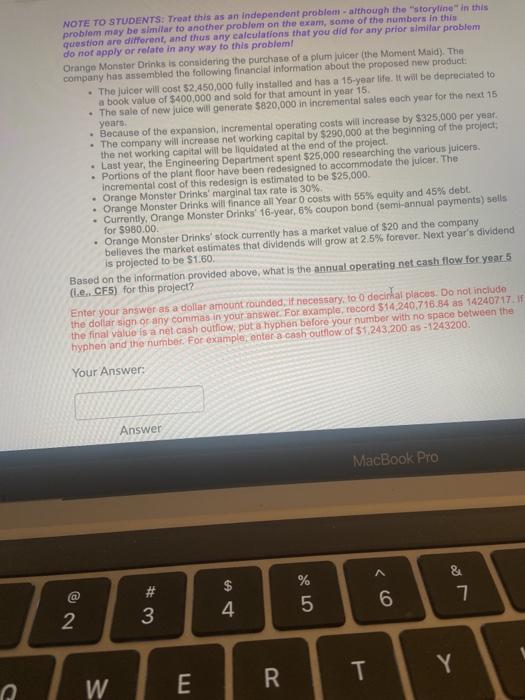

NOTE TO STUDENTS: Treat this as an independent problem - although the storyline in this problem may be similar to another problem on the exam, some of the numbers in this question are different, and thus any calculations that you did for any prior similar problem do not apply or relate in any way to this problem! Orange Monster Drinks is considering the purchase of a plum juicer (the Moment Maid). The company has assembled the following financial Information about the proposed new product: The juicer will cost $2,450,000 fully installed and has a 15-year life. It wl be depreciated to a book value of $400,000 and sold for that amount in year 15 The sale of new juice will generate $820,000 in incremental sales each year for the next 15 years . Because of the expansion, Incremental operating costs will increase by $325,000 per year. The company will increase not working capital by $290,000 at the beginning of the project; the not working capital will be liquidated at the end of the project. . Last year, the Engineering Department spent $25,000 researching the various juicers. Portions of the plant floor have been redesigned to accommodate the juicer. The incremental cost of this redesign is estimated to be $25,000 Orange Monster Drinks' marginal tax rate is 30% Orange Monster Drinks will finance all Year 0 costs with 55% equity and 45% debt. Currently, Orange Monster Drinks' 16-year, 6% coupon bond (semi-annual payments) solls for $980.00 Orange Monster Drinks stock currently has a market value of $20 and the company believes the market estimates that dividends will grow at 2.5% forever. Next year's dividend is projected to be $1.60. Based on the information provided above, what is the annual operating net cash flow for year 5 lle. CE5) for this project? Enter your answer as a dollar amount rounded, it necessary to decir al places. Do not include the dollar sign or any commas in your answer. For example, record $14.240.716.84 as 14240717. If the final value is a net cash outlow, put a hyphen before your number with no space between the hyphen and the number. For example, enter a cash outflow of $1.243,200 as - 1243200 Your Answer: Answer MacBook Pro % 5 # 3 & 7