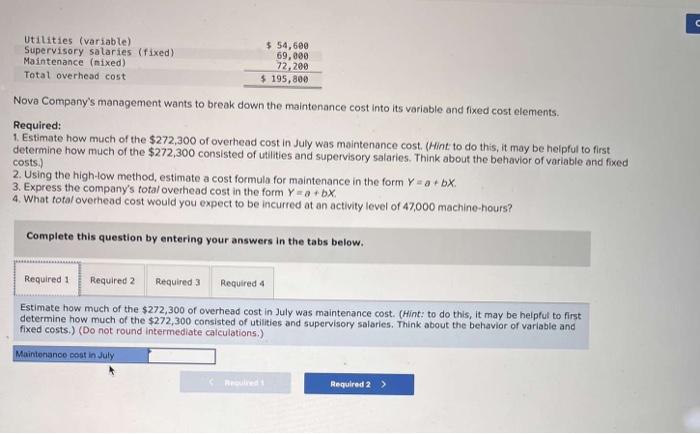

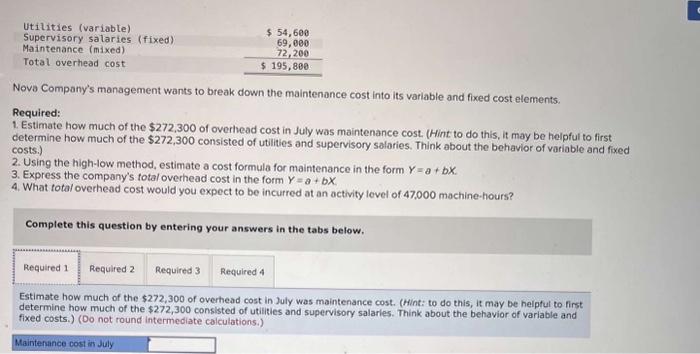

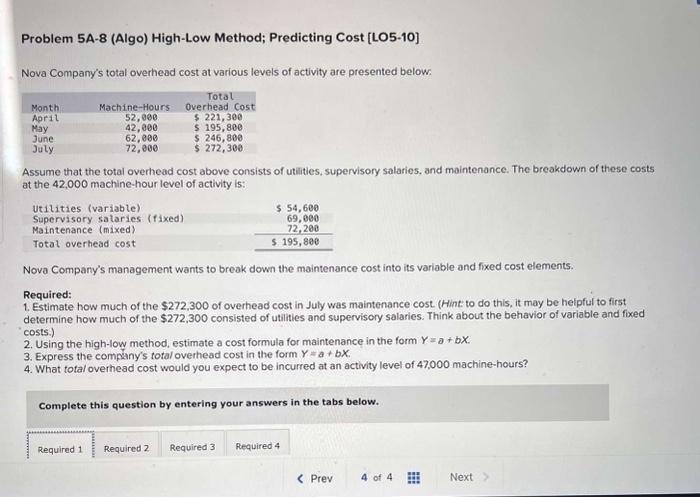

Nova Company's management wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $272,300 of overhead cost in July was maintenance cost. (Hint to do this, it may be heipful to first determine how much of the $272,300 consisted of utilities and supervisory salaries. Think about the behavior of variable and fixed costs.) 2. Using the high-tow method, estimate a cost formula for maintenance in the form Y=a+bX. 3. Express the company's total overhead cost in the form Y=a+bX. 4. What total overhead cost would you expect to be incurred at an activity level of 47,000 machine-hours? Complete this question by entering your answers in the tabs below. Estimate how much of the $272,300 of overhead cost in July was maintenance cost. (Hint: to do this, it may be helpful to first determine how much of the $272,300 consisted of utilities and supervisory salaries. Think about the behavior of variable and fixed costs.) (Do not round intermediate calculations.) Nova Company's management wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $272,300 of overhead cost in July was maintenance cost. (Hint to do this, it may be helpful to first determine how much of the $272,300 consisted of utilities and supervisory salaries. Think about the behavior of variable and fixed costs.) 2. Using the high-low method, estimate a cost formula for maintenance in the form Y=a+bX. 3. Express the company's total overhead cost in the form Y=a+bX. 4. What total overhead cost would you expect to be incurred at an activity level of 47,000 machine-hours? Complete this question by entering your answers in the tabs below. Estimate how much of the $272,300 of overhead cost in July was maintenance cost. (Hint: to do this, it may be helpfut to first determine how much of the $272,300 consisted of utilities and supervisory salarles. Think about the behavior of varlable and fixed costs.) (Do not round intermediate calculations.) Problem 5A-8 (Algo) High-Low Method; Predicting Cost [LO5-10] Nova Company's total overhead cost at various levels of activity are presented below: Assume that the total overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 42,000 machine-hour level of activity is: Nova Company's management wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $272,300 of overhead cost in July was maintenance cost. (Hint: to do this, it may be helpful to first determine how much of the $272,300 consisted of utilities and supervisory salaries. Think about the behavior of variable and fixed costs.) 2. Using the high-low method, estimate a cost formula for maintenance in the form Y=a+bX. 3. Express the company's total overhead cost in the form Y=a+bX. 4. What total overhead cost would you expect to be incurred at an activity level of 47,000 machine-hours? Complete this question by entering your answers in the tabs below