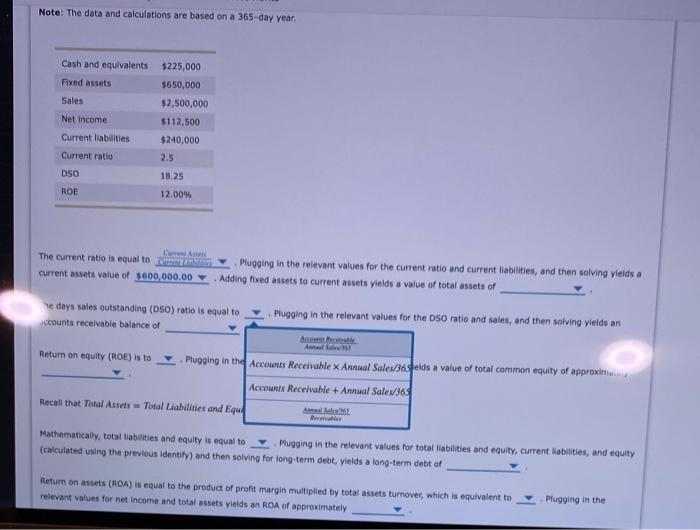

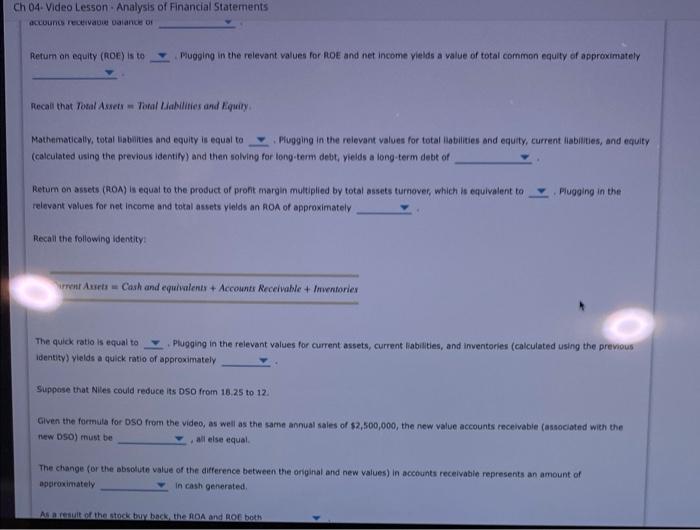

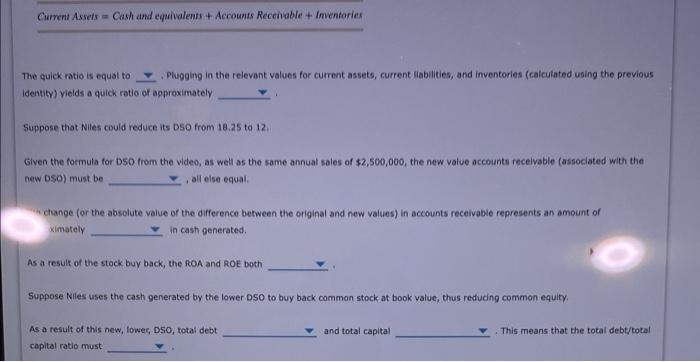

Note: The data and calculations are based on a 365-day year. Cash and equivalents $225,000 Fixed assets $650,000 Sales $2,500,000 Net Income $112,500 Current liabilities $240,000 Current ratio 2.5 DSO 18.25 ROE 12.00% The current ratio is equal to current assets value of $600,000.00 Plugging in the relevant values for the current ratio and current liabilities, and then solving yields a Adding fixed assets to current assets yields a value of total assets of ne days sales outstanding (DSO) ratio is equal to ccounts receivable balance of Plugging in the relevant values for the Dso ratio and sales, and then solving yields an Awit Return on equity (ROE) is to Plugging in the Accounts Receivable x Annual Sales/36elds a value of total common equity of approxim. Accounts Receivable + Annual Sales/365 Recall that Total Assets - Total Liabilities and Equ Rawh Mathematically, total liabilities and equity is equal to Plugging in the relevant values for total liabilities and equity, current liabilities, and equity (calculated using the previous identity) and then solving for long-term debt, yields a long-term debt of Return on assets (ROA) is equal to the product of profit margin multiplied by total assets turnover, which is equivalent to relevant values for net income and total assets yields an ROA of approximately Plugging in the Ch 04. Video Lesson Analysis of Financial Statements Account Van Dalance of Return on equity (ROE) is to Mugging in the relevant values for ROE and net income vields a value of total common equity of approximately Recall that Total Asset Tonal Liabilities and Equity Mathematically, total abilities and equity is equal to Plugging in the relevant values for total liabilities and equity, current liabilities, and equity (calculated using the previous identity and then solving for long term debt. Vields a long-term debt of Plugging in the Retum on assets (ROA) is equal to the product or profit margin multiplied by total assets turnover, which is equivalent to relevant values for net income and total asut ylelds an ROA of approximately Recall the following identity rrent Arts Cash and equivalents + Accounts Receivable + Inwentories The quick ratio is equal to Plugging in the relevant values for current assets, current liabilities, and inventories (calculated using the previous Identity yields a quick ratio of approximately Suppose that Niles could reduce its So from 18.25 to 12 Given the formula for DS from the video, as well as the same annual sales of $2,500,000, the new value accounts receivable (anaociated with the new DSO) must be all else equal The change (or the absolute value of the difference between the original and new values) in accounts receivable represents an amount of approximately In cash generated AS the stock back the ROA and Roboth Current Assets Cash and equivalents + Accounts Recehable + Inventories The quick ratio is equal to Plugging in the relevant values for current assets, current abilities, and inventories (calculated using the previous Identity) yields a quick ratio of approximately Suppose that Niles could reduce its DSO from 18.25 to 12 Given the formula for DSO from the video, as well as the same annual sales of $2,500,000, the new value accounts receivable (associated with the new DSO) must be all else equal change for the absolute value of the difference between the original and new values) in accounts receivable represents an amount of ximately in cash generated As a result of the stock buy back, the ROA and ROE both Suppose Niles uses the cash generated by the lower DSC to buy back common stock at book value, thus reducing common equity and total capital As a result of this new, lower, DSO, total debt capital ratio must This means that the total debt/total