Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you are considering an investment, which would require you to pay $1,000 up front (today), and you would receive a payment of

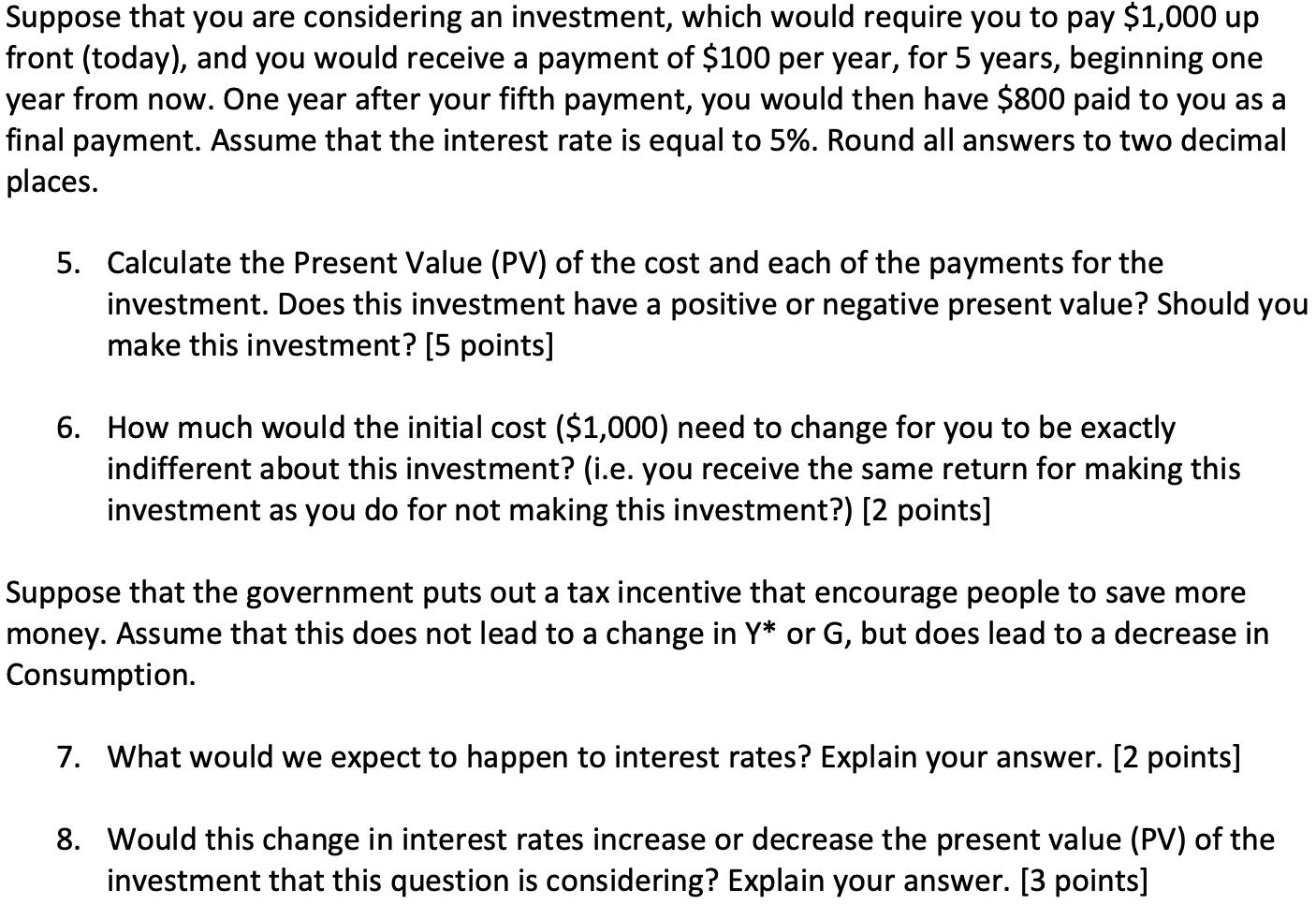

Suppose that you are considering an investment, which would require you to pay $1,000 up front (today), and you would receive a payment of $100 per year, for 5 years, beginning one year from now. One year after your fifth payment, you would then have $800 paid to you as a final payment. Assume that the interest rate is equal to 5%. Round all answers to two decimal places. 5. Calculate the Present Value (PV) of the cost and each of the payments for the investment. Does this investment have a positive or negative present value? Should you make this investment? [5 points] 6. How much would the initial cost ($1,000) need to change for you to be exactly indifferent about this investment? (i.e. you receive the same return for making this investment as you do for not making this investment?) [2 points] Suppose that the government puts out a tax incentive that encourage people to save more money. Assume that this does not lead to a change in Y* or G, but does lead to a decrease in Consumption. 7. What would we expect to happen to interest rates? Explain your answer. [2 points] 8. Would this change in interest rates increase or decrease the present value (PV) of the investment that this question is considering? Explain your answer. [3 points]

Step by Step Solution

★★★★★

3.56 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started