Answered step by step

Verified Expert Solution

Question

1 Approved Answer

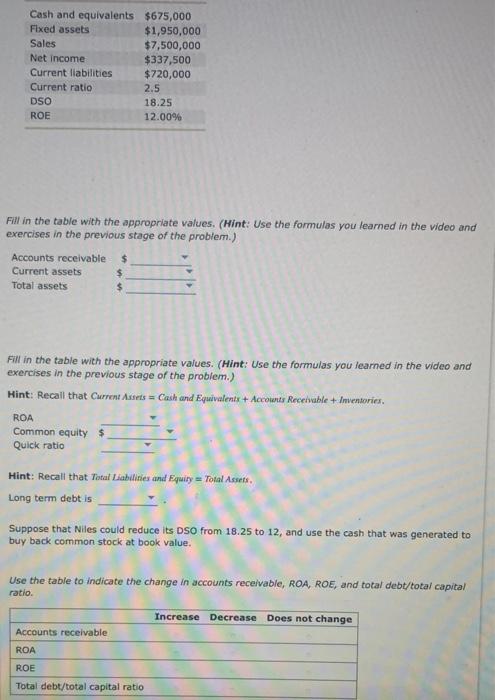

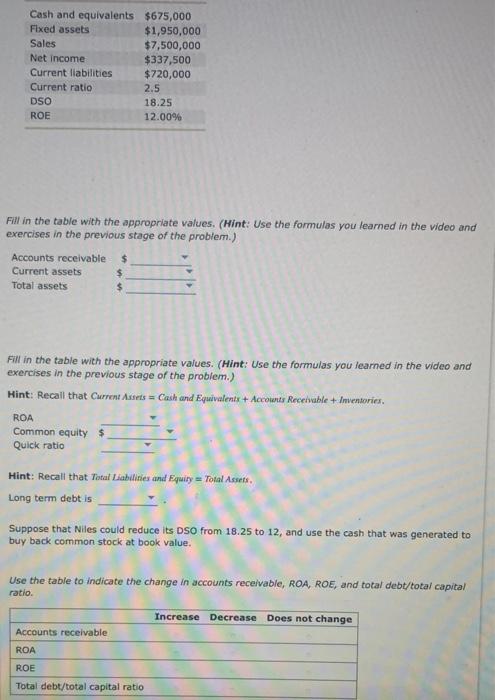

Note: The data and calculations are based on a 365-day year. Cash and equivalents $675,000 Fixed assets $1,950,000 Sales $7,500,000 Net income $337,500 Current liabilities

Note: The data and calculations are based on a 365-day year.

Cash and equivalents $675,000 Fixed assets $1,950,000 Sales $7,500,000 Net income $337,500 Current liabilities $720,000 Current ratio 2.5 DSO 18.25 ROE 12.00% Fill in the table with the appropriate values. (Hint: Use the formulas you learned in the video and exercises in the previous stage of the problem.) Accounts receivable $ Current assets $ Total assets Fill in the table with the appropriate values. (Hint: Use the formulas you learned in the video and exercises in the previous stage of the problem.) Hint: Recall that Current Assets Cash and Equivalents + Accounts Receivable + Inventories. ROA Common equity $ Quick ratio Hint: Recall that Total Liabilities and Equity = Total Assets Long term debt is Suppose that Niles could reduce its DSO from 18.25 to 12, and use the cash that was generated to buy back common stock at book value. Use the table to indicate the change in accounts receivable, ROA, ROE, and total debt/total capital ratio Increase Decrease Does not change Accounts receivable ROA ROE Total debt/total capital ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started