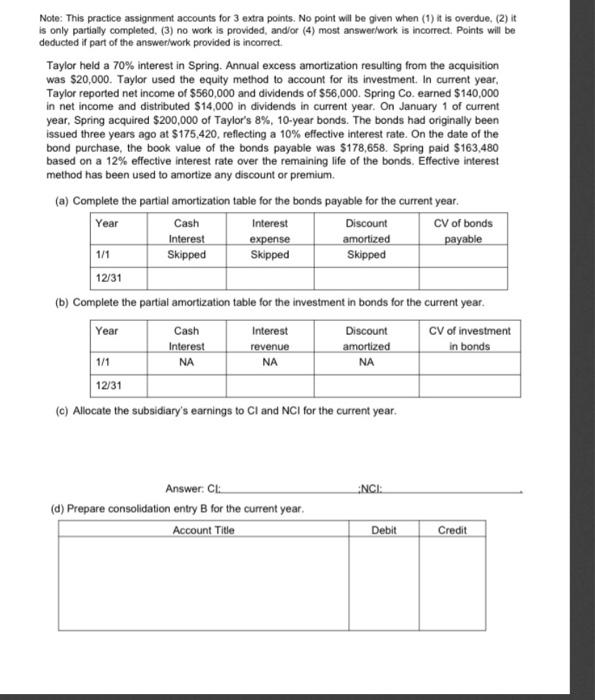

Note: This practice assignment accounts for 3 extra points. No point will be given when (1) it is overdue, (2) it is only partially completed. (3) no work is provided, and/or (4) most answer work is incorrect. Points will be deducted if part of the answer/work provided is incorrect Taylor held a 70% interest in Spring. Annual excess amortization resulting from the acquisition was $20,000. Taylor used the equity method to account for its investment. In current year, Taylor reported net income of $560,000 and dividends of $56,000. Spring Co. earned $140,000 in net income and distributed $14,000 in dividends in current year. On January 1 of current year. Spring acquired $200,000 of Taylor's 8%, 10-year bonds. The bonds had originally been issued three years ago at $175,420, reflecting a 10% effective interest rate. On the date of the bond purchase, the book value of the bonds payable was $178,658. Spring paid $163,480 based on a 12% effective interest rate over the remaining life of the bonds. Effective interest method has been used to amortize any discount or premium. (a) Complete the partial amortization table for the bonds payable for the current year. Year Interest CV of bonds Cash Interest Skipped Discount amortized payable expense Skipped 1/1 Skipped 12/31 (b) Complete the partial amortization table for the investment in bonds for the current year. Year Cash Interest Discount CV of investment Interest revenue amortized in bonds 111 NA NA NA 12/31 (c) Allocate the subsidiary's earnings to Cl and NCI for the current year. Answer. CE NCI: (d) Prepare consolidation entry B for the current year. Account Title Debit Credit Note: This practice assignment accounts for 3 extra points. No point will be given when (1) it is overdue, (2) it is only partially completed. (3) no work is provided, and/or (4) most answer work is incorrect. Points will be deducted if part of the answer/work provided is incorrect Taylor held a 70% interest in Spring. Annual excess amortization resulting from the acquisition was $20,000. Taylor used the equity method to account for its investment. In current year, Taylor reported net income of $560,000 and dividends of $56,000. Spring Co. earned $140,000 in net income and distributed $14,000 in dividends in current year. On January 1 of current year. Spring acquired $200,000 of Taylor's 8%, 10-year bonds. The bonds had originally been issued three years ago at $175,420, reflecting a 10% effective interest rate. On the date of the bond purchase, the book value of the bonds payable was $178,658. Spring paid $163,480 based on a 12% effective interest rate over the remaining life of the bonds. Effective interest method has been used to amortize any discount or premium. (a) Complete the partial amortization table for the bonds payable for the current year. Year Interest CV of bonds Cash Interest Skipped Discount amortized payable expense Skipped 1/1 Skipped 12/31 (b) Complete the partial amortization table for the investment in bonds for the current year. Year Cash Interest Discount CV of investment Interest revenue amortized in bonds 111 NA NA NA 12/31 (c) Allocate the subsidiary's earnings to Cl and NCI for the current year. Answer. CE NCI: (d) Prepare consolidation entry B for the current year. Account Title Debit Credit