Answered step by step

Verified Expert Solution

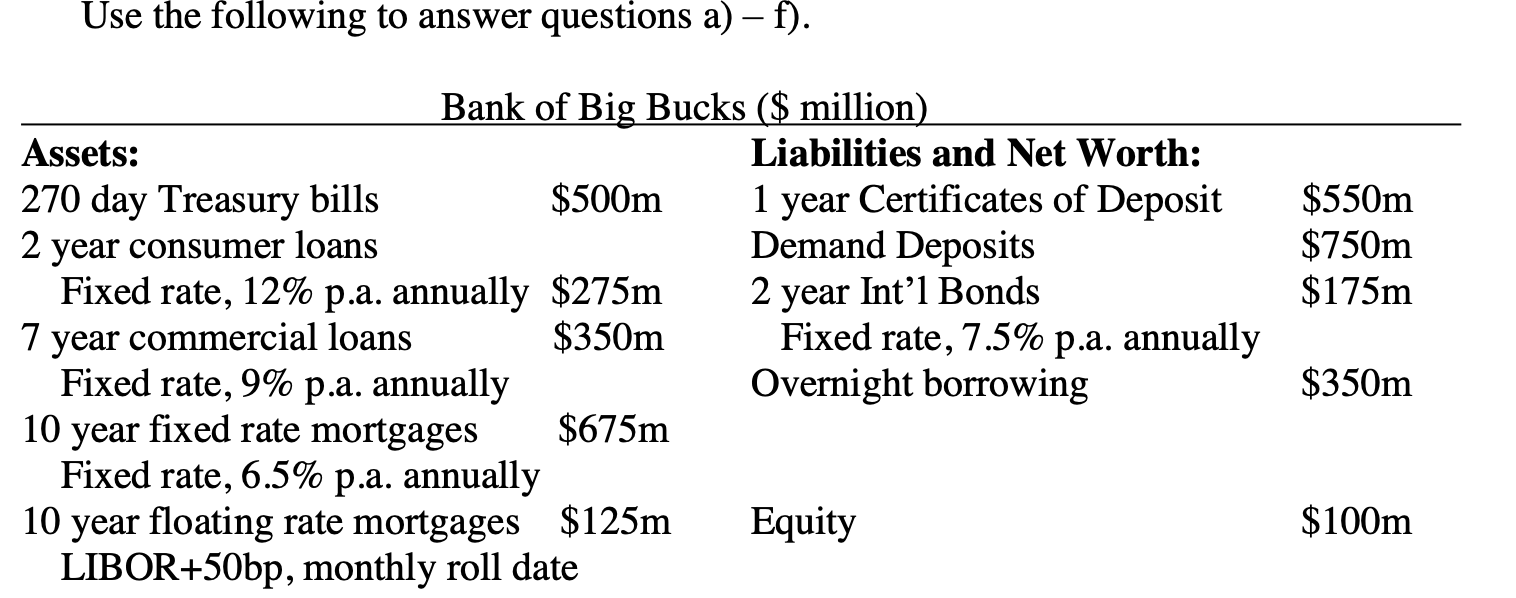

Question

1 Approved Answer

Notes: The 1 year Certificates of Deposit pay 1 . 9 5 % p . a . annually and will be rolled over at maturity.

Notes:

The year Certificates of Deposit pay pa annually and will be rolled over at

maturity. The year commercial loans have a duration of years. The fixed rate

mortgages have a duration of years. All values are market values and are trading at

par.

Assumption: days per month; days per quarter; days per year.

a What is the banks duration gap?

a years

b years

c years

d years

e years

b What is the banks interest rate risk exposure ie exposed to rising or falling rates

c What is the onbalancesheet impact on the bank if all interest rates increase basis

points? ie suppose RR is equal to an increase of basis points.

d Suppose you are a risk manager of the bank. Construct an appropriate swap hedge for

your bank.

i Specify whether your bank should be a fixed or variablerate payer in the swap,

and

ii Calculate the notional of swap, NS for a perfect hedge. Suppose the fixed side of

the swap has a duration of years, while the variable side of the swap is floating

on a biennial base.

e How would you use futures contracts on Canada Bond to hedge your banks interest

rate risk exposure? Specify whether your bank should conduct a long or short hedge.

Justify your strategy.

f How would you use put option contracts to hedge the interest rate risk exposure of

your bank? That is should the bank buy or sell put options on Canada Bond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started