Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: write in words please Question B1 Johnson Corp. is a company based in the US, it imports goods denominated in euro () and regularly

Note: write in words please

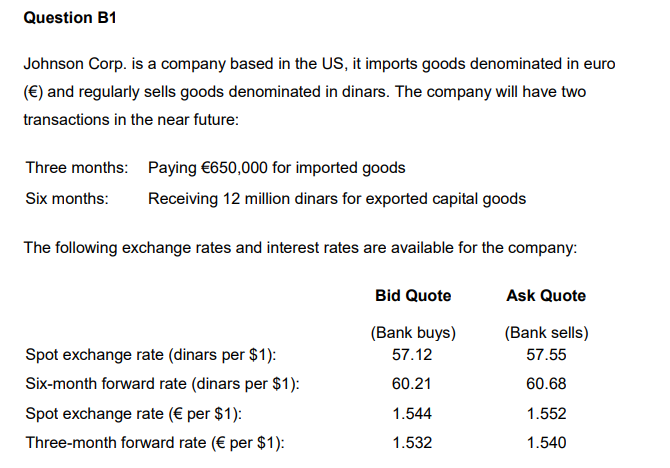

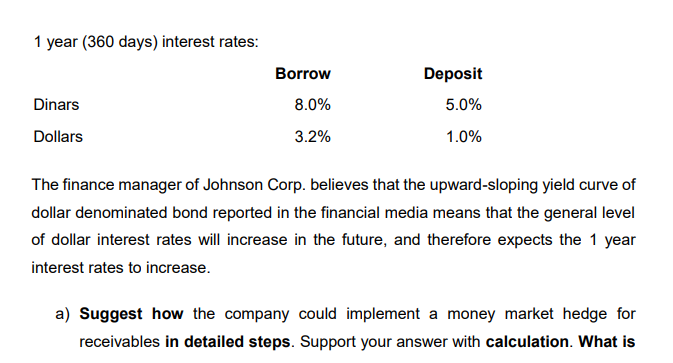

Question B1 Johnson Corp. is a company based in the US, it imports goods denominated in euro () and regularly sells goods denominated in dinars. The company will have two transactions in the near future: Three months: Six months: Paying 650,000 for imported goods Receiving 12 million dinars for exported capital goods The following exchange rates and interest rates are available for the company: Bid Quote Ask Quote (Bank buys) 57.12 60.21 (Bank sells) 57.55 60.68 Spot exchange rate (dinars per $1): Six-month forward rate (dinars per $1): Spot exchange rate ( per $1): Three-month forward rate ( per $1): 1.544 1.552 1.532 1.540 1 year (360 days) interest rates: Borrow Deposit 5.0% Dinars 8.0% 3.2% Dollars 1.0% The finance manager of Johnson Corp. believes that the upward-sloping yield curve of dollar denominated bond reported in the financial media means that the general level of dollar interest rates will increase in the future, and therefore expects the 1 year interest rates to increase. a) Suggest how the company could implement a money market hedge for receivables in detailed steps. Support your answer with calculation. What is the future dollar value of the dinar receipt using a money market hedge? Would Johnson Corp. be better off using a forward hedge or a money market hedge? (10 marks) b) Will the hedging methods listed below help to reduce the company's overall exchange rate risk? Explain. (8 marks) (1) Taking out a long-term euro-denominated loan (2) Taking out a dinar-denominated overdraft c) As Johnson Corp. exports goods denominated dinars and also imports goods denominated in euro (). How can it use an invoicing strategy to reduce the transaction exposure? Discuss the limitations on the effectiveness of this strategy. (10 marks) Total 28 marks Question B1 Johnson Corp. is a company based in the US, it imports goods denominated in euro () and regularly sells goods denominated in dinars. The company will have two transactions in the near future: Three months: Six months: Paying 650,000 for imported goods Receiving 12 million dinars for exported capital goods The following exchange rates and interest rates are available for the company: Bid Quote Ask Quote (Bank buys) 57.12 60.21 (Bank sells) 57.55 60.68 Spot exchange rate (dinars per $1): Six-month forward rate (dinars per $1): Spot exchange rate ( per $1): Three-month forward rate ( per $1): 1.544 1.552 1.532 1.540 1 year (360 days) interest rates: Borrow Deposit 5.0% Dinars 8.0% 3.2% Dollars 1.0% The finance manager of Johnson Corp. believes that the upward-sloping yield curve of dollar denominated bond reported in the financial media means that the general level of dollar interest rates will increase in the future, and therefore expects the 1 year interest rates to increase. a) Suggest how the company could implement a money market hedge for receivables in detailed steps. Support your answer with calculation. What is the future dollar value of the dinar receipt using a money market hedge? Would Johnson Corp. be better off using a forward hedge or a money market hedge? (10 marks) b) Will the hedging methods listed below help to reduce the company's overall exchange rate risk? Explain. (8 marks) (1) Taking out a long-term euro-denominated loan (2) Taking out a dinar-denominated overdraft c) As Johnson Corp. exports goods denominated dinars and also imports goods denominated in euro (). How can it use an invoicing strategy to reduce the transaction exposure? Discuss the limitations on the effectiveness of this strategy. (10 marks) Total 28 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started