Answered step by step

Verified Expert Solution

Question

1 Approved Answer

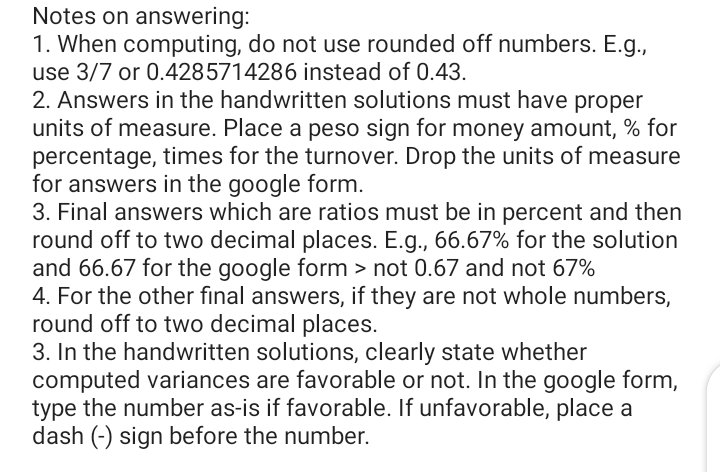

Notes on answering: 1. When computing, do not use rounded off numbers. E.g., use 3/7 or 0.4285714286 instead of 0.43. 2. Answers in the handwritten

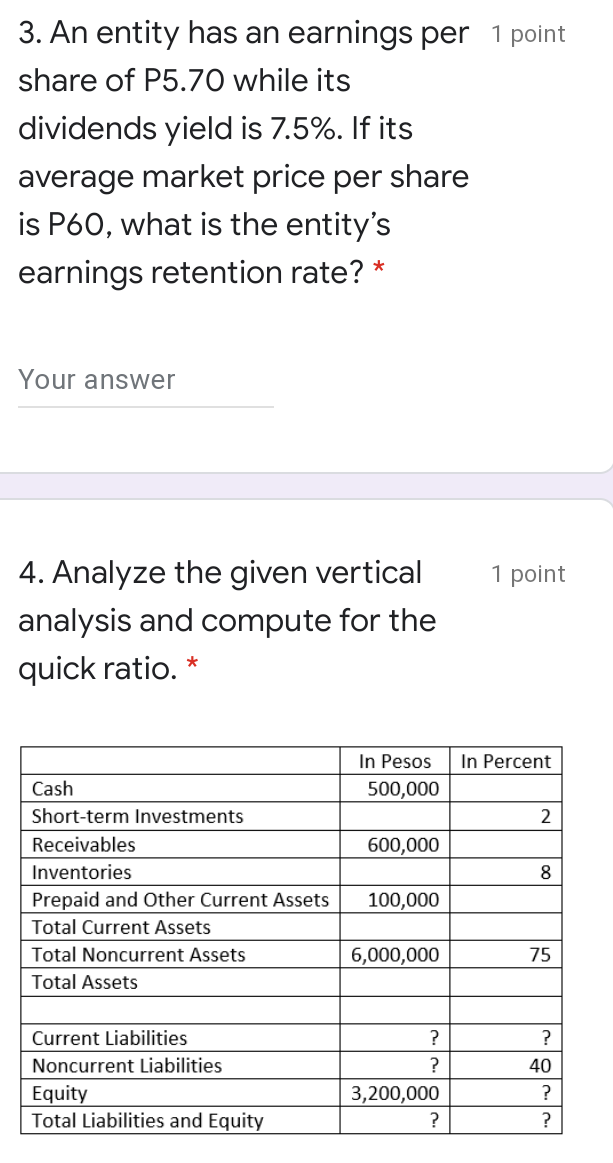

Notes on answering: 1. When computing, do not use rounded off numbers. E.g., use 3/7 or 0.4285714286 instead of 0.43. 2. Answers in the handwritten solutions must have proper units of measure. Place a peso sign for money amount, % for percentage, times for the turnover. Drop the units of measure for answers in the google form. 3. Final answers which are ratios must be in percent and then round off to two decimal places. E.g., 66.67% for the solution and 66.67 for the google form > not 0.67 and not 67% 4. For the other final answers, if they are not whole numbers, round off to two decimal places. 3. In the handwritten solutions, clearly state whether computed variances are favorable or not. In the google form, type the number as-is if favorable. If unfavorable, place a dash (-) sign before the number. 3. An entity has an earnings per 1 point share of P5.70 while its dividends yield is 7.5%. If its average market price per share is P60, what is the entity's earnings retention rate? * Your answer 1 point 4. Analyze the given vertical analysis and compute for the quick ratio. * In Percent In Pesos 500,000 2 600,000 8 Cash Short-term Investments Receivables Inventories Prepaid and Other Current Assets Total Current Assets Total Noncurrent Assets Total Assets 100,000 6,000,000 75 ? Current Liabilities Noncurrent Liabilities Equity Total Liabilities and Equity ? ? 3,200,000 ? 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started