Answered step by step

Verified Expert Solution

Question

1 Approved Answer

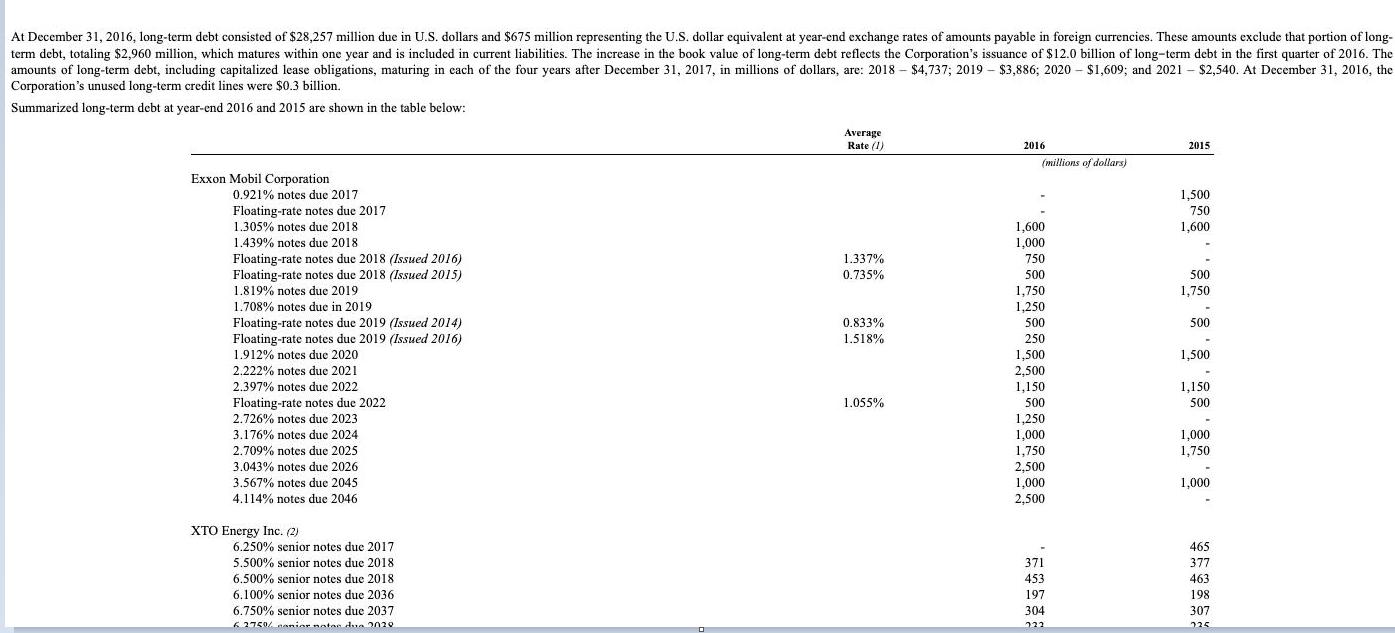

At December 31, 2016, long-term debt consisted of $28,257 million due in U.S. dollars and $675 million representing the U.S. dollar equivalent at year-end

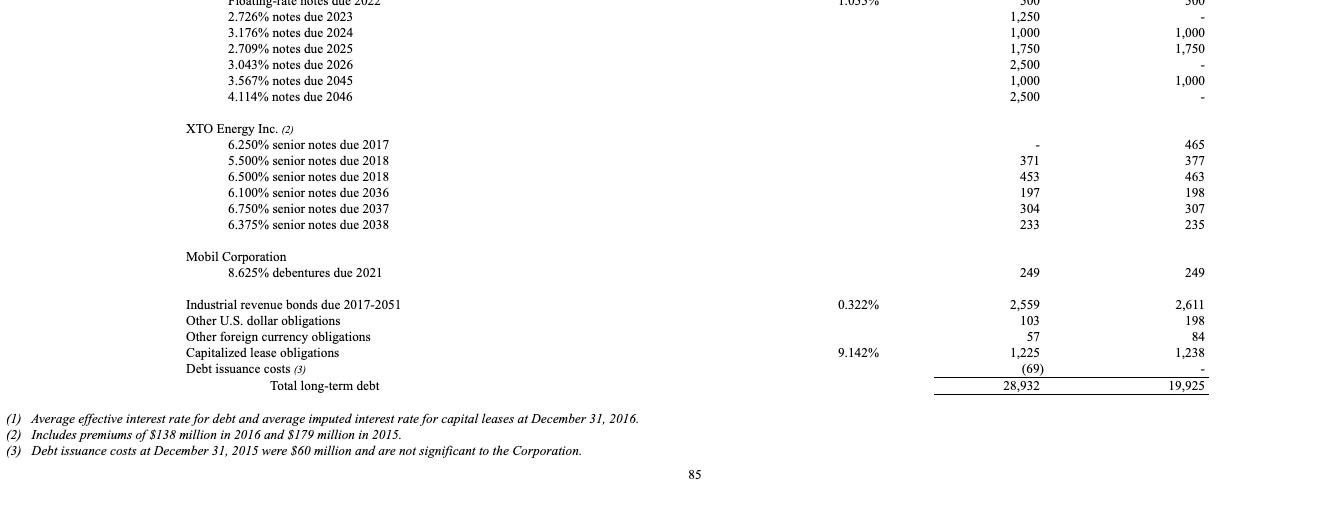

At December 31, 2016, long-term debt consisted of $28,257 million due in U.S. dollars and $675 million representing the U.S. dollar equivalent at year-end exchange rates of amounts payable in foreign currencies. These amounts exclude that portion of long- term debt, totaling $2,960 million, which matures within one year and is included in current liabilities. The increase in the book value of long-term debt reflects the Corporation's issuance of $12.0 billion of long-term debt in the first quarter of 2016. The amounts of long-term debt, including capitalized lease obligations, maturing in each of the four years after December 31, 2017, in millions of dollars, are: 2018- $4,737; 2019 - $3,886; 2020 - $1,609; and 2021 - $2,540. At December 31, 2016, the Corporation's unused long-term credit lines were $0.3 billion. Summarized long-term debt at year-end 2016 and 2015 are shown in the table below: Exxon Mobil Corporation 0.921% notes due 2017 Floating-rate notes due 2017 1.305% notes due 2018 1.439% notes due 2018 T Floating-rate notes due 2018 (Issued 2016) latin Floating-rate notes due 2018 (Issued 2015) 1910% moto de 2010 1.819% notes due 2019 1.708% notes due in 2019 Floating to be de Floating-rate notes due 2019 (Issued 2014) Floating-rate notes due 2019 (Issued 2016) 1912% notes due 2020 1.912% notes due 2020 2.222% notes due 2021 22079 2022 2.397% notes due 2022 Hoe Floating-rate notes due 2022 726% no de 2003 2.726% notes due 2023 3.176% notes due 2024 2.709% notes due 2025 3.043% notes due 2026 3.567% notes due 2045 4.114% notes due 2046 XTO Energy Inc. (2) 6.250% senior notes due 2017 5.500% senior notes due 2018 6.500% senior notes due 2018 6.100% senior notes due 2036 6.750% senior notes due 2037 62750/nonior notae dua 2029 Average Rate (1) 1.337% 0.735% 0.833% 1.518% 1.055% 2016 (millions of dollars) 1,600 1,000 750 500 1360 1,750 1.250 1,250 FOO 500 360 250 1.500 1,500 2.500 2,500 1150 1,150 ** 500 1.250 1,250 1.000 1,000 1,750 750 2,500 1,000 2,500 371 453 197 304 222 2015 1,500 750 1,600 500 1,750 - 500 500 1,500 1,150 500 1,000 1,750 1,000 465 377 463 198 307 725 loating 2.726% notes due 2023 3.176% notes due 2024. 2.709% notes due 2025 3.043% notes due 2026 3.567% notes due 2045 4.114% notes due 2046 XTO Energy Inc. (2) 6.250% senior notes due 2017 5.500% senior notes due 2018. 6.500% senior notes due 2018. 6.100% senior notes due 2036 6.750% senior notes due 2037 6.375% senior notes due 2038 Mobil Corporation 8.625% debentures due 2021 Industrial revenue bonds due 2017-2051 Other U.S. dollar obligations Other foreign currency obligations Capitalized lease obligations Debt issuance costs (3) Total long-term debt (1) Average effective interest rate for debt and average imputed interest rate for capital leases at December 31, 2016. (2) Includes premiums of $138 million in 2016 and $179 million in 2015. (3) Debt issuance costs at December 31, 2015 were $60 million and are not significant to the Corporation. 85 1.0376 0.322% 9.142% 1,250 1,000 1,750 2,500 1,000 2,500 371 453 197 304 233 249 2,559 103 57 1.225 (69) 28,932 1,000 1,750 - 1,000 465 377 463 198 307 235 249 2,611 198 84 1,238 19,925

Step by Step Solution

★★★★★

3.61 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

a The amount of longterm debt which matures within one year and is included in current ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started