Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NOTE: The money market fund is the risk-free asset and the stock index fund is the one risky asset that the investor has access to.

NOTE: The money market fund is the risk-free asset and the stock index fund is the one risky asset that the investor has access to.

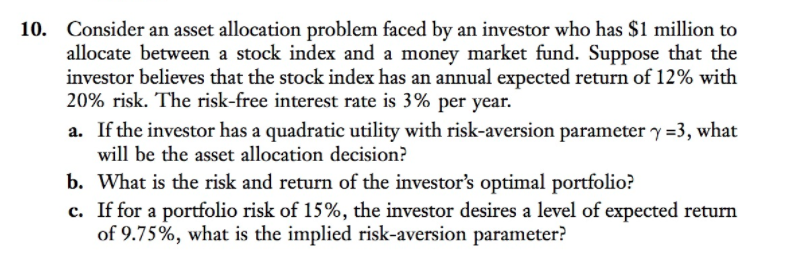

Consider an asset allocation problem faced by an investor who has S1 million to allocate between a stock index and a money market fund. Suppose that the investor believes that the stock index has an annual expected return of 12% with 20% risk. The risk-free interest rate is 3% per year. a. If the investor has a quadratic utility with risk-aversion parameter -3, what 10. will be the asset allocation decision? b. What is the risk and return of the investor's optimal portfolio? c. If for a portfolio risk of 15%, the investor desires a level of expected return of 9.75%, what is the implied risk-aversion parameterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started