Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ruth, age 25, has recently decided to switch from working full-time to full- time studying in order to get her bachelor's degree in Accounting

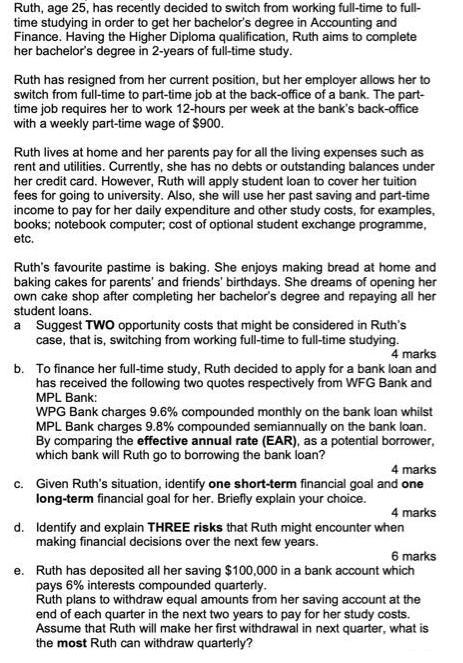

Ruth, age 25, has recently decided to switch from working full-time to full- time studying in order to get her bachelor's degree in Accounting and Finance. Having the Higher Diploma qualification, Ruth aims to complete her bachelor's degree in 2-years of full-time study. Ruth has resigned from her current position, but her employer allows her to switch from full-time to part-time job at the back-office of a bank. The part- time job requires her to work 12-hours per week at the bank's back-office with a weekly part-time wage of $900. Ruth lives at home and her parents pay for all the living expenses such as rent and utilities. Currently, she has no debts or outstanding balances under her credit card. However, Ruth will apply student loan to cover her tuition fees for going to university. Also, she will use her past saving and part-time income to pay for her daily expenditure and other study costs, for examples, books; notebook computer; cost of optional student exchange programme, etc. Ruth's favourite pastime is baking. She enjoys making bread at home and baking cakes for parents' and friends' birthdays. She dreams of opening her own cake shop after completing her bachelor's degree and repaying all her student loans. a Suggest TWO opportunity costs that might be considered in Ruth's case, that is, switching from working full-time to full-time studying. 4 marks b. To finance her full-time study, Ruth decided to apply for a bank loan and has received the following two quotes respectively from WFG Bank and MPL Bank: WPG Bank charges 9.6% compounded monthly on the bank loan whilst MPL Bank charges 9.8% compounded semiannually on the bank loan. By comparing the effective annual rate (EAR), as a potential borrower, which bank will Ruth go to borrowing the bank loan? 4 marks c. Given Ruth's situation, identify one short-term financial goal and one long-term financial goal for her. Briefly explain your choice. 4 marks d. Identify and explain THREE risks that Ruth might encounter when making financial decisions over the next few years. 6 marks e. Ruth has deposited all her saving $100,000 in a bank account which pays 6% interests compounded quarterly. Ruth plans to withdraw equal amounts from her saving account at the end of each quarter in the next two years to pay for her study costs. Assume that Ruth will make her first withdrawal in next quarter, what is the most Ruth can withdraw quarterly?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a 1 The opportunity cost of fulltime studying is the time spent studying which could be used for working and earning an income 2 The opportunity cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started