Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Notes to Consolidated Financial Statements 2. Summary of significant accounting policies: Inventories. Inventories are valued at cost, not in excess of market. Cost is

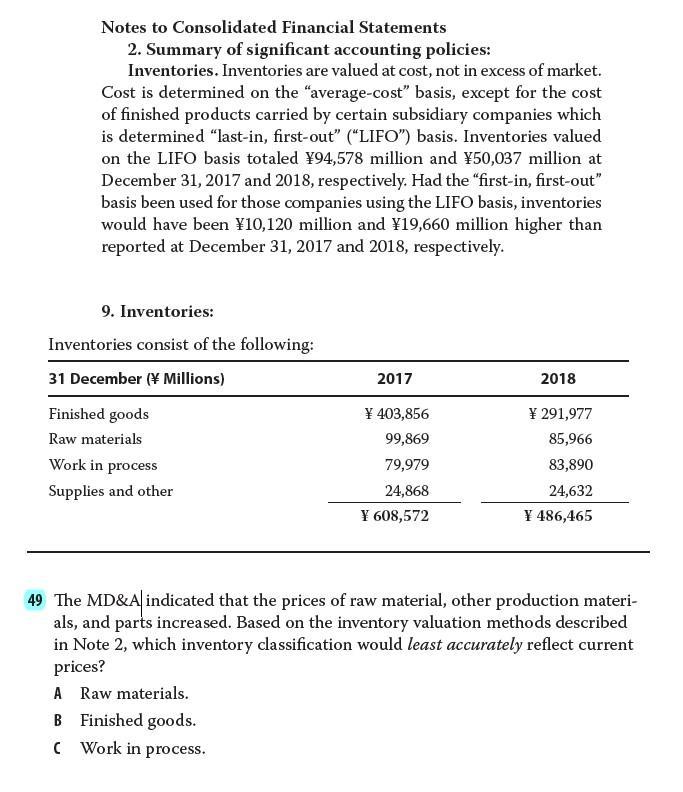

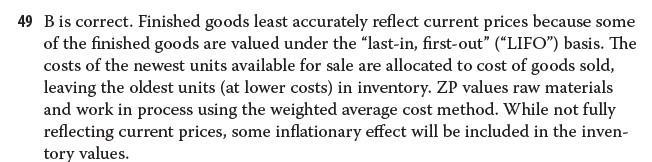

Notes to Consolidated Financial Statements 2. Summary of significant accounting policies: Inventories. Inventories are valued at cost, not in excess of market. Cost is determined on the "average-cost" basis, except for the cost of finished products carried by certain subsidiary companies which is determined "last-in, first-out" ("LIFO") basis. Inventories valued on the LIFO basis totaled 94,578 million and 50,037 million at December 31, 2017 and 2018, respectively. Had the "first-in, first-out" basis been used for those companies using the LIFO basis, inventories would have been 10,120 million and 19,660 million higher than reported at December 31, 2017 and 2018, respectively. 9. Inventories: Inventories consist of the following: 31 December ( Millions) Finished goods Raw materials Work in process Supplies and other 2017 2018 403,856 291,977 99,869 85,966 79,979 83,890 24,868 24,632 608,572 486,465 49 The MD&A indicated that the prices of raw material, other production materi- als, and parts increased. Based on the inventory valuation methods described in Note 2, which inventory classification would least accurately reflect current prices? A Raw materials. B Finished goods. C Work in process.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started