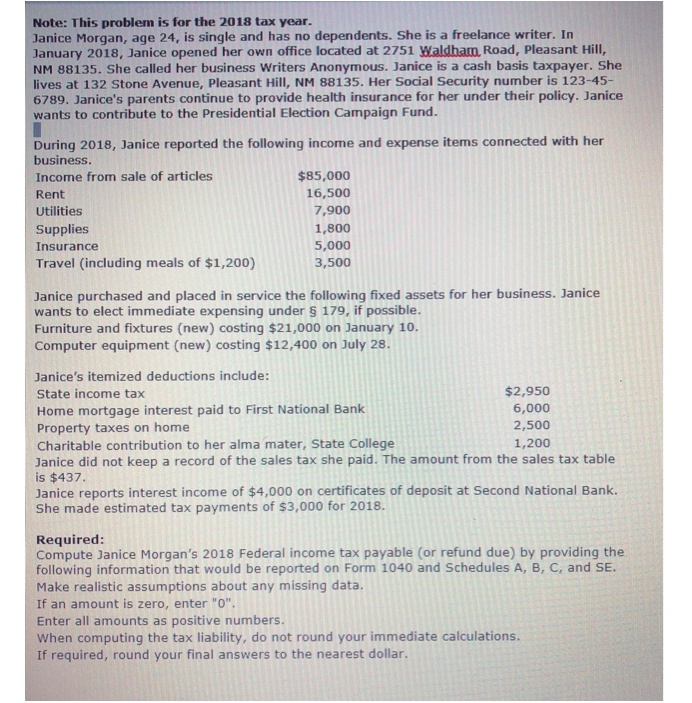

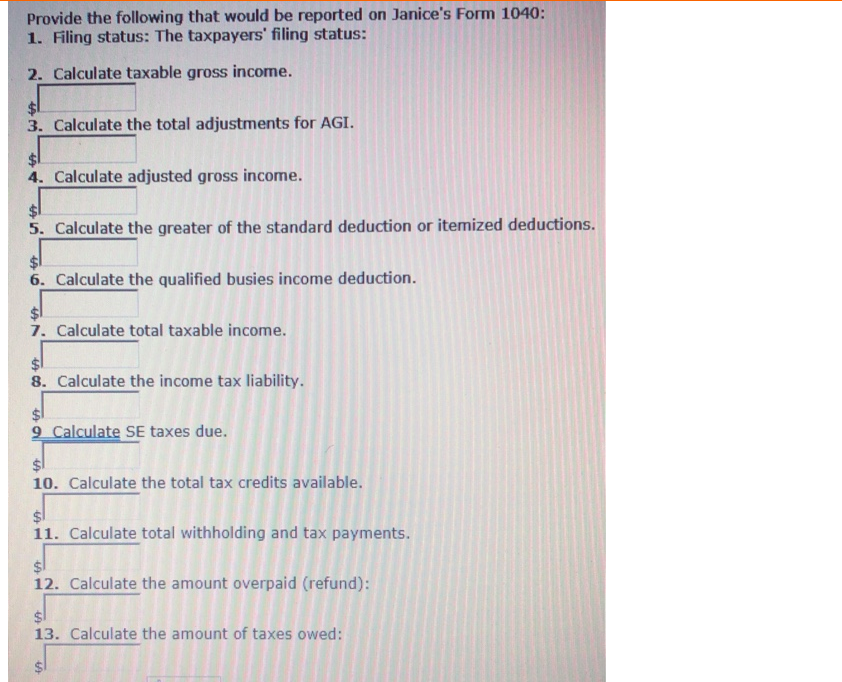

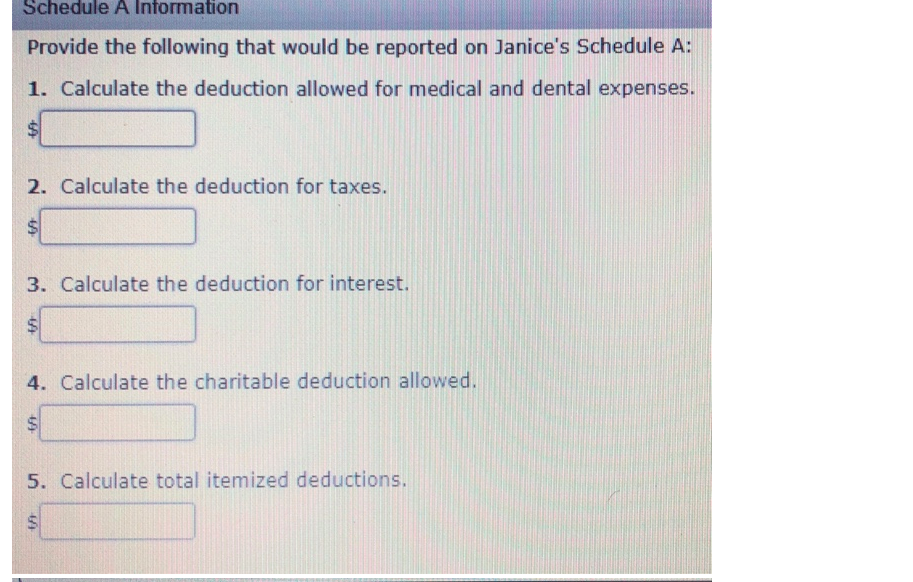

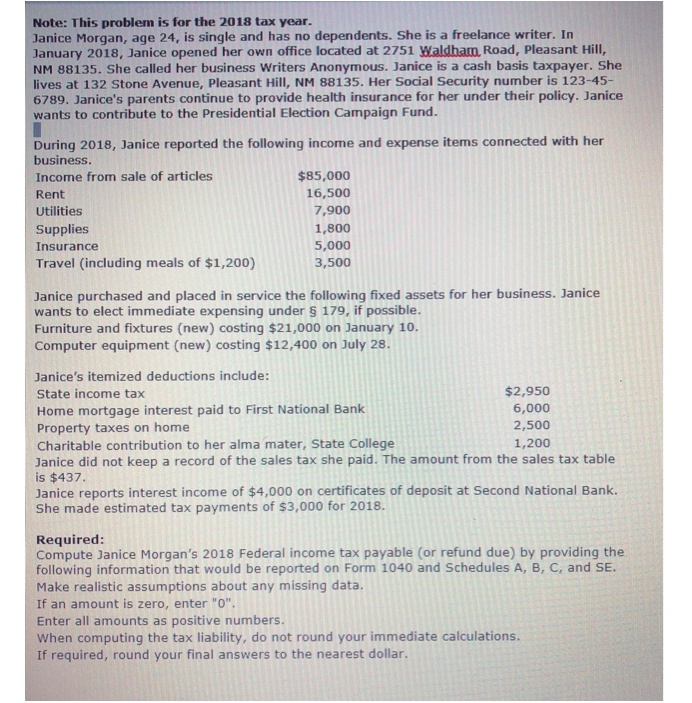

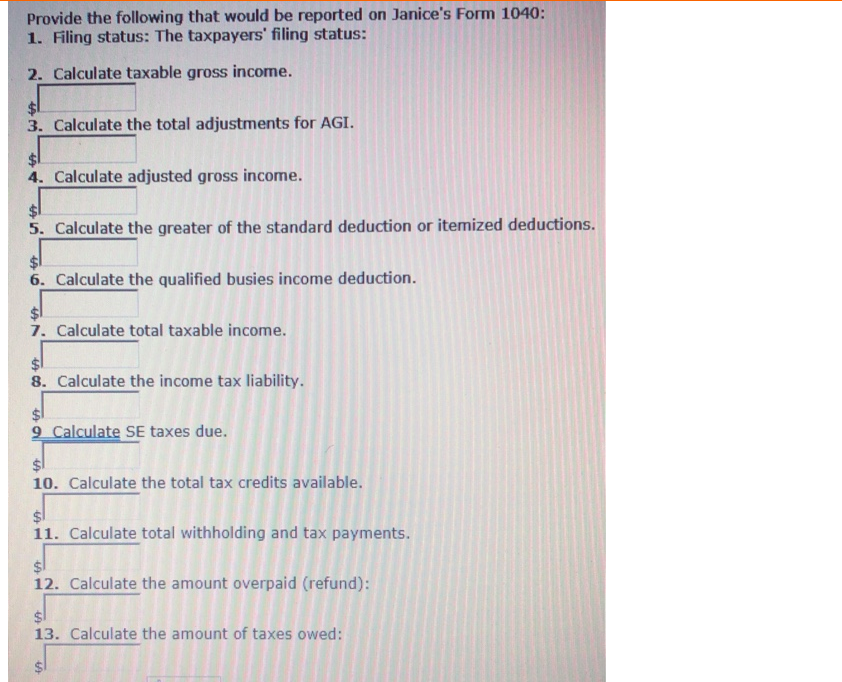

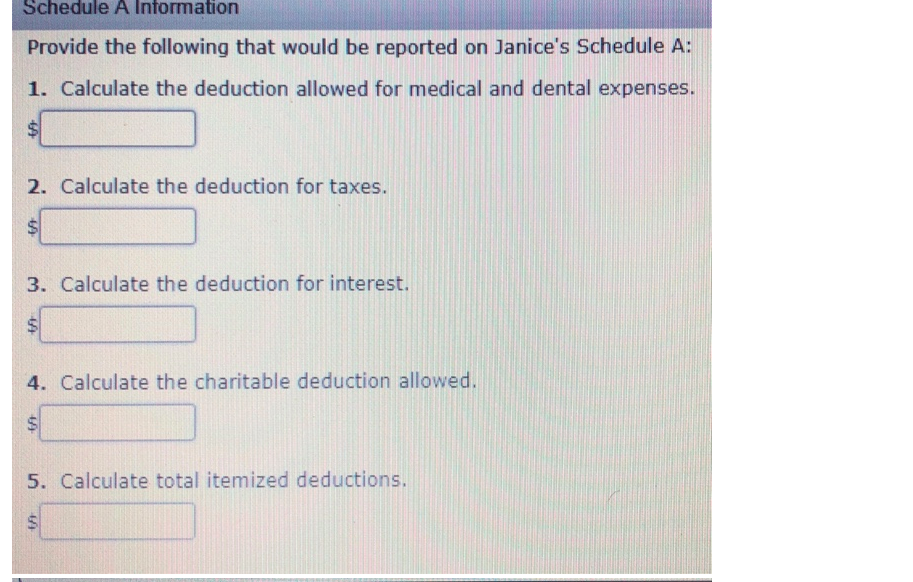

Note: This problem is for the 2018 tax year. Janice Morgan, age 24, is single and has no January 2018, Janice opened her own office located at 2751 Waldham. Road, Pleasant Hill, NM 88135. She called her business Writers Anonymous. Janice is a cash basis taxpayer. She lives at 132 Stone Avenue, Pleasant Hill, NM 88135. Her Social Security number is 123-45- 6789. Janice's parents continue to provide health insurance for her under their policy. Janice wants to contribute to the Presidential Election Campaign Fund. dependents. She is a freelance writer. In During 2018, Janice reported the following income and expense items connected with her business. Income from sale of articles $85,000 16,500 Rent 7,900 1,800 Utilities Supplies 5,000 Insurance Travel (including meals of $1,200) 3,500 Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect immediate expensing under 179, if possible. Furniture and fixtures (new) costing $21,000 on January 10. Computer equipment (new) costing $12,400 on July 28. Janice's itemized deductions include: $2,950 State income tax Home mortgage interest paid to First National Bank Property taxes on home Charitable contribution to her alma mater, State College Janice did not keep a record of the sales tax she paid. The amount from the sales tax table is $437. Janice reports interest income of $4,000 on certificates of deposit at Second National Bank. She made estimated tax payments of $3,000 for 2018. 6,000 2,500 1,200 Required: Compute Janice Morgan's 2018 Federal income tax payable (or refund due) by providing the following information that would be reported on Form 1040 and Schedules A, B, C, and SE. Make realistic assumptions about any missing data. If an amount is zero, enter "O" Enter all amounts as positive numbers. When computing the tax liability, do not round your immediate calculations. If required, round your final answers to the nearest dollar. Provide the following that would be reported on Janice's Form 1040: 1. Filing status: The taxpayers' filing status: 2. Calculate taxable gross income. $ 3. Calculate the total adjustments for AGI. 4. Calculate adjusted gross income. 5. Calculate the greater of the standard deduction or itemized deductions. 6. Calculate the qualified busies income deduction. 7. Calculate total taxable income. 8. Calculate the income tax liability. 9 Calculate SE taxes due. 10. Calculate the total tax credits available. 11. Calculate total withholding and tax payments. $ 12. Calculate the amount overpaid (refund): $ 13. Calculate the amount of taxes owed: Schedule A Information Provide the following that would be reported on Janice's Schedule A: 1. Calculate the deduction allowed for medical and dental expenses. 2. Calculate the deduction for taxes. $ 3. Calculate the deduction for interest. $ 4. Calculate the charitable deduction allowed. $ 5. Calculate total itemized deductions. Note: This problem is for the 2018 tax year. Janice Morgan, age 24, is single and has no January 2018, Janice opened her own office located at 2751 Waldham. Road, Pleasant Hill, NM 88135. She called her business Writers Anonymous. Janice is a cash basis taxpayer. She lives at 132 Stone Avenue, Pleasant Hill, NM 88135. Her Social Security number is 123-45- 6789. Janice's parents continue to provide health insurance for her under their policy. Janice wants to contribute to the Presidential Election Campaign Fund. dependents. She is a freelance writer. In During 2018, Janice reported the following income and expense items connected with her business. Income from sale of articles $85,000 16,500 Rent 7,900 1,800 Utilities Supplies 5,000 Insurance Travel (including meals of $1,200) 3,500 Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect immediate expensing under 179, if possible. Furniture and fixtures (new) costing $21,000 on January 10. Computer equipment (new) costing $12,400 on July 28. Janice's itemized deductions include: $2,950 State income tax Home mortgage interest paid to First National Bank Property taxes on home Charitable contribution to her alma mater, State College Janice did not keep a record of the sales tax she paid. The amount from the sales tax table is $437. Janice reports interest income of $4,000 on certificates of deposit at Second National Bank. She made estimated tax payments of $3,000 for 2018. 6,000 2,500 1,200 Required: Compute Janice Morgan's 2018 Federal income tax payable (or refund due) by providing the following information that would be reported on Form 1040 and Schedules A, B, C, and SE. Make realistic assumptions about any missing data. If an amount is zero, enter "O" Enter all amounts as positive numbers. When computing the tax liability, do not round your immediate calculations. If required, round your final answers to the nearest dollar. Provide the following that would be reported on Janice's Form 1040: 1. Filing status: The taxpayers' filing status: 2. Calculate taxable gross income. $ 3. Calculate the total adjustments for AGI. 4. Calculate adjusted gross income. 5. Calculate the greater of the standard deduction or itemized deductions. 6. Calculate the qualified busies income deduction. 7. Calculate total taxable income. 8. Calculate the income tax liability. 9 Calculate SE taxes due. 10. Calculate the total tax credits available. 11. Calculate total withholding and tax payments. $ 12. Calculate the amount overpaid (refund): $ 13. Calculate the amount of taxes owed: Schedule A Information Provide the following that would be reported on Janice's Schedule A: 1. Calculate the deduction allowed for medical and dental expenses. 2. Calculate the deduction for taxes. $ 3. Calculate the deduction for interest. $ 4. Calculate the charitable deduction allowed. $ 5. Calculate total itemized deductions