Answered step by step

Verified Expert Solution

Question

1 Approved Answer

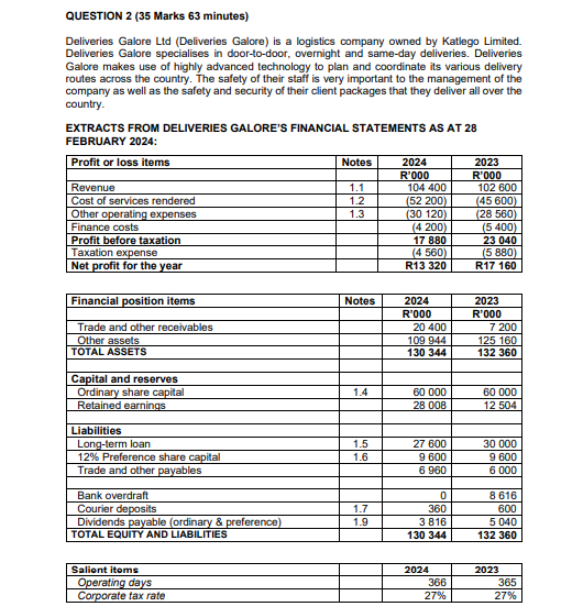

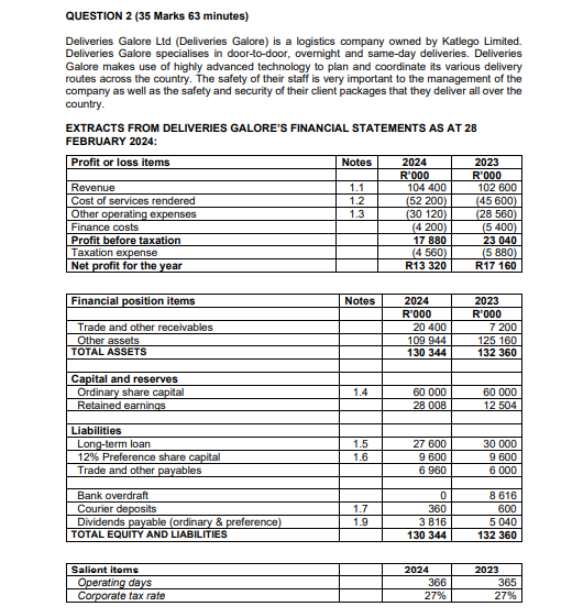

Notes and additional information: 1 . 1 . 9 0 % of revenue is generated on credit sales to contractual corporate customers, while 1 0

Notes and additional information:

of revenue is generated on credit sales to contractual corporate customers, while

is generated from sales to payaswedeliver household customers.

Cost of services rendered does not include any onceoff or exceptional expenses.

Other operating expenses include depreciation and amortisation charges of R million

: R million

Deliveries Galore has million shares in issue and on February these shares

were trading at R each.

On February the market value of the longterm loan was Rmillion.

All the preference shares will be redeemed on February at discount on par

value. On February the marketrelated cost of similar redeemable preference

shares was The par value of each preference share is R

All corporate customers are required to pay a courier deposit as security for the afforded

credit facility. Upon cancellation of any corporate customer contract, the courier deposit is

repaid in full.

As at February the marketrelated cost of equity was and the marketrelated cost of the longterm loan was

All dividends are declared on February and subsequently paid on July in the

following year

a For question a only, assume that Deliveries Galore uses book values and closing

balances when calculating and analysing the ratios:

Calculate the following ratios for both the and the financial years and provide

a possible reason for each movement:

i Trade receivable collection period

ii Gross profit margin

iii EBITDA margin

iv Ordinary dividend payout ratio

iv Asset turnover ratio

b Provide one possible reason why Deliveries Galores working capital management would

not include the management of trading inventory.

c Calculate Deliveries Galores weighted average cost of capital WACC as at

February

d From the information provided, discuss the nonfinancial risks that Deliveries Galore

might be facing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started