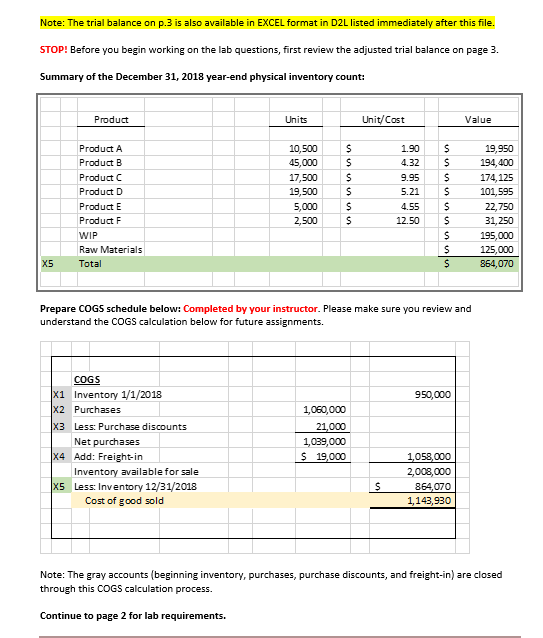

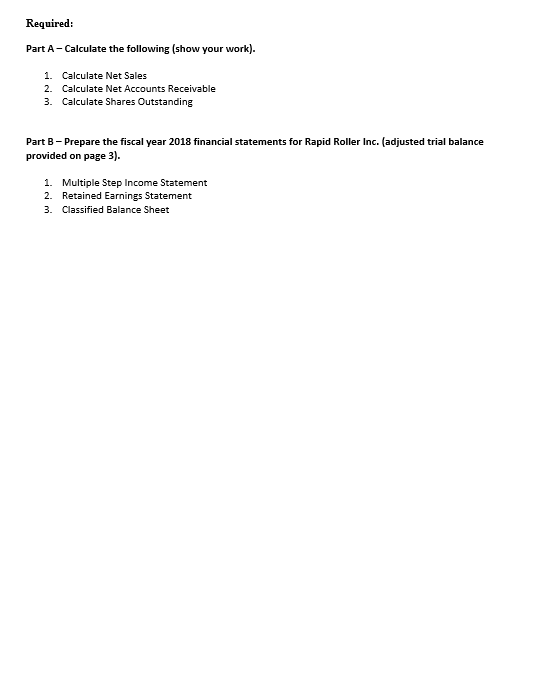

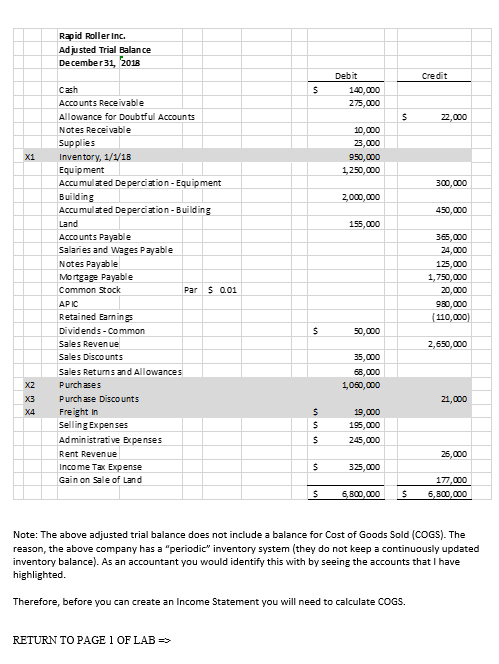

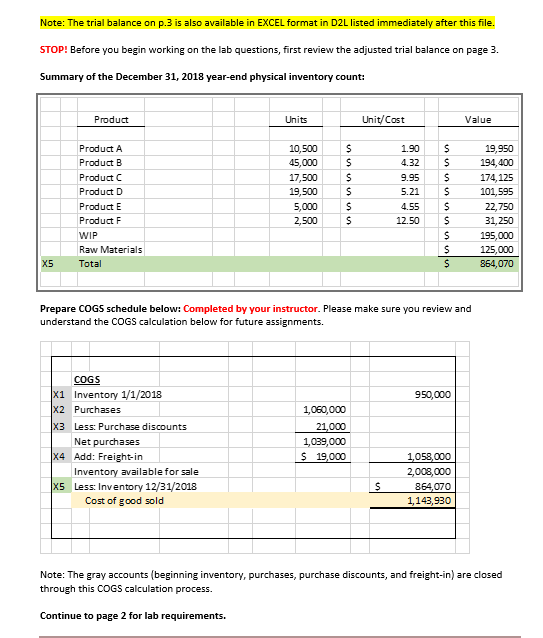

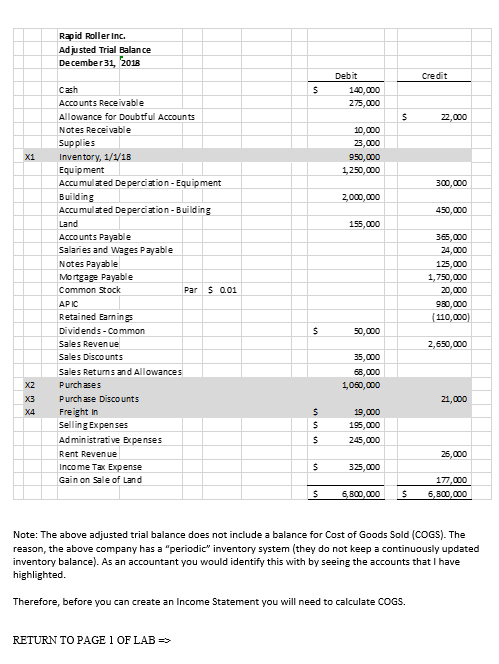

Note: The trial balance on p.3 is also available in EXCEL format in D2L listed immediately after this file. STOP! Before you begin working on the lab questions, first review the adjusted trial balance on page 3. Summary of the December 31, 2018 year-end physical inventory count: Product Units Unit/Cost Value Product A Product B Product Product D Product E Product F WIP Raw Materials Total 10,500 45,000 17,500 19,500 5,000 2,500 unui 1.90 4.32 9.95 5.21 4.55 12.50 $ S $ S S $ S S $ 19,950 194,400 174,125 101,595 22,750 31,250 195,000 125,000 864,070 X5 Prepare COGS schedule below: Completed by your instructor. Please make sure you review and understand the COGS calculation below for future assignments. 950,000 COGS X1 Inventory 1/1/2018 |X2 Purchases X3 Less: Purchase discounts Net purchases x4 Add: Freight-in Inventory available for sale X5 Less: Inventory 12/31/2018 Cost of good sold 1,060,000 21,000 1,039,000 $ 19,000 1,058,000 2,008,000 864,070 1,143,930 S Note: The gray accounts (beginning inventory, purchases, purchase discounts, and freight-in) are closed through this COGS calculation process. Continue to page 2 for lab requirements. Required: Part A - Calculate the following (show your work). 1. Calculate Net Sales 2. Calculate Net Accounts Receivable 3. Calculate Shares Outstanding Part B - Prepare the fiscal year 2018 financial statements for Rapid Roller Inc. (adjusted trial balance provided on page 3). 1. Multiple Step Income Statement 2. Retained Earnings Statement 3. Classified Balance Sheet Rapid Roller Inc. Adjusted Trial Balance December 31, 2018 Credit $ Debit 140,000 275,000 s 22,000 10,000 23,000 950,000 1,250,000 X1 300,000 2,000,000 450,000 155,000 Cash Accounts Receivable Allowance for Doubtful Accounts Notes Receivable Supplies Inventory, 1/1/18 Equipment Accumulated De per ciation - Equipment Building Accumulated De Perciation - Building Land Accounts Payable Salaries and Wages Payable Notes Payable Mortgage Payable Common Stock Par 5 0.01 APIC Retained Earning Dividends - Common Sales Revenue Sales Discounts Sales Returns and Allowances Purchases Purchase Discounts Freight in Selling Expenses Administrative Expenses Rent Revenue Income Tax Expense Gain on Sale of Land 365,000 24,000 125,000 1,750,000 20,000 980,000 (110,000) $ 50,000 2,650,000 35,000 68,000 1,050,000 X2 21,000 X3 X4 $ 19,000 195,000 245,000 A 25,000 $ 325,000 177,000 6,800,000 5 6,800,000 $ Note: The above adjusted trial balance does not include a balance for Cost of Goods Sold (COGS). The reason, the above company has a "periodic" inventory system (they do not keep a continuously updated inventory balance). As an accountant you would identify this with by seeing the accounts that I have highlighted. Therefore, before you can create an Income Statement you will need to calculate COGS. RETURN TO PAGE 1 OF LAB => Note: The trial balance on p.3 is also available in EXCEL format in D2L listed immediately after this file. STOP! Before you begin working on the lab questions, first review the adjusted trial balance on page 3. Summary of the December 31, 2018 year-end physical inventory count: Product Units Unit/Cost Value Product A Product B Product Product D Product E Product F WIP Raw Materials Total 10,500 45,000 17,500 19,500 5,000 2,500 unui 1.90 4.32 9.95 5.21 4.55 12.50 $ S $ S S $ S S $ 19,950 194,400 174,125 101,595 22,750 31,250 195,000 125,000 864,070 X5 Prepare COGS schedule below: Completed by your instructor. Please make sure you review and understand the COGS calculation below for future assignments. 950,000 COGS X1 Inventory 1/1/2018 |X2 Purchases X3 Less: Purchase discounts Net purchases x4 Add: Freight-in Inventory available for sale X5 Less: Inventory 12/31/2018 Cost of good sold 1,060,000 21,000 1,039,000 $ 19,000 1,058,000 2,008,000 864,070 1,143,930 S Note: The gray accounts (beginning inventory, purchases, purchase discounts, and freight-in) are closed through this COGS calculation process. Continue to page 2 for lab requirements. Required: Part A - Calculate the following (show your work). 1. Calculate Net Sales 2. Calculate Net Accounts Receivable 3. Calculate Shares Outstanding Part B - Prepare the fiscal year 2018 financial statements for Rapid Roller Inc. (adjusted trial balance provided on page 3). 1. Multiple Step Income Statement 2. Retained Earnings Statement 3. Classified Balance Sheet Rapid Roller Inc. Adjusted Trial Balance December 31, 2018 Credit $ Debit 140,000 275,000 s 22,000 10,000 23,000 950,000 1,250,000 X1 300,000 2,000,000 450,000 155,000 Cash Accounts Receivable Allowance for Doubtful Accounts Notes Receivable Supplies Inventory, 1/1/18 Equipment Accumulated De per ciation - Equipment Building Accumulated De Perciation - Building Land Accounts Payable Salaries and Wages Payable Notes Payable Mortgage Payable Common Stock Par 5 0.01 APIC Retained Earning Dividends - Common Sales Revenue Sales Discounts Sales Returns and Allowances Purchases Purchase Discounts Freight in Selling Expenses Administrative Expenses Rent Revenue Income Tax Expense Gain on Sale of Land 365,000 24,000 125,000 1,750,000 20,000 980,000 (110,000) $ 50,000 2,650,000 35,000 68,000 1,050,000 X2 21,000 X3 X4 $ 19,000 195,000 245,000 A 25,000 $ 325,000 177,000 6,800,000 5 6,800,000 $ Note: The above adjusted trial balance does not include a balance for Cost of Goods Sold (COGS). The reason, the above company has a "periodic" inventory system (they do not keep a continuously updated inventory balance). As an accountant you would identify this with by seeing the accounts that I have highlighted. Therefore, before you can create an Income Statement you will need to calculate COGS. RETURN TO PAGE 1 OF LAB =>