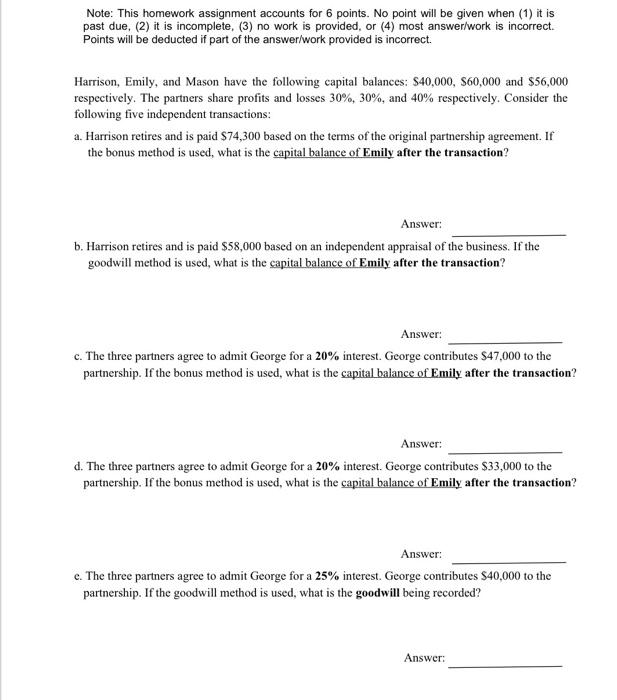

Note: This homework assignment accounts for 6 points. No point will be given when (1) it is past due, (2) it is incomplete, (3) no work is provided, or (4) most answer/work is incorrect. Points will be deducted if part of the answer/work provided is incorrect. Harrison, Emily, and Mason have the following capital balances: $40,000,$60,000 and $56,000 respectively. The partners share profits and losses 30%,30%, and 40% respectively. Consider the following five independent transactions: a. Harrison retires and is paid $74,300 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of Emily after the transaction? Answer: b. Harrison retires and is paid $58,000 based on an independent appraisal of the business. If the goodwill method is used, what is the capital balance of Emily after the transaction? Answer: c. The three partners agree to admit George for a 20% interest. George contributes $47,000 to the partnership. If the bonus method is used, what is the capital balance of Emily after the transaction? Answer: d. The three partners agree to admit George for a 20% interest. George contributes $33,000 to the partnership. If the bonus method is used, what is the capital balance of Emily after the transaction? Answer: e. The three partners agree to admit George for a 25% interest. George contributes $40,000 to the partnership. If the goodwill method is used, what is the goodwill being recorded? Note: This homework assignment accounts for 6 points. No point will be given when (1) it is past due, (2) it is incomplete, (3) no work is provided, or (4) most answer/work is incorrect. Points will be deducted if part of the answer/work provided is incorrect. Harrison, Emily, and Mason have the following capital balances: $40,000,$60,000 and $56,000 respectively. The partners share profits and losses 30%,30%, and 40% respectively. Consider the following five independent transactions: a. Harrison retires and is paid $74,300 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of Emily after the transaction? Answer: b. Harrison retires and is paid $58,000 based on an independent appraisal of the business. If the goodwill method is used, what is the capital balance of Emily after the transaction? Answer: c. The three partners agree to admit George for a 20% interest. George contributes $47,000 to the partnership. If the bonus method is used, what is the capital balance of Emily after the transaction? Answer: d. The three partners agree to admit George for a 20% interest. George contributes $33,000 to the partnership. If the bonus method is used, what is the capital balance of Emily after the transaction? Answer: e. The three partners agree to admit George for a 25% interest. George contributes $40,000 to the partnership. If the goodwill method is used, what is the goodwill being recorded