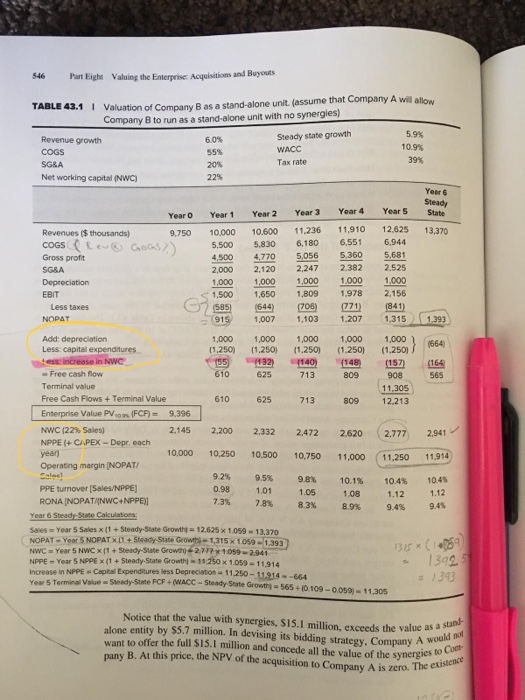

Notice that the value with synergies, SI5.1 million, exceeds the value as a stand- want to offer the full SIS.I million and concede all the value of the synergies to Com alone entity by S5.7 million. In devising its bidding strategy. Company A would not pany B. At this price, the NPV of the acquisition to Company A is zero. The existence 546 Part Eight Valuing the Enterprise: Acquisitions and Buyouts TABLE 43.1 | Valuation of Company B as a stand-alone unit (assume that Company A will allow Company B to run as a stand-alone unit with no synergies) Revenue growth 60% Steady state growth 5.9% COGS 55 WACC SGSA 20% Tax rate 39% Net working capital (NWC) 229 10.94 Year 6 Steady State Year o Year 1 Year 2 Year 5 Year 4 13.370 Revenues (thousands) 9.750 COGS (le GOG) Gross profit SG&A Depreciation EBIT Less taxes NOPAT 10.000 5,500 4,500 2.000 1,000 1,500 10.600 5.830 4,770 2,120 1.000 1,650 (644) 1,007 Year 3 11.236 6,180 5,056 2.247 1,000 1,809 (706 1,103 11.910 6.551 5,360 2.382 1.000 1,978 771) 1.207 12.625 6.944 5,681 2.525 1.000 2.156 (841) 1.315 915 1.393 1664) (164 565 2.941 11,914 Add: depreciation 1,000 1.000 1,000 1,000 1.000 Less: capital expenditures (1.250) (1.250) 11.250) (1.250) (1.250) ess: increase in NWC 155 132 1140) 1148 (157) Free cash flow 610 625 713 809 908 Terminal value 11,305 Free Cash Flows + Terminal Value 610 625 713 809 12 213 Enterprise Value PV. (FCF) = 9.396 NWC (22% Sales) 2.145 2,200 2.332 2.472 2,620 2.777 NPPE + CAPEX - Deproach yean 10.000 10.250 10.500 10.750 11,000 11.250 Operating margin (NOPATI Sale! 9.2% 9.5% 9.8% 10.1% 10.4% PPE turnover (Sales/NPPE) 0.98 1.01 1.08 1.12 RONA [NOPATINWC+NPPE) 7.3% 7.8% 8.3% 8.9% 9.4% Year 6 SteadyState Calculations Sales - Year 5 Sales x (1 + Steady-State Growth = 12.625 X 1.059 - 13,370 NOPAT - Year 5 NOPATX (1+SteadyState Grow-1,315 x 1.059 - 1,393 NWC = Year 5 NWC x 11 Steady-State Growth-2.71710592,941 NPPE-Year 5 NPPEX (1 + SteadyState Growthi 11.250 x 1.059 - 11.914 Increase in NPPE - Capital Expenditures less Depreciation - 11.250 -1.914--664 Your Terminal Value Steady-State FCF (WACC - Steady State Growth = 565 +0.109 -0.059) - 11,305 10.45 1.12 1.05 13925 = 1393 Please can you write exactly how they calculate Less capital expenditure AND NPPE ( 10000- 10250-10500-10750-11000-11250) Show me how to get this amount (they wrote the equation but when I do it, i do not get the same answers) I highlighted with yellow Show me for all years