Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Noting the success of Energizer's long-running advertising campaign featuring a robotic rabbit and AFLAC's campaign showcasing a duck, you decide to combine the two ideas

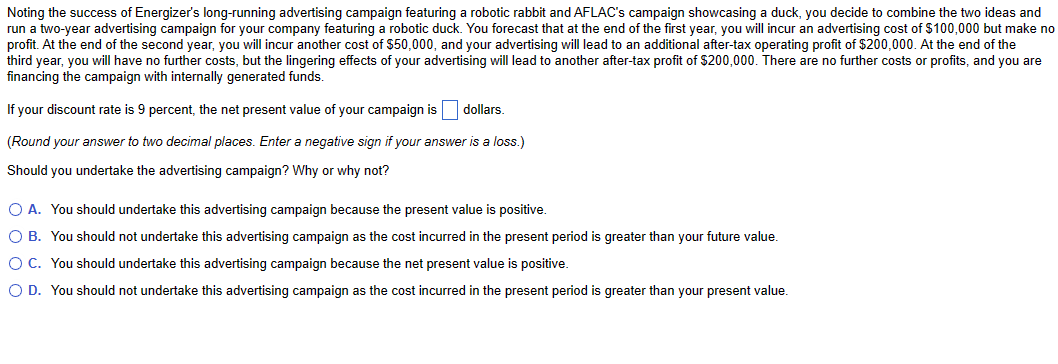

Noting the success of Energizer's long-running advertising campaign featuring a robotic rabbit and AFLAC's campaign showcasing a duck, you decide to combine the two ideas and run a two-year advertising campaign for your company featuring a robotic duck. You forecast that at the end of the first year, you will incur an advertising cost of \\( \\$ 100,000 \\) but make no profit. At the end of the second year, you will incur another cost of \\( \\$ 50,000 \\), and your advertising will lead to an additional after-tax operating profit of \\( \\$ 200,000 \\). At the end of the third year, you will have no further costs, but the lingering effects of your advertising will lead to another after-tax profit of \\( \\$ 200,000 \\). There are no further costs or profits, and you are financing the campaign with internally generated funds. If your discount rate is 9 percent, the net present value of your campaign is dollars. (Round your answer to two decimal places. Enter a negative sign if your answer is a loss.) Should you undertake the advertising campaign? Why or why not? A. You should undertake this advertising campaign because the present value is positive. B. You should not undertake this advertising campaign as the cost incurred in the present period is greater than your future value. C. You should undertake this advertising campaign because the net present value is positive. D. You should not undertake this advertising campaign as the cost incurred in the present period is greater than your present value

Noting the success of Energizer's long-running advertising campaign featuring a robotic rabbit and AFLAC's campaign showcasing a duck, you decide to combine the two ideas and run a two-year advertising campaign for your company featuring a robotic duck. You forecast that at the end of the first year, you will incur an advertising cost of \\( \\$ 100,000 \\) but make no profit. At the end of the second year, you will incur another cost of \\( \\$ 50,000 \\), and your advertising will lead to an additional after-tax operating profit of \\( \\$ 200,000 \\). At the end of the third year, you will have no further costs, but the lingering effects of your advertising will lead to another after-tax profit of \\( \\$ 200,000 \\). There are no further costs or profits, and you are financing the campaign with internally generated funds. If your discount rate is 9 percent, the net present value of your campaign is dollars. (Round your answer to two decimal places. Enter a negative sign if your answer is a loss.) Should you undertake the advertising campaign? Why or why not? A. You should undertake this advertising campaign because the present value is positive. B. You should not undertake this advertising campaign as the cost incurred in the present period is greater than your future value. C. You should undertake this advertising campaign because the net present value is positive. D. You should not undertake this advertising campaign as the cost incurred in the present period is greater than your present value Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started