Answered step by step

Verified Expert Solution

Question

1 Approved Answer

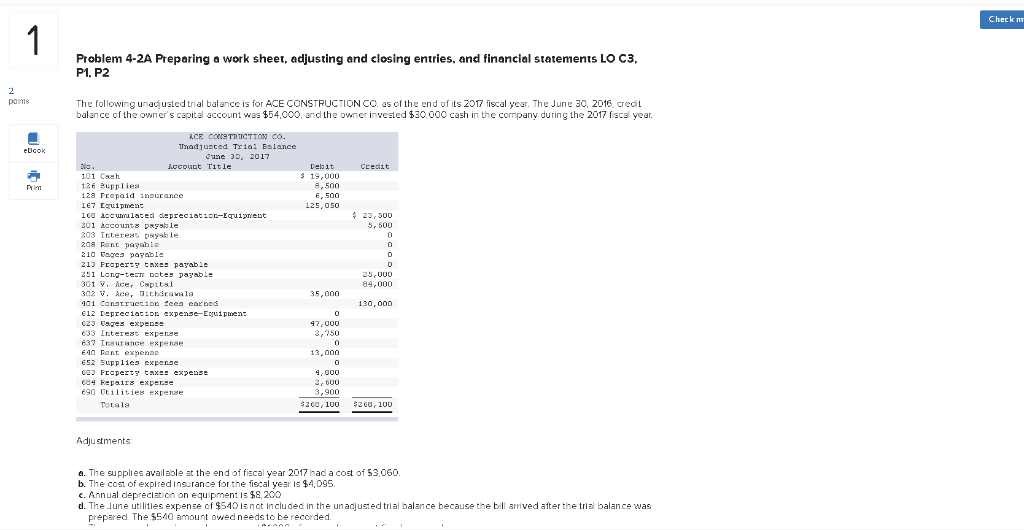

NOTICE;THE ANSWER IS NOT COMPLETE Problem 4-2A Preparing a work sheet, adjusting and closing entries, and financial statements LO C3 The following unacjusted trial balance

NOTICE;THE ANSWER IS NOT COMPLETE

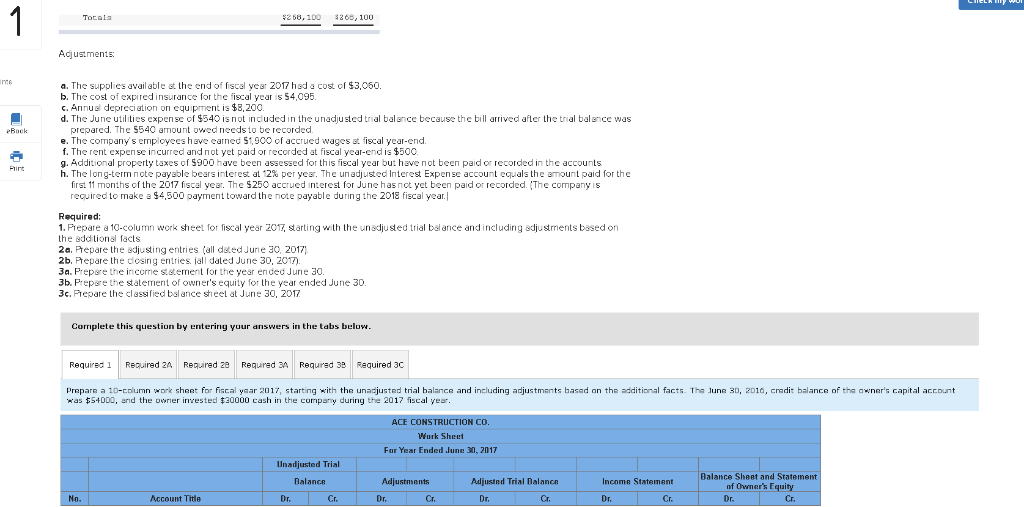

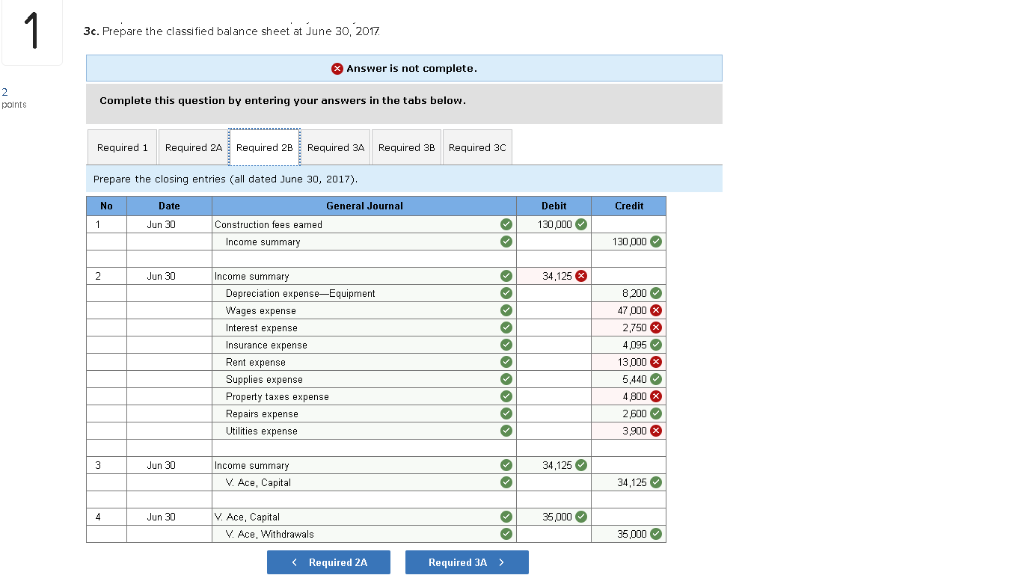

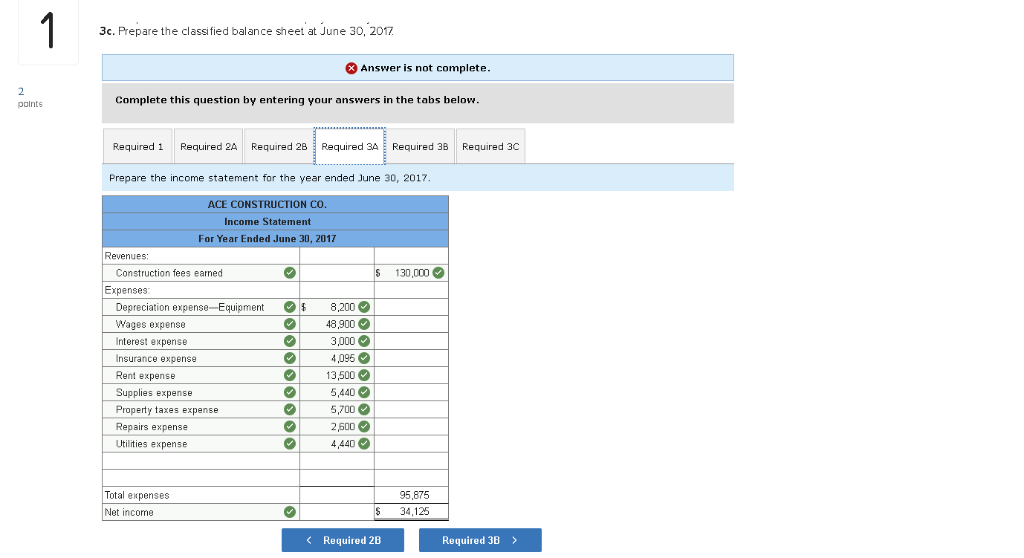

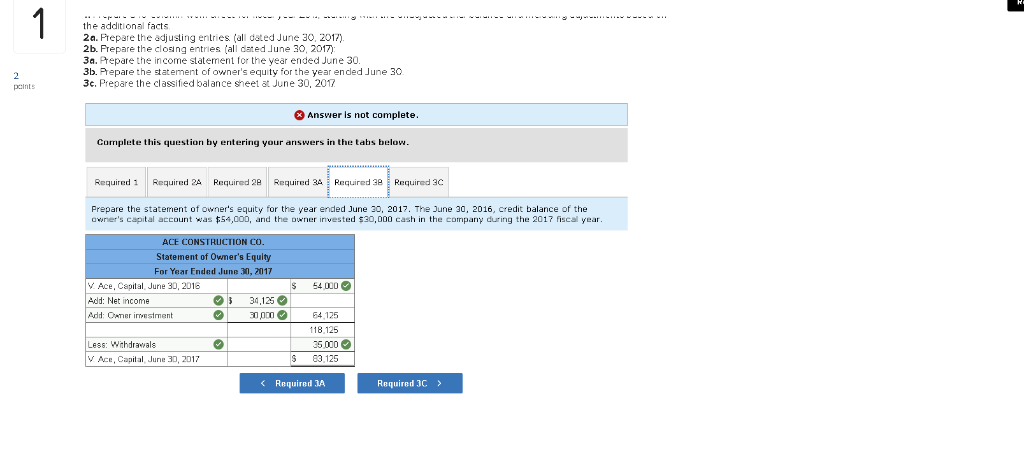

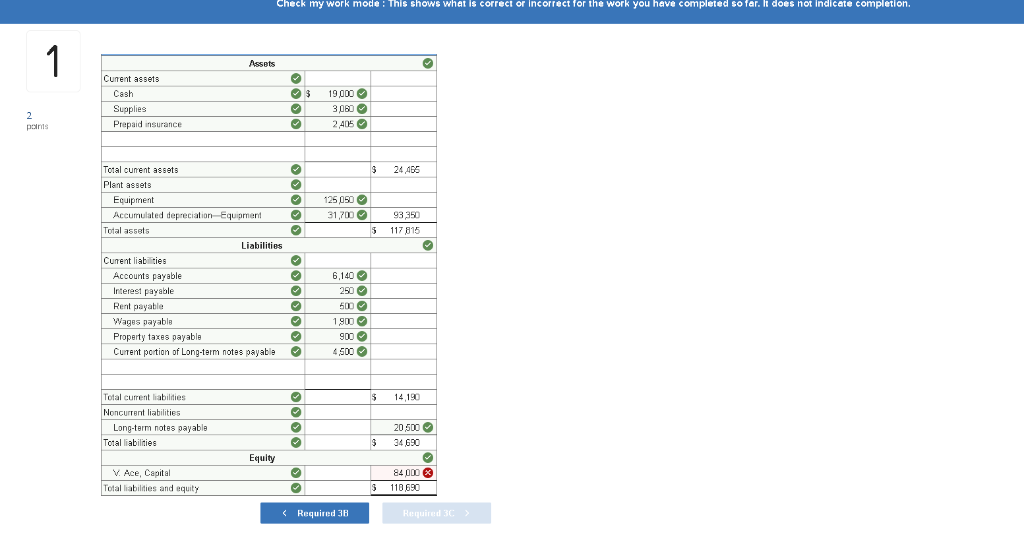

Problem 4-2A Preparing a work sheet, adjusting and closing entries, and financial statements LO C3 The following unacjusted trial balance is for ACE CONSTRUCTION CO as of the end of its 2017 fiscal year. The June 30, 2016, credt oalance of the owner's catal account was $54,000, and the owner invested $30 000 cash n the company during the 2017 fsca year. Unad1usted Trial Balanco une 30, 2017 ccount Title 101 Caah 128 prepaid in urance 167 Equipment ea ccumulated depreciatior-lquirent 2500 5r 500 303 Intereat psyable 210 agea 213 Fraperx!! payable 35,000 84,000 130,000 301 V. Ace, Cspital teea cr 12 DEpreciation xpense Euipumenz 623 ages e 637 Inaurance expenae 652 supplie expense 604 kepairs e 690 Utilities expnse 13,000 xpense 3,900 20,100 60 100 Adjustments a. The supplies available at the end of fiscal year 2017had a cost of 53,060 b. The cost of expiredinsurance for the fiscal year is $4,095. c. Annual depreclation on equ pment is $8,200 d. The June utiltles expense of 510Isnot Included In the unadjusted trial balance because the bll aved after the tral balance was prepared The $540 amount owed needs to be recorded. Totala 268,100 68, 100 Acjustments: a. The supplies avail able st the end of fiscal year 2017 hed a cost of $3,050. b. The cost of expired insurance for the fiscal year is 54,095 c. Annu depreciation on equipment is $8,200. d. ThJune uulities expense of $54O1s not in ouded in thunadjusted tral balance because the bill arrived after the trial balance was prepared. The 5540 amount owed needsto be recorded e. The company's employees have carned S1,9CO of accrued wages st fiscal year-end. f. The rent expense incurred and not yet paid or reccrded at fiscal year-end is $500. g. Additional property taxes of $900 have been assessed for this fiscal year bu: have not been paid or recorded in the accounts h. The long-term note pavaole bears interest at 12% per year. The unadjusted Interest Expense account equals the armountaid for the first 11 months of the 2017 fiscal year. The $250 accrued nterest for June hasnot yet been paidor recorded. The company is required to make a $4,500 payment toward the note payable during the 2018 fiscal year.| Required: 1. Prepare a 10-column work sheel for fiscal year 20 starting wth lhe unadjusted trial balance and including odjustments based on the addtional facts 2aPrepare the edjusting entries Call dded June 30, 2017; 2b. Ptepare the desing entries all daled June 30, 2017). 3a. Prepsre the incoe sstement for the year ended June 30 3b. Prepsre the atemerit of owner's equity for the year ended June 30 3c. Prepare the clssified bal ance sheel at June 30, 2017 Complete this question by entering your answers in the tabs beluw Required 1 Required 2A Required 28 Required 3 Required 3B Required 3C Prepare a 10-column work sheet for fiscal yaar 2017, starting with the unadjusted trial balance and including adjustments hasad on the additional facts. Tha June 3D, 2010, cradit balance of the awner's capital account was $540D0, arnd the owrier invested $30000 cash in the compay during the 2017 fiseal year ACE CONSTRUCTION Work Sheet For Year Ended June 3,2017 Unadjusted Trial Balance Sheet and Statem Dalance Adjusted Trial Balance Income Statement of Owner's E Account Title Dr. Cr. Dr. Cr. Dr Dr. Cr. Dr. Cr. 3c. Prepare the classified balance sheet at June 30, 2017 Answer is not complete Complete this question by entering your answers in the tabs below points Requred 1 Required 2A : Required 2B : Required 3A Required 3B Required 3C Prepare the closing entries (all dated June 30, 2017). No Date General Journal Debit Credit Construction fees eamed Income summary Jun 30 130,000 30 000 Jun 30 Incorme summary 34,125 Depreciation expense-Equipment Wages expense Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Repairs expense Utilities expense 8200 47 000 2,750 095 13,000 5,440 4 800 2600 3900 Jun 30 Income summary 34,125 V. Ace, Capital 34,125 Jun 30 V. Ace, Capital 5000 V Ace. Withdrawals 35,000 3c. Prepare the classified balance sheet at June 30, 2017 Answer is not complete Complete this question by entering your answers in the tabs below polnts Required 1 Required 2A Required 2BRequired 3A Required 3B Required 3C Prepare the income statement for the year ended June 30, 2017 ACE CONSTRUCTION CO Income Statement For Year Ended June 30, 2017 Revenues Construction fees earned 30,000 Expenses Depreciation expense-Equipment Wages expense Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Repairs expense Utilities expense 8,200 43,900 3,000 4,095 13,500 5,700 2600 Total expenses Net income 95,875 34,125 the additional facts 2a. Prepare the adjusting entries (all dated June 30, 2017). 2b. Frepare the closing entries aldated June 30, 2017) 3a. Prepare the income statement othe year ended June 30 3b. Prepare the statement of owner's equity for the year ended June 30 3c. Prepare the classified balance sheet at June 30, 201 paints Answer is not complete Complete this question by entering your answers in the tabs below Required Required 2A Required 2Requied 3Required 38Required 3C Prepare the statement of owner's equity for the year ended June 30, 2017. The 30 ,2016 , credit balance of the owner's capital account was 54,000, and the owner invested S30.000 cash in the company during the 2017 fiscal year ACE CONSTRUCTION CO. Statement of Owner's Equity For Year Ended June 30, 2017 Ace, Capital, June 30, 20186 Add: Net income Add: CATmer iestment 30,125 Less: Withdrawals Ace, Capial, Jurne 30, 2017 118,125 35000 S 83.125 Required JA Required 3c> Chck my work mod : This $how$ what is correct or incorrect for th work you hav@ completed $0 far. It do@$ not indicate completion. Assets Cument assets Cash Supplies Prepaid insurance 19,000 3060 405 paints Total cuent assets Plant assets 24465 Equipment Accumulated depreciation Equipment 25 050 31793350 Total assets 117 815 Liabilities Cunent liabi ties 6,140 Accounts payable Interest payable payable Wages payable Property taxes payabla CuTent pcrtian of Long-term notes payab500 1900 900 Total curent habildies 14,190 Noncurrent liabilities Long-term notes payabla Total liabilities 20500 34690 Equlty v. Ace, Capital Total liabildies and equity 84 000 110 690 Required 3BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started