 2055 provides a new buyer with an attractive, meticulously renovated, turnkey and fully stabilized asset in a highly desirable rental market. Revenue increases can be achieved over time through parking, storage and yearly market-permitted rent increases. OVER $600K IN CAPITAL IMPROVEMENTS Casa 2055 has undergone extensive renovations to exteriors, electrical, plumbing and mechanical systems, common areas and unit interiors, which total over $600K in capital expenditures (see pages 14, 15 for a complete list of renovations). "MODERN SPANISH DESIGN MARRIES OLD WORLD CHARM WITH MODERN AMENITIES The improvements enhance the Hacienda-style architecture with a "modern Spanish" aesthetic. Spanish tiling, ironwork, dark hardwood flooring, period built-ins and casement windows are married with modern appliances and amenitieis and high-end design materials and finishes. CALIFORNIA INDOOR/OUTDOOR HACIENDA STYLE Open-air hallways and walkways meander towards a landscaped common courtyard, providing a residential indoor-outdoor ambiance. The central courtyard has the potential to be transformed into areas for dining, lounging and entertaining. HIGHLY DESIRABLE LOCATION The property is located in Bluff Heights, a neighborhood popular with young urban professionals and families, nestled between Alamitos Beach and Belmont Heights. With a walk score of 94 and bike score of 88, the area offers residents a plethora of outdoor recreation and cultural destinations. The property is walkable to the dining and shopping amenities along 4th Street / Retro Row. TECHNOLOGY-DRIVEN PROPERTY MANAGEMENT SOLUTION Real Property Management Southland (RPM) is the in-place property management company for Casa 2055. Based in Long Beach and founded in 2014, RPM employs a combination of eight experienced full-time team members, part-time onsite property managers, a deep bench of reliable trade vendors, and best-in-class technology systems to deliver efficient property management services at attractive fees. UNIT MIX INFORMATION DESCRIPTION NO. UNITS AVG. RENT/MO SF 0+1 6 $1,651 515 1+1 2 $2,377 800 1+1 4 $2,560 850 2+1 1 $2,850 1,196 WALK SCORE Walker's Paradise (94) BIKE SCORE Biker's Paradise (88) Current Rents and Unit Mix are stated in the attatched addendum Complete shaded cells using the assumptions the rent roll and this tab Operating Expenses are currently $7,500 per unit/yr Current Vacancy is estimated at 3% annually Market Rents are estimated to be 5% higher than current rents Market Vacancy is estimated to be 5% Pro Forma Operating Expenses are estimated at 30% of EGI Market CAP Rate is CAP based on Pro Forma Available loan terms are as follows: 4.5%, 25 Year Amortization, 70% LTV, 1.25 DSCR Gross Schedule Income is expected to grow annually at 5% Vacancy is expected to remain stable Operating Expenses are expected to rise by by 3% annually The termination CAP Rate is .25% lower than the acquisition CAP Rate Net Equity Proceeds are the sales price based on the EXIT/TERMINATION CAP Rate, less the loan amount, ignoring amortization The target return on capital is 12% annually Number of Units Unit Description Average Current Rent Market Rent Gross Scheduled Income Gross Scheduled Income Vacancy Effective Gross Income Operating Expenses Net Operating Income Current CAP Rate Market CAP Rate Price Per Unit Loan Amount Based on LTV Loan Amount Based on Debt Service Final Loan Amount Final Debt Service Y1 Y2 Y3 Y4 Y5 Equity Investment Effective Gross Income Operating Expenses Net Operating Income Debt Service Net Equity Proceeds Pre-Tax Cash Flows Internal Rate of Return Net Present Value

Note: The answer already available on Chegg is incorrect and incomplete. Hence, if someone copies that on my question. I will downvote.. Do the work with your own knowledge and understanding,, I am sharing the templates as well..

Note: The answer already available on Chegg is incorrect and incomplete. Hence, if someone copies that on my question. I will downvote.. Do the work with your own knowledge and understanding,, I am sharing the templates as well..

Investment Returns

Investment Returns