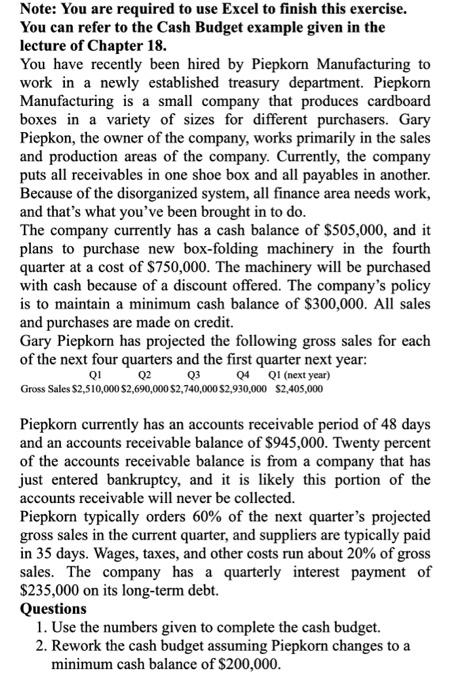

Note: You are required to use Excel to finish this exercise. You can refer to the Cash Budget example given in the lecture of Chapter 18. You have recently been hired by Piepkorn Manufacturing to work in a newly established treasury department. Piepkorn Manufacturing is a small company that produces cardboard boxes in a variety of sizes for different purchasers. Gary Piepkon, the owner of the company, works primarily in the sales and production areas of the company. Currently, the company puts all receivables in one shoe box and all payables in another. Because of the disorganized system, all finance area needs work, and that's what you've been brought in to do. The company currently has a cash balance of $505,000, and it plans to purchase new box-folding machinery in the fourth quarter at a cost of $750,000. The machinery will be purchased with cash because of a discount offered. The company's policy is to maintain a minimum cash balance of $300,000. All sales and purchases are made on credit. Gary Piepkorn has projected the following gross sales for each of the next four quarters and the first quarter next year: Piepkorn currently has an accounts receivable period of 48 days and an accounts receivable balance of $945,000. Twenty percent of the accounts receivable balance is from a company that has just entered bankruptcy, and it is likely this portion of the accounts receivable will never be collected. Piepkorn typically orders 60% of the next quarter's projected gross sales in the current quarter, and suppliers are typically paid in 35 days. Wages, taxes, and other costs run about 20% of gross sales. The company has a quarterly interest payment of $235,000 on its long-term debt. Questions 1. Use the numbers given to complete the cash budget. 2. Rework the cash budget assuming Piepkorn changes to a minimum cash balance of $200,000. Note: You are required to use Excel to finish this exercise. You can refer to the Cash Budget example given in the lecture of Chapter 18. You have recently been hired by Piepkorn Manufacturing to work in a newly established treasury department. Piepkorn Manufacturing is a small company that produces cardboard boxes in a variety of sizes for different purchasers. Gary Piepkon, the owner of the company, works primarily in the sales and production areas of the company. Currently, the company puts all receivables in one shoe box and all payables in another. Because of the disorganized system, all finance area needs work, and that's what you've been brought in to do. The company currently has a cash balance of $505,000, and it plans to purchase new box-folding machinery in the fourth quarter at a cost of $750,000. The machinery will be purchased with cash because of a discount offered. The company's policy is to maintain a minimum cash balance of $300,000. All sales and purchases are made on credit. Gary Piepkorn has projected the following gross sales for each of the next four quarters and the first quarter next year: Piepkorn currently has an accounts receivable period of 48 days and an accounts receivable balance of $945,000. Twenty percent of the accounts receivable balance is from a company that has just entered bankruptcy, and it is likely this portion of the accounts receivable will never be collected. Piepkorn typically orders 60% of the next quarter's projected gross sales in the current quarter, and suppliers are typically paid in 35 days. Wages, taxes, and other costs run about 20% of gross sales. The company has a quarterly interest payment of $235,000 on its long-term debt. Questions 1. Use the numbers given to complete the cash budget. 2. Rework the cash budget assuming Piepkorn changes to a minimum cash balance of $200,000