Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* * * * Note this question is not the same as a previously asked question * * * * Example 3 - 5 Taylor

Note this question is not the same as a previously asked question

Example

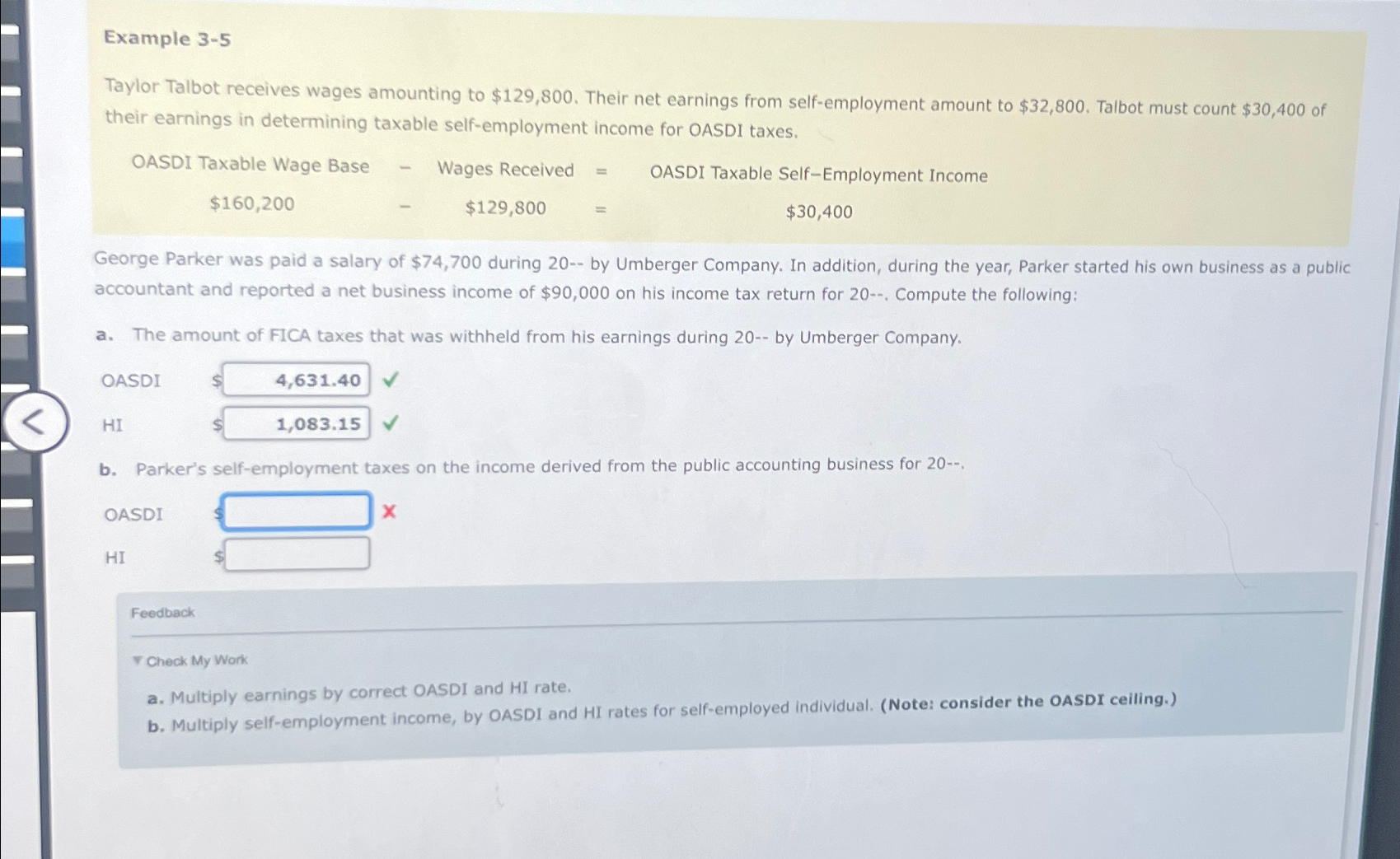

Taylor Talbot receives wages amounting to $ Their net earnings from selfemployment amount to $ Talbot must count $ of their earnings in determining taxable selfemployment income for OASDI taxes.

OASDI Taxable Wage Base Wages Received OASDI Taxable SelfEmployment Income

$ $$

George Parker was paid a salary of $ during by Umberger Company. In addition, during the year, Parker started his own business as a public accountant and reported a net business income of $ on his income tax return for Compute the following:

a The amount of FICA taxes that was withheld from his earnings during by Umberger Company.

OASDI

b Parker's selfemployment taxes on the income derived from the public accounting business for

OASDI

$

Feedback

T Check My Work

a Muttiply eamings by correct OASDI and HI rate.

b Multiply selfemployment income, by OASDI and HI rates for selfemployed individual. Note: consider the OASDI ceiling.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started