Answered step by step

Verified Expert Solution

Question

1 Approved Answer

note: You can't force the increase/decrease amount and/or the ending balance amount to be the number you want it to be... thats fraudulent financial reporting

note: You can't force the increase/decrease amount and/or the ending balance amount to be the number you want it to be... thats fraudulent financial reporting. You have to report the amount that your schedule supports even if you know it doesn't agree to your cash balance.

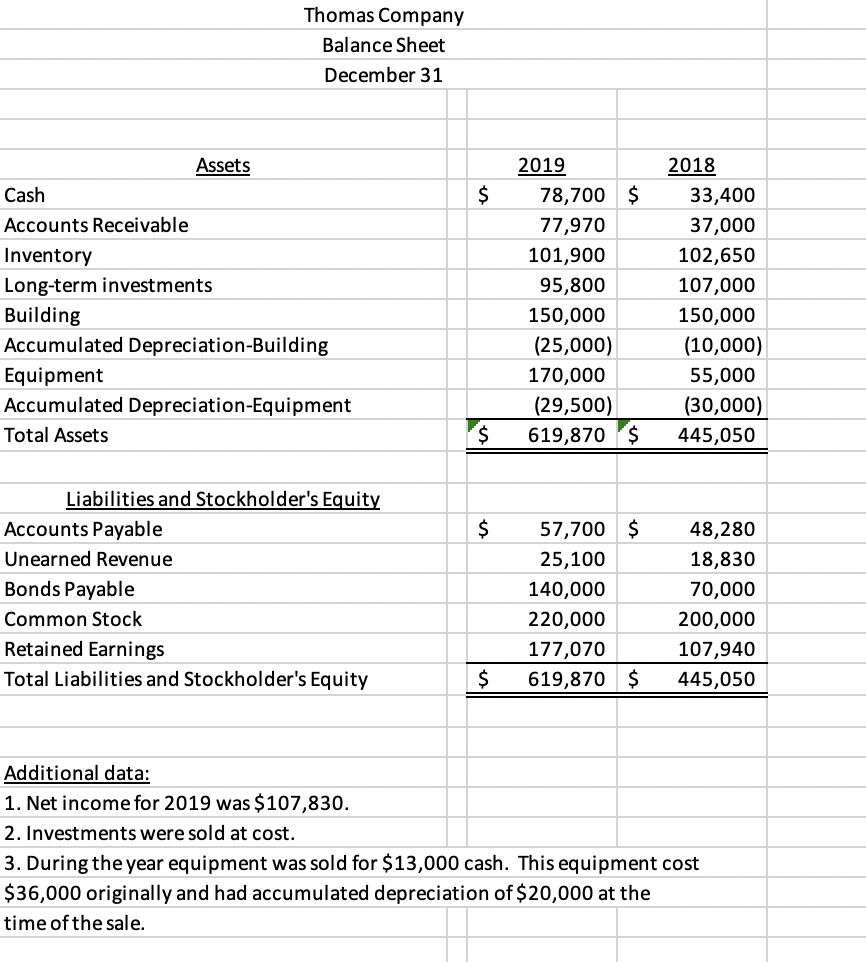

Thomas Company Balance Sheet December 31 Assets Cash Accounts Receivable Inventory Long-term investments Building Accumulated Depreciation-Building Equipment Accumulated Depreciation Equipment Total Assets 2019 78,700 $ 77,970 101,900 95,800 150,000 (25,000) 170,000 (29,500) 619,870 $ 2018 33,400 37,000 102,650 107,000 150,000 (10,000) 55,000 (30,000) 445,050 $ $ $ Liabilities and Stockholder's Equity Accounts Payable Unearned Revenue Bonds Payable Common Stock Retained Earnings Total Liabilities and Stockholder's Equity 57,700 25,100 140,000 220,000 177,070 619,870 48,280 18,830 70,000 200,000 107,940 445,050 $ $ Additional data: 1. Net income for 2019 was $107,830. 2. Investments were sold at cost. 3. During the year equipment was sold for $13,000 cash. This equipment cost $36,000 originally and had accumulated depreciation of $20,000 at the time of the saleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started