Question

Notes: 1. Travel allowance Virgil was reimbursed by the university for distances he had to travel with his own vehicle during the year for university

Notes: 1. Travel allowance Virgil was reimbursed by the university for distances he had to travel with his own vehicle during the year for university business purposes. The university reimbursed him at R 3 per km. His vehicle cost him R 160 000 (excluding VAT). Virgils logbook indicated that he traveled a total of 18 000 kilometers during the year. 2000 kilometers were traveled for university purposes. 2. Parking facility Undercover parking facilities are made available to employees at the university Virgil's parking cost him R 2 000 for the year A market-related fee In respect of a similar parking facility would have cost him R 4 000 for a year. 3. Bursary The university supports employees who want to further their studies Virgil received a bursary from the university and enrolled for a doctorate degree at the university. The bursary conditions stipulate that employees must reimburse the university if they do not complete their studies.

REQUIRED: Calculate Virgils net normal tax for the 2019 year of assessment

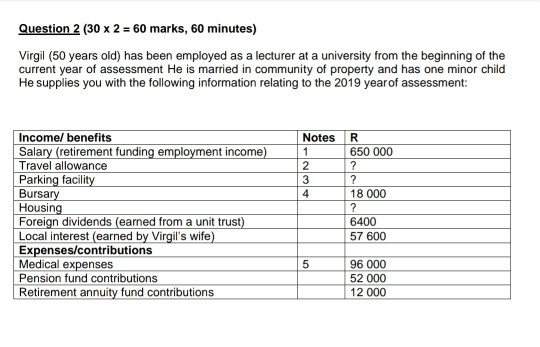

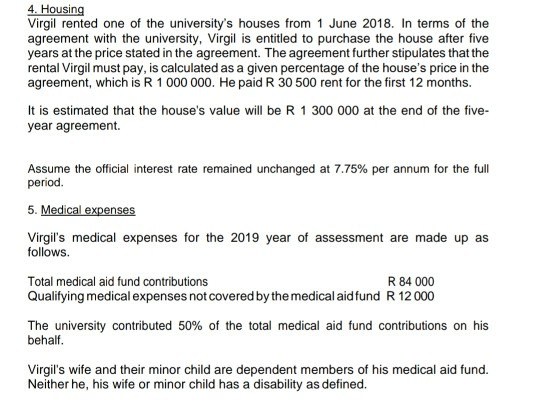

Question 2 (30 x 2 = 60 marks, 60 minutes) Virgil (50 years old) has been employed as a lecturer at a university from the beginning of the current year of assessment He is married in community of property and has one minor child He supplies you with the following information relating to the 2019 year of assessment: Notes 1 2 3 4 Incomel benefits Salary (retirement funding employment income) Travel allowance Parking facility Bursary Housing Foreign dividends (earned from a unit trust) Local interest (earned by Virgil's wife) Expenses/contributions Medical expenses Pension fund contributions Retirement annuity fund contributions R 650 000 ? ? 18 000 ? 6400 57 600 5 96 000 52 000 12 000 4. Housing Virgil rented one of the university's houses from 1 June 2018. In terms of the agreement with the university, Virgil is entitled to purchase the house after five years at the price stated in the agreement. The agreement further stipulates that the rental Virgil must pay, is calculated as a given percentage of the house's price in the agreement, which is R 1 000 000. He paid R 30 500 rent for the first 12 months. It is estimated that the house's value will be R 1 300 000 at the end of the five- year agreement Assume the official interest rate remained unchanged at 7.75% per annum for the full period. 5. Medical expenses Virgil's medical expenses for the 2019 year of assessment are made up as follows. Total medical aid fund contributions R 84000 Qualifying medical expenses not covered by the medical aid fund R 12000 The university contributed 50% of the total medical aid fund contributions on his behalf Virgil's wife and their minor child are dependent members of his medical aid fund. Neither he, his wife or minor child has a disability as defined. Question 2 (30 x 2 = 60 marks, 60 minutes) Virgil (50 years old) has been employed as a lecturer at a university from the beginning of the current year of assessment He is married in community of property and has one minor child He supplies you with the following information relating to the 2019 year of assessment: Notes 1 2 3 4 Incomel benefits Salary (retirement funding employment income) Travel allowance Parking facility Bursary Housing Foreign dividends (earned from a unit trust) Local interest (earned by Virgil's wife) Expenses/contributions Medical expenses Pension fund contributions Retirement annuity fund contributions R 650 000 ? ? 18 000 ? 6400 57 600 5 96 000 52 000 12 000 4. Housing Virgil rented one of the university's houses from 1 June 2018. In terms of the agreement with the university, Virgil is entitled to purchase the house after five years at the price stated in the agreement. The agreement further stipulates that the rental Virgil must pay, is calculated as a given percentage of the house's price in the agreement, which is R 1 000 000. He paid R 30 500 rent for the first 12 months. It is estimated that the house's value will be R 1 300 000 at the end of the five- year agreement Assume the official interest rate remained unchanged at 7.75% per annum for the full period. 5. Medical expenses Virgil's medical expenses for the 2019 year of assessment are made up as follows. Total medical aid fund contributions R 84000 Qualifying medical expenses not covered by the medical aid fund R 12000 The university contributed 50% of the total medical aid fund contributions on his behalf Virgil's wife and their minor child are dependent members of his medical aid fund. Neither he, his wife or minor child has a disability as definedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started