Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: use a postal code ONTARIO, L 7 A 1 Z 1 , BRAMPTON Phone number: , ( 6 4 7 ) 3 6 9

Note: use a postal code ONTARIO, BRAMPTON

Phone number:

Note:

Email address:

kdox@rogers.

Taxpayer #

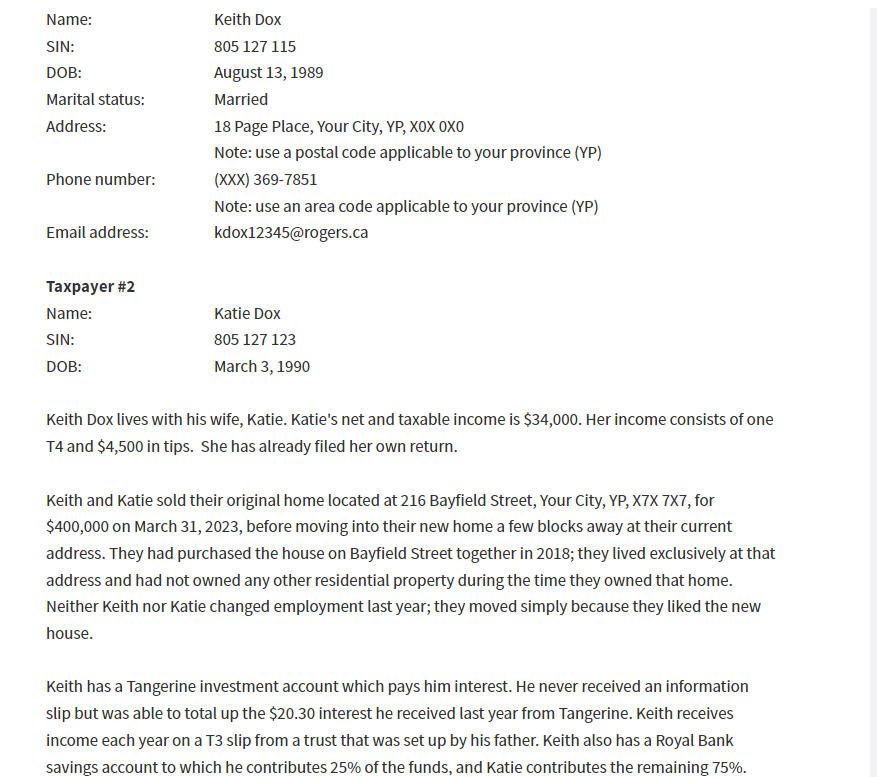

Keith Dox lives with his wife, Katie. Katie's net and taxable income $ Her income consists one

and $ tips. She has already filed her own return.

Keith and Katie sold their original home located Bayfield Street, Your City, for

$ March before moving into their new home a few blocks away their current

address. They had purchased the house Bayfield Street together ; they lived exclusively that

address and had not owned any other residential property during the time they owned that home.

Neither Keith nor Katie changed employment last year; they moved simply because they liked the new

house.

Keith has a Tangerine investment account which pays him interest. never received information

slip but was able total the $ interest received last year from Tangerine. Keith receives

income each year slip from a trust that was set his father. Keith also has a Royal Bank

savings account which contributes the funds, and Katie contributes the remaining Keith inherited a bank account the with a balance $ from his uncle. that

time, the exchange rate was neither contributed nor withdrew any amounts from this

account. According the bank statements, the account had a balance $ January

and $ December The bank statements also show that the only credits this

account are for monthly interest payments. For the annual average exchange rate was

Keith

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started