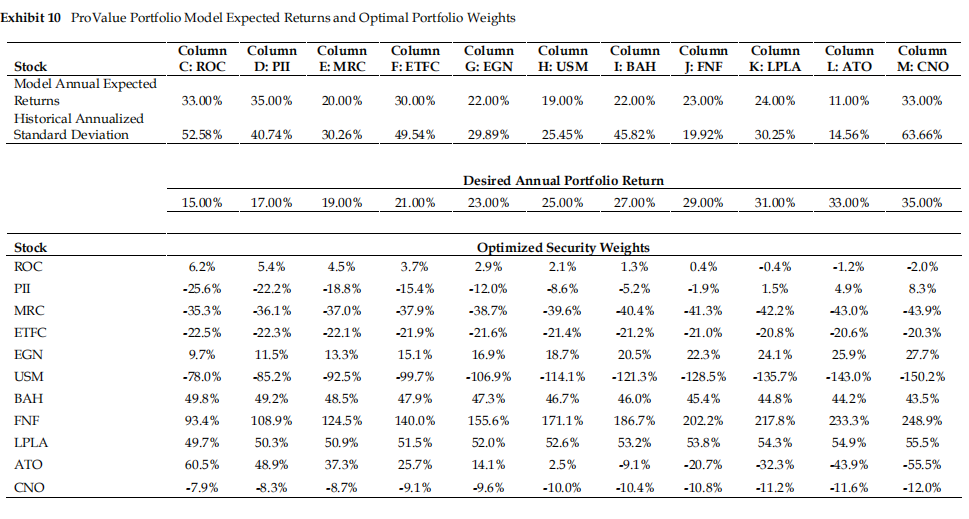

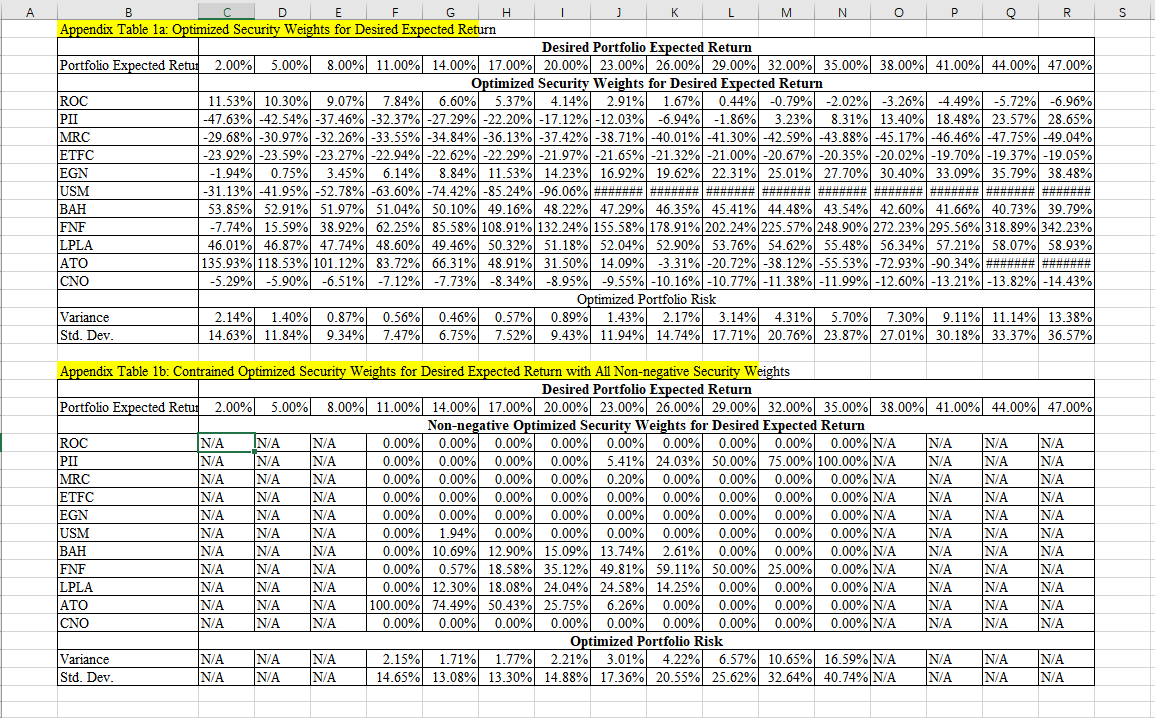

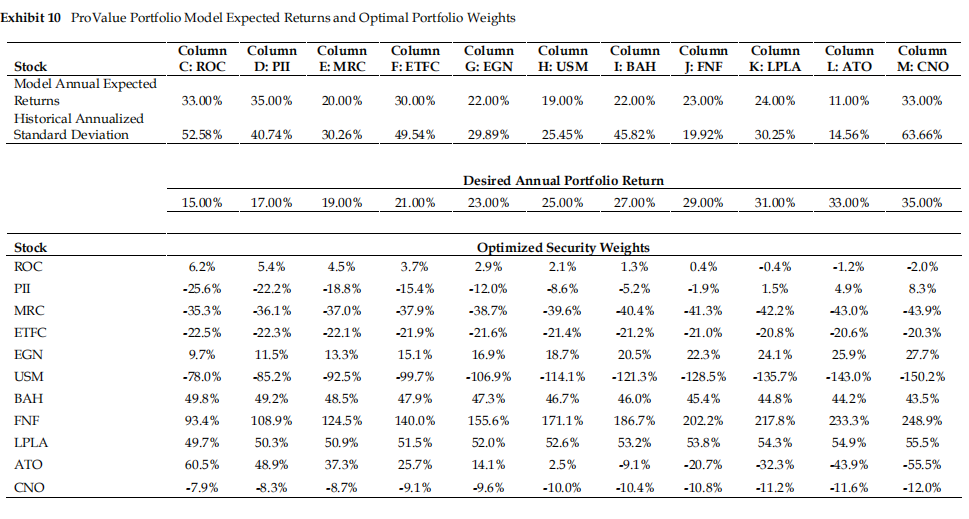

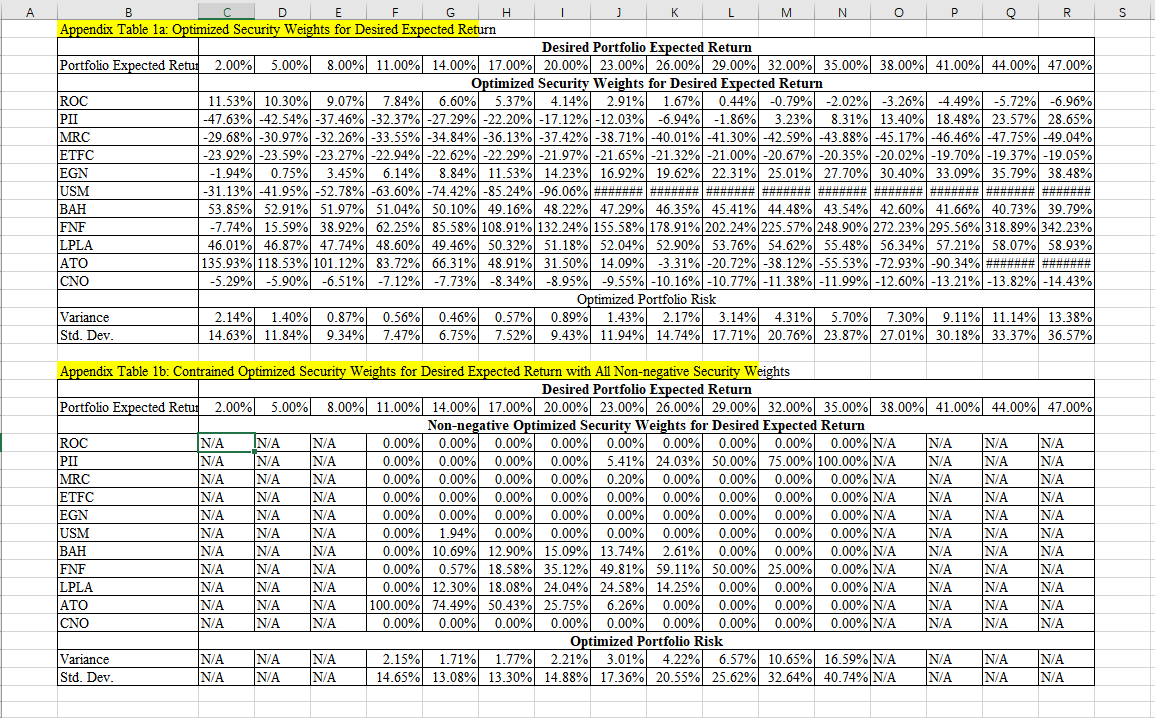

- Notice that there are negative weights in the optimized weights in Exhibit 10, which means that TAM has to take short positions to optimize the portfolio. What if the college endowment would not accept short position? An extra table (Appendix Table 1b) with Non-negative optimized security weights, where the security weights are calculated to minimize portfolio variance for each given portfolio expected return and the security weights have to be non-negative.

Exhibit 10 Pro Value Portfolio Model Expected Returns and Optimal Portfolio Weights Column C: ROC Column D: PII Column E: MRC Column F: ETFC Column G: EGN Column H: USM Column I: BAH Column T: FNF Column K: LPLA Column L: ATO Column M: CNO Stock Model Annual Expected Returns Historical Annualized Standard Deviation 33.00% 35.00% 20.00% 30.00% 22.00% 19.00% 22.00% 23.00% 24.00% 11.00% 33.00% 52.58% 40.74% 30.26% 49.54% 29.89% 25.45% 45.82% 19.92% 30.25% 14.56% 63.66% Desired Annual Portfolio Return 23.00% 25,00% 27.00% 15.00% 17.00% 19.00% 21.00% 29.00% 31.00% 33.00% 35.00% 6.2% 5.4% 4.5% 0.4% -0.4% - 1.2% -2.0% -22.2% -18.8% 3.7% -15.4% -37.9% -1.9% 4.9% 8.3% 1.5% 42.2% Optimized Security Weights 2.9% 2.1% 1.3% - 12.0% -8.6% -5.2% -38.7% -39.6% 40.4% -21.6% -21.4% -21.2% 16.9% 18.7% 20.5% 36.1% -37.0% -41.3% 43.0% Stock ROC PII MRC ETFC EGN USM BAH -43.9% -25.6% -35.3% -22.5% 9.7% -22.3% -22.1% -21.9% -21.0% -20.8% -20.6% -20.3% 11.5% 15.1% 22.3% 24.1% 25.9% 27.7% -78.0% -85,2% 13.3% -92.5% 48.5% -106.9% -121.3% -128,5% -135.7% -143.0% -150.2% -114.1% 46.7% 49.8% 49.2% 47.3% 46.0% 44.8% 44.2% 43.5% 45.4% 202.2% FNF 124.5% -99.7% 47.9% 140.0% 51.5% 25.7% 93.4% 49.7% 155.6% 108.9% 50.3% 171.1% 52.6% LPLA 233.3% 54.9% 50.9% 186.7% 53.2% -9.1% 52.0% 217.8% 54.3% -32.3% 53,8% 248.9% 55.5% -55.5% 48.9% 37.3% 14.1% 2.5% -20.7% 43.9% ATO CNO 60.5% -7.9% -8.3% -8.7% -9.1% -9.6% -10.0% -10.4% - 10.8% -11.2% -11.6% -12.0% A B D E F G H 1 M N O Q R Appendix Table la: Optimized Security Weights for Desired Expected Return Desired Portfolio Expected Return Portfolio Expected Retu: 2.00% 5.00% 8.00% 11.00% 14.00% 17.00% 20.00% 23.00% 26.00% 29.00% 32.00% 35.00% 38.00% 41.00% 44.00% 47.00% Optimized Security Weights for Desired Expected Return ROC 11.53% 10.30% 9.07% 7.84% 6.60% 5.37% 4.14% 2.91% 1.67% 0.44% -0.79% -2.02% -3.26% -4.49% -5.72% -6.96% PII -47.63% -42.54% -37.46% -32.37% -27.29% -22.20% -17.12% -12.03% -6.94% -1.86% 3.23% 8.31% 13.40% 18.48% 23.57% 28.65% MRC -29.68% -30.97% -32.26% -33.55% -34.84% -36.13% -37.42% -38.71% -40.01% -41.30% -42.59% -43.88% -45.17% -46.46% -47.75% -49.04% ETFC -23.92% -23.59% -23.27% -22.94% -22.62% -22.29% -21.97% -21.65% -21.32% -21.00% -20,67% -20.35%-20.02% -19.70% -19.37% -19.05% EGN -1.94% 0.75% 3.45% 6.14% 8.84% 11.53% 14.23% 16.92% 19.62% 22.31% 25.01% 27.70% 30.40% 33.09% 35.79% 38.48% USM -31.13% -41.95%-52.78% -63.60% -74.42% -85.24% -96.06% #****########################################################## 53.85% 52.91% 51.97% 51.04% 50.10% 49.16% 48.22% 47.29% 46.35% 45.41% 44.48% 43.54% 42.60% 41.66% 40.73% 39.79% FNF -7.74% 15.59% 38.92% 62.25% 85.58% 108.91% 132.24% 155.58% 178.91% 202.24% 225.57% 248.90% 272.23% 295.56% 318.89% 342.23% LPLA 46.01% 46.87% 47.74% 48.60% 49.46% 50.32% 51.18% 52.04% 52.90% 53.76% 54.62% 55.48% 56.34% 57.21% 58.07% 58.93% ATO 135.93% 118.53% 101.12% 83.72% 66.31% 48.91% 31.50% 14.09% -3.31% -20.72% -38.12% -55.53% -72.93% -90.34% ############## -5.29% -5,90% -6.51% -7.12% -7.73% -8.34% -8.95% -9.55% -10.16% -10.77% -11.38% -11.99% -12.60% -13.21% -13.82% -14.43% Optimized Portfolio Risk Variance 2.14% 1.40% 0.87% 0.56% 0.46% 0.57% 0.89% 1.43% 2.17% 3.14% 4.31% 5.70% 7.30% 9.11% 11.14% 13.38% Std. Dev 14.63% 11.84% 9.34% 7.47% 6.75% 7.52% 9.43% 11.94% 14.74% 17.71% 20.76% 23.87% 27.01% 30.18% 33.37% 36.57% CNO Appendix Table 16: Contrained Optimized Security Weights for Desired Expected Return with All Non-negative Security Weights Desired Portfolio Expected Return Portfolio Expected Retut 2.00% 5.00% 8.00% 11.00% 14.00% 17.00% 20.00% 23.00% 26.00% 29.00% 32.00% 35.00% 38.00% 41.00% 44.00% 47.00% Non-negative Optimized Security Weights for Desired Expected Return ROC N/A IN/A N/A 0.00% 0.00% 0.00% 0.00%| 0.00% 0.00% 0.00% 0.00% 0.00% N/A N/A N/A N/A PII N/A INA NA 0.00% 0.00% 0.00% 0.00%| 5.41% 24.03% 50.00% 75.00% 100.00% N/A N/A N/A N/A MRC NA N/A N/A 0.00% 0.00% 0.00% 0.00% 0.20% 0.00% 0.00% 0.00% 0.00%N/A N/A N/A N/A ETFC N/A N/A N/A 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% NA N/A NA NA EGN N/A N/A N/A 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% N/A N/A N/A NA USM N/A N/A N/A 0.00% 1.94% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% NA N/A N/A N/A BAH N/A N/A N/A 0.00% 10.69% 12.90% 15.09% 13.74% 2.61% 0.00% 0.00% 0.00% N/A N/A N/A N/A FNF N/A N/A N/A 0.00% 0.57% 18.58% 35.12% 49.81% 59.11% 50.00% 25.00% 0.00% NA NA N/A N/A LPLA N/A N/A N/A 0.00% 12.30% 18.08% 24.04% 24.58% 14.25% 0.00% 0.00% 0.00% NA NA N/A N/A ATO NA N/A N/A 100.00% 74.49% 50.43% 25.75% 6.26% 0.00% 0.00% 0.00% 0.00% N/A N/A N/A NA CNO N/A N/A N/A 0.00%| 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% NA N/A N/A NA Optimized Portfolio Risk Variance N/A N/A N/A 2.15% 1.71% 1.77% 2.21% 3.01% 4.22% 6.57% 10.65% 16.59% N/A N/A N/A N/A Std. Dev. N/A N/A N/A 14.65% 13.08% 13.30% 14.88% 17.36% 20.55% 25.62% 32.64% 40.74% NA N/A N/A N/A Exhibit 10 Pro Value Portfolio Model Expected Returns and Optimal Portfolio Weights Column C: ROC Column D: PII Column E: MRC Column F: ETFC Column G: EGN Column H: USM Column I: BAH Column T: FNF Column K: LPLA Column L: ATO Column M: CNO Stock Model Annual Expected Returns Historical Annualized Standard Deviation 33.00% 35.00% 20.00% 30.00% 22.00% 19.00% 22.00% 23.00% 24.00% 11.00% 33.00% 52.58% 40.74% 30.26% 49.54% 29.89% 25.45% 45.82% 19.92% 30.25% 14.56% 63.66% Desired Annual Portfolio Return 23.00% 25,00% 27.00% 15.00% 17.00% 19.00% 21.00% 29.00% 31.00% 33.00% 35.00% 6.2% 5.4% 4.5% 0.4% -0.4% - 1.2% -2.0% -22.2% -18.8% 3.7% -15.4% -37.9% -1.9% 4.9% 8.3% 1.5% 42.2% Optimized Security Weights 2.9% 2.1% 1.3% - 12.0% -8.6% -5.2% -38.7% -39.6% 40.4% -21.6% -21.4% -21.2% 16.9% 18.7% 20.5% 36.1% -37.0% -41.3% 43.0% Stock ROC PII MRC ETFC EGN USM BAH -43.9% -25.6% -35.3% -22.5% 9.7% -22.3% -22.1% -21.9% -21.0% -20.8% -20.6% -20.3% 11.5% 15.1% 22.3% 24.1% 25.9% 27.7% -78.0% -85,2% 13.3% -92.5% 48.5% -106.9% -121.3% -128,5% -135.7% -143.0% -150.2% -114.1% 46.7% 49.8% 49.2% 47.3% 46.0% 44.8% 44.2% 43.5% 45.4% 202.2% FNF 124.5% -99.7% 47.9% 140.0% 51.5% 25.7% 93.4% 49.7% 155.6% 108.9% 50.3% 171.1% 52.6% LPLA 233.3% 54.9% 50.9% 186.7% 53.2% -9.1% 52.0% 217.8% 54.3% -32.3% 53,8% 248.9% 55.5% -55.5% 48.9% 37.3% 14.1% 2.5% -20.7% 43.9% ATO CNO 60.5% -7.9% -8.3% -8.7% -9.1% -9.6% -10.0% -10.4% - 10.8% -11.2% -11.6% -12.0% A B D E F G H 1 M N O Q R Appendix Table la: Optimized Security Weights for Desired Expected Return Desired Portfolio Expected Return Portfolio Expected Retu: 2.00% 5.00% 8.00% 11.00% 14.00% 17.00% 20.00% 23.00% 26.00% 29.00% 32.00% 35.00% 38.00% 41.00% 44.00% 47.00% Optimized Security Weights for Desired Expected Return ROC 11.53% 10.30% 9.07% 7.84% 6.60% 5.37% 4.14% 2.91% 1.67% 0.44% -0.79% -2.02% -3.26% -4.49% -5.72% -6.96% PII -47.63% -42.54% -37.46% -32.37% -27.29% -22.20% -17.12% -12.03% -6.94% -1.86% 3.23% 8.31% 13.40% 18.48% 23.57% 28.65% MRC -29.68% -30.97% -32.26% -33.55% -34.84% -36.13% -37.42% -38.71% -40.01% -41.30% -42.59% -43.88% -45.17% -46.46% -47.75% -49.04% ETFC -23.92% -23.59% -23.27% -22.94% -22.62% -22.29% -21.97% -21.65% -21.32% -21.00% -20,67% -20.35%-20.02% -19.70% -19.37% -19.05% EGN -1.94% 0.75% 3.45% 6.14% 8.84% 11.53% 14.23% 16.92% 19.62% 22.31% 25.01% 27.70% 30.40% 33.09% 35.79% 38.48% USM -31.13% -41.95%-52.78% -63.60% -74.42% -85.24% -96.06% #****########################################################## 53.85% 52.91% 51.97% 51.04% 50.10% 49.16% 48.22% 47.29% 46.35% 45.41% 44.48% 43.54% 42.60% 41.66% 40.73% 39.79% FNF -7.74% 15.59% 38.92% 62.25% 85.58% 108.91% 132.24% 155.58% 178.91% 202.24% 225.57% 248.90% 272.23% 295.56% 318.89% 342.23% LPLA 46.01% 46.87% 47.74% 48.60% 49.46% 50.32% 51.18% 52.04% 52.90% 53.76% 54.62% 55.48% 56.34% 57.21% 58.07% 58.93% ATO 135.93% 118.53% 101.12% 83.72% 66.31% 48.91% 31.50% 14.09% -3.31% -20.72% -38.12% -55.53% -72.93% -90.34% ############## -5.29% -5,90% -6.51% -7.12% -7.73% -8.34% -8.95% -9.55% -10.16% -10.77% -11.38% -11.99% -12.60% -13.21% -13.82% -14.43% Optimized Portfolio Risk Variance 2.14% 1.40% 0.87% 0.56% 0.46% 0.57% 0.89% 1.43% 2.17% 3.14% 4.31% 5.70% 7.30% 9.11% 11.14% 13.38% Std. Dev 14.63% 11.84% 9.34% 7.47% 6.75% 7.52% 9.43% 11.94% 14.74% 17.71% 20.76% 23.87% 27.01% 30.18% 33.37% 36.57% CNO Appendix Table 16: Contrained Optimized Security Weights for Desired Expected Return with All Non-negative Security Weights Desired Portfolio Expected Return Portfolio Expected Retut 2.00% 5.00% 8.00% 11.00% 14.00% 17.00% 20.00% 23.00% 26.00% 29.00% 32.00% 35.00% 38.00% 41.00% 44.00% 47.00% Non-negative Optimized Security Weights for Desired Expected Return ROC N/A IN/A N/A 0.00% 0.00% 0.00% 0.00%| 0.00% 0.00% 0.00% 0.00% 0.00% N/A N/A N/A N/A PII N/A INA NA 0.00% 0.00% 0.00% 0.00%| 5.41% 24.03% 50.00% 75.00% 100.00% N/A N/A N/A N/A MRC NA N/A N/A 0.00% 0.00% 0.00% 0.00% 0.20% 0.00% 0.00% 0.00% 0.00%N/A N/A N/A N/A ETFC N/A N/A N/A 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% NA N/A NA NA EGN N/A N/A N/A 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% N/A N/A N/A NA USM N/A N/A N/A 0.00% 1.94% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% NA N/A N/A N/A BAH N/A N/A N/A 0.00% 10.69% 12.90% 15.09% 13.74% 2.61% 0.00% 0.00% 0.00% N/A N/A N/A N/A FNF N/A N/A N/A 0.00% 0.57% 18.58% 35.12% 49.81% 59.11% 50.00% 25.00% 0.00% NA NA N/A N/A LPLA N/A N/A N/A 0.00% 12.30% 18.08% 24.04% 24.58% 14.25% 0.00% 0.00% 0.00% NA NA N/A N/A ATO NA N/A N/A 100.00% 74.49% 50.43% 25.75% 6.26% 0.00% 0.00% 0.00% 0.00% N/A N/A N/A NA CNO N/A N/A N/A 0.00%| 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% NA N/A N/A NA Optimized Portfolio Risk Variance N/A N/A N/A 2.15% 1.71% 1.77% 2.21% 3.01% 4.22% 6.57% 10.65% 16.59% N/A N/A N/A N/A Std. Dev. N/A N/A N/A 14.65% 13.08% 13.30% 14.88% 17.36% 20.55% 25.62% 32.64% 40.74% NA N/A N/A N/A