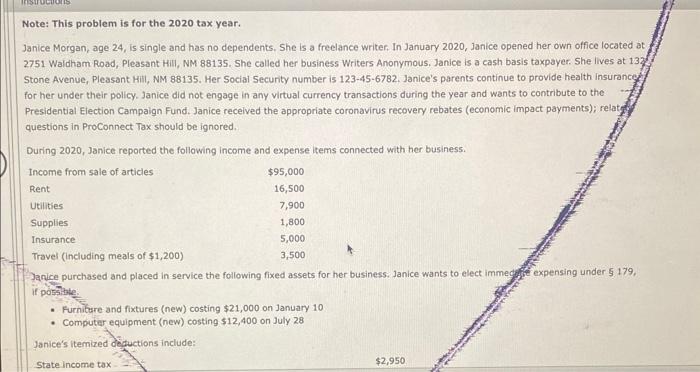

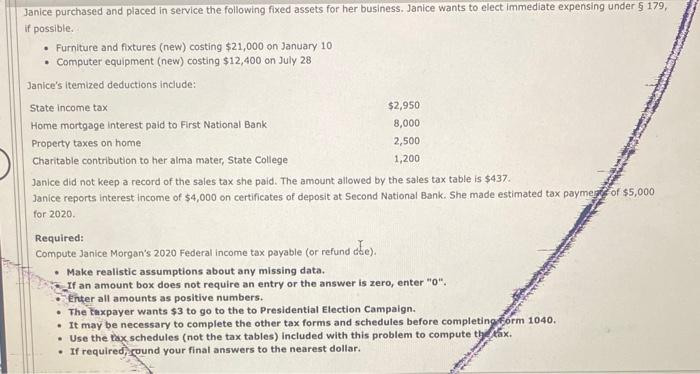

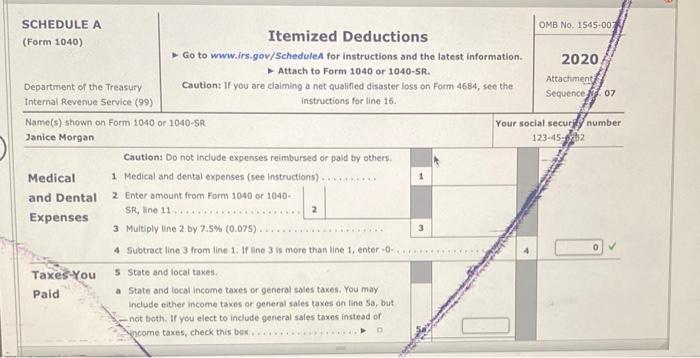

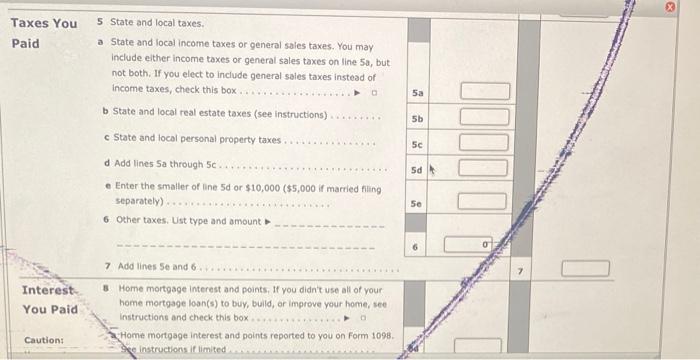

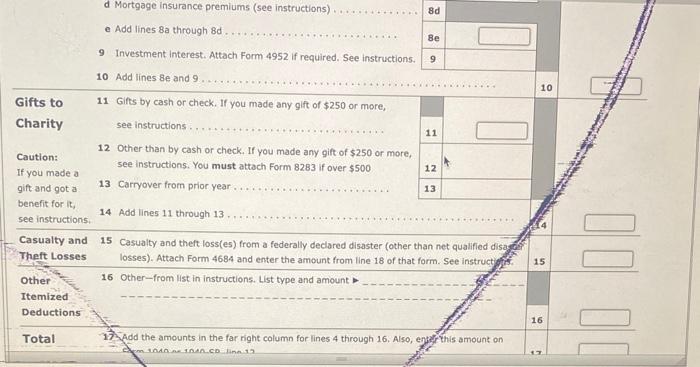

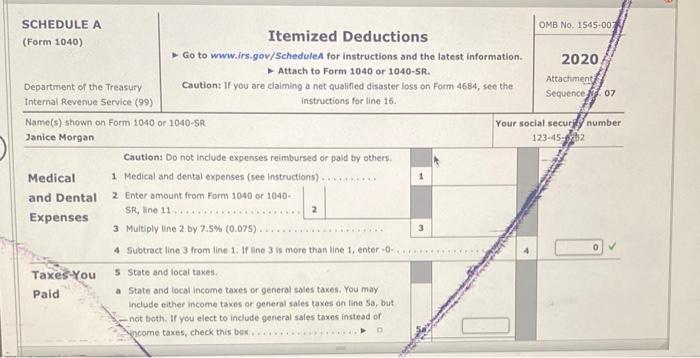

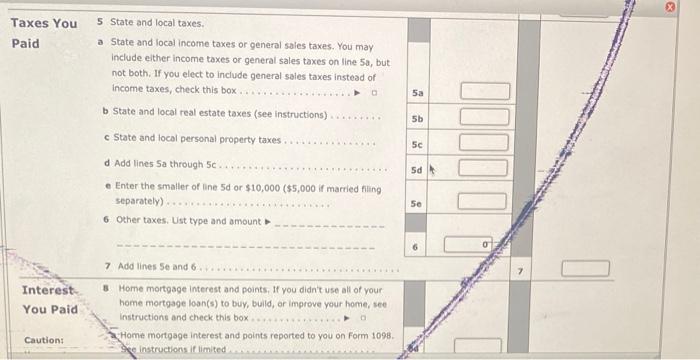

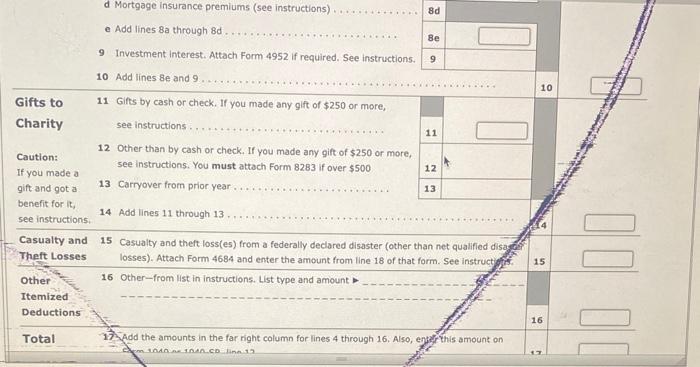

Note: This problem is for the 2020 tax year. Janice Morgan, age 24, is single and has no dependents, She is a freelance writer, In January 2020, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135. She called her business Writers Anonymous. Janice is a cash basis taxpayer. She lives at 1327 f Stone Avenue, Pleasant Hill, NM 88135 . Her Social Secunity number is 123-45-6782. Janice's parents continue to provide health insurances for her under their policy. Janice did not engage in any virtual currency transactions during the year and wants to contribute to the Presidential Election Campaign Fund. Janice recelved the appropriate coronavirus recovery rebates (economic impact payments); relatg questions in ProConnect Tax should be ignored. During 2020, Janice reported the following income and expense items connected with her business. Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect immediate expensing under 5179 , if possible. - Furniture and fixtures (new) costing $21,000 on January 10 - Computer equipment (new) costing $12,400 on July 28 Janice did not keep a record of the sales tax she paid. The amount allowed by the sales tax table is $437. Janice reports interest income of $4,000 on certificates of deposit at Second National Bank. She made estimated tax paymes f of $5,000 for 2020. You 5 State and local taxes. a State and local income taxes or general sales taxes. You may include elther income taxes or general sales taxes on line 5a, but. not both. If you elect to include general sales taxes instead of income taxes, check this box. b State and local real estate taxes (see instructions) c State and local personal property taxes ................ d Add lines 5 a through 5c..... e Enter the smaller of line 5d or $10,000($5,000 if married filing separately) ......................... 6. Other taxes. Ust type and amount n 7 Add lines 5e and 6 : 8. Home mortgage interest and points. If you didn't use all of your. Paid home mortgage loan(s) to buy, bulld, or improve your home, see instructions and check this box. Home mortgage interest and points reported to you on form 1098. Tee instructions if limited. d Mortgage insurance premiums (see instructions) . 8d e Add lines 8 a through 8 d ....................... Be 9 Investment interest. Attach Form 4952 if required. See instructions. 9 10 Add lines 8 en and 9 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions ++ Caution: 12 Other than by cash or check, If you made any gift of $250 or more, If you made a see instructions. You must attach Form 8283 if over $500 gift and got a 13 Carryover from prior year. ....................... benefit for it, see instructions. Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified disas Theft Losses losses). Attach Form 4684 and enter the amount from line 18 of that form. See instruction. 15 Other 16 Other-from Ist in instructions. List type and amount Itemized Deductions Total 17. Add the amounts in the far right column for lines 4 through 16. Also, eghtr this amount on dxminaneinanco linnia